2025-26 Federal Budget Financial Planning Summary

It is that time of the year again, and Treasurer Jim Chalmers delivered the Government’s 2025-2026 Federal Budget.

As expected, Labor’s fourth Budget centred on easing cost-of-living pressures with the welcomed surprise of proposed tax cuts. Super remained mostly untouched—no updates on Division 296 tax measures or residency rules for small super funds.

We have summarised the key points which impact financial planning strategies below, and you can view the full Government Budget details here.

For our ongoing service package clients, your adviser will be in contact to provide guidance on changes that may impact your strategy.

IMPORTANT: Please remember that these measures are subject to becoming law, so confirm this before taking action.

Taxation

Income tax cuts

The Government has proposed tax cuts in the form of a tax rate reduction to be introduced over two years, delivering a savings boost for Australian taxpayers. This will be achieved by reducing the 16% tax rate that applies to taxable income earned between $18,201 and $45,000.

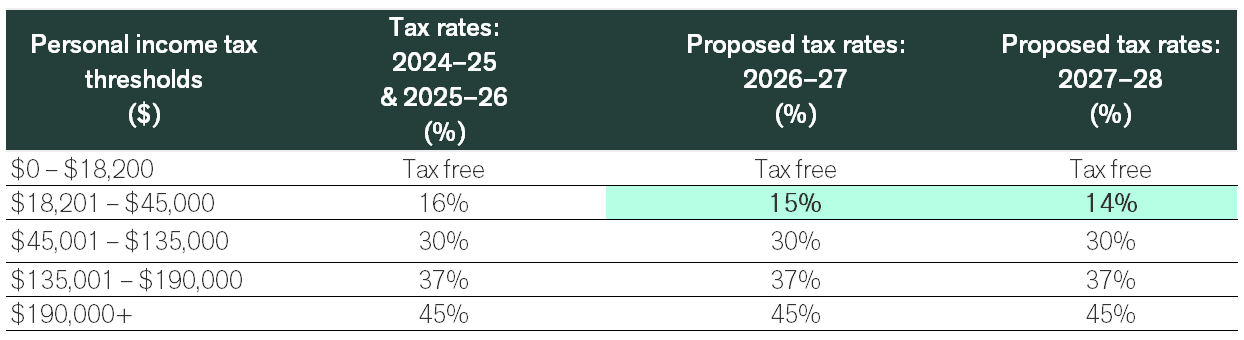

The Government will reduce the current 16% income tax rate as follows:

- From 1 July 2026, that rate will be reduced to 15%.

- From 1 July 2027, this tax rate will be reduced further to 14%.

As outlined in the table below, there has been no proposed change(s) to either the personal income tax thresholds, nor to any of the other personal income tax rates.

The outcome is a tax saving of $268 in 2026-2027 and $536 per year from 2027-2028 for taxpayers earning over $45,000.

Medicare levy threshold increased

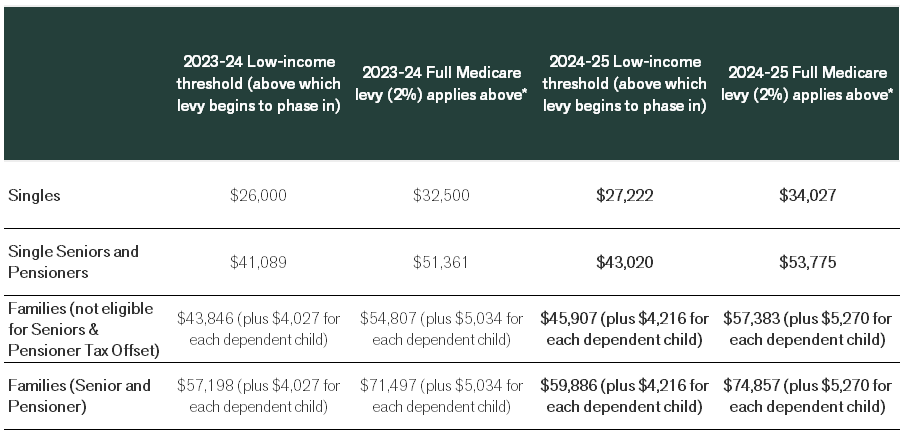

The Government will increase the Medicare levy low-income thresholds by 4.7% for singles, families, seniors and pensioners from 1 July 2024 to provide cost-of-living relief.

The increase to these thresholds aims to ensure that low-income individuals continue to be exempt from paying the Medicare levy or pay a reduced levy rate.

Superannuation

Strengthening tax integrity

The Government will allocate $50 million over three years from 1 July 2026 to extend the Tax Integrity Program.

This will enable the ATO to continue its engagement program to ensure timely payment of tax and superannuation liabilities by medium and large businesses and wealthy groups. This measure is estimated to increase receipts by $31 million in unpaid superannuation to be disbursed to employees.

Cost of Living

Energy bill relief

The Government has announced the extension of energy bill relief for eligible Australian households and small businesses until 31 December 2025. This measure, which provides $150 in relief paid as $75 over two quarters, aims to alleviate the cost-of-living pressures.

Additional funding for medicines

From 1 January 2026, it’s proposed the Pharmaceutical Benefits Scheme (PBS) general patient co-payment will be reduced from $31.60 to $25.00, with concession card holders continuing to pay $7.70 for PBS-listed medicines.

Cutting student debt

Outstanding Higher Education Loan Program (HELP) and other student debts are proposed to be reduced by 20 per cent from 1 June 2025.

In addition, from 1 July 2025, the Government has proposed to increase the amount that people can earn before they are required to start paying back their loans from $54,435 in 2024–25 to $67,000 in 2025–26.

On top of this, compulsory repayments will be lower for people earning under around $180,000 and above the current minimum threshold.

First Home Buyers

Help to Buy program

The Government proposed to increase funding for the Help to Buy program by $800 million, so more first time home buyers can purchase a property.

Income caps will increase from $90,000 to $100,000 for singles and from $120,000 to $160,000 for joint applications.

In addition, the property price cap will be increased (these vary depending on location).

How can we help?

If you have any questions or would like further clarification in regards to any of the above measures outlined in the 2025-2026 Federal Budget, please feel free to book a chat with your adviser.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).