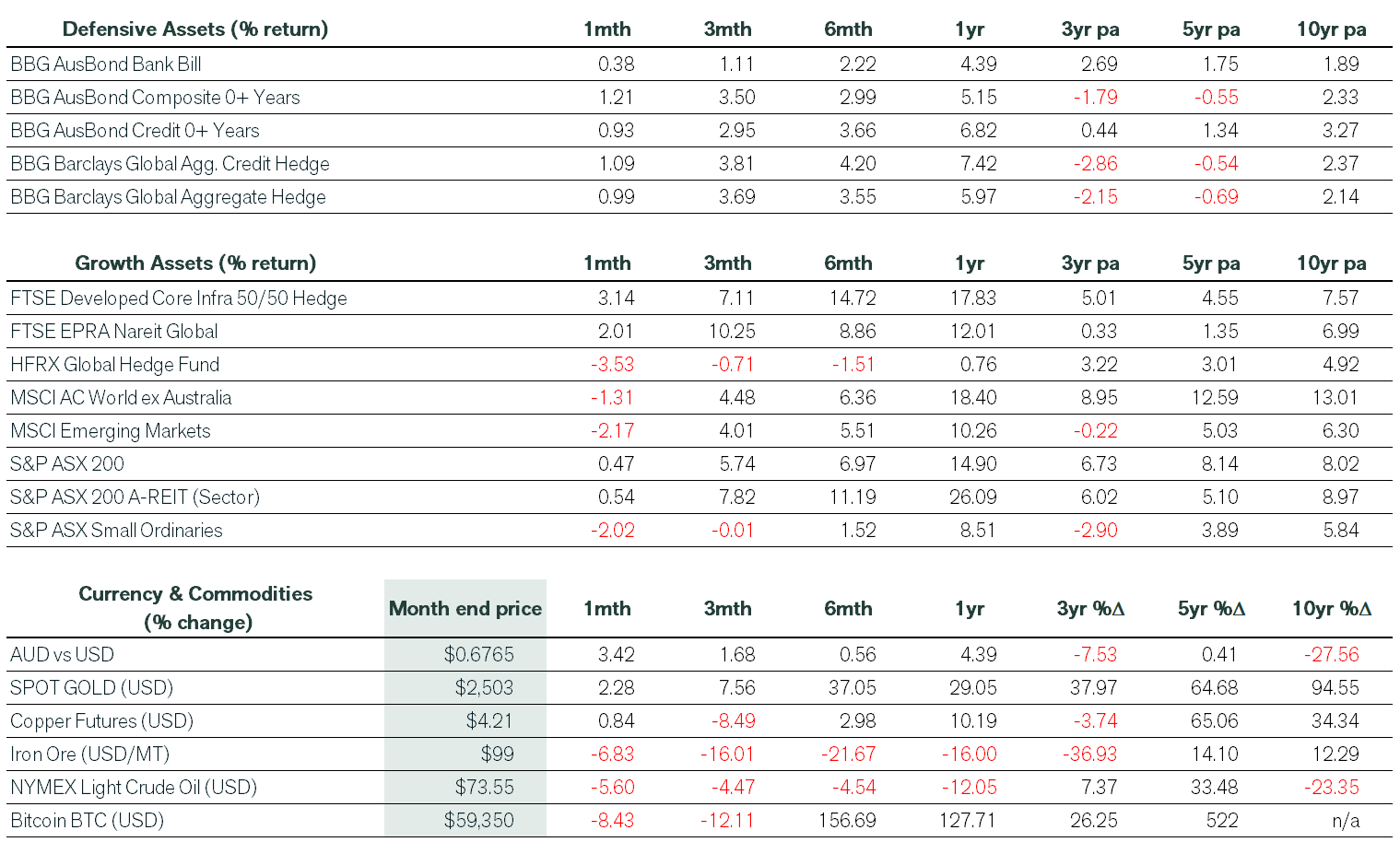

August 2024 Economic & Market Review – Market Volatility, Fed Shifts, and Fixed Interest Resurgence

Talking points

- Market Volatility Returns, But Recovery Follows Quickly: August kicked off with a market shake-up, driven by US economic uncertainty and a global sell-off. Factors including concentrated market trading and geopolitical tensions amplified the volatility. Despite the initial turmoil, markets bounced back as the possibility of a “soft landing” gained traction.

- Fed’s Shift to Labor Focus and Rate Cuts: The Federal Reserve signalled potential rate cuts as inflation cooled. Fed Chair Jerome Powell’s remarks at Jackson Hole shifted the focus to the labor market, hinting at upcoming interest rate adjustments. Historically, rate cuts outside of a recession tend to boost the S&P 500, a key indicator for future market trends.

- Currency Movements Impact Australian Investors: Despite positive global equity performances in August, the Australian dollar’s surge dented returns for unhedged domestic investors. This currency shift translated gains into losses for those without hedging strategies, underlining the importance of currency risk management.

- Strong US Earnings, Mixed Australian Results: US Q2 earnings beat expectations in most sectors, with financials and utilities leading the charge. However, Australia’s full-year results lagged, with more misses than beats. Weak margins and cautious outlooks have tempered investor enthusiasm domestically, starkly contrasting the upbeat US market.

- Fixed Interest Shines Amid Rate Cut Expectations: With growing anticipation of the Fed’s rate cuts, fixed income markets saw their fourth consecutive month of positive returns, the longest streak since 2020. Lower interest rates boosted bonds, which regained their traditional role as a hedge against equity market declines. This highlights the renewed value of fixed interest in balancing portfolios during periods of economic uncertainty.

Market Commentary

Tough times returned at the beginning of August, as financial markets experienced a jolt of volatility. US economic uncertainty sparked a global sell-off, exacerbated by multiple factors—a combination of concentrated market trading, rich PE multiples, hedging of short volatility strategies, heightened geopolitical tensions, and the unwinding of the yen carry trade resulted in tumult – albeit briefly.

Despite the initial market tumult early in the month, equities quickly recovered losses as the likelihood of a soft landing increased. It wasn’t all good news for Australian investors however, as a surge in the Australian dollar impacted global returns for unhedged domestic investors.

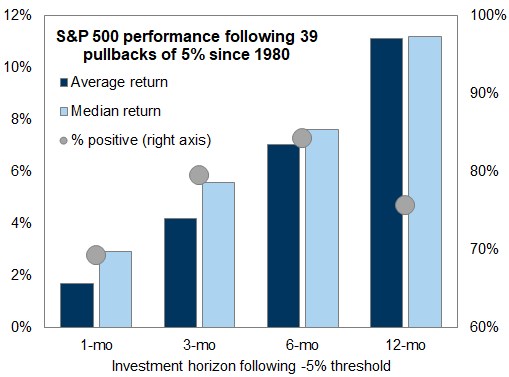

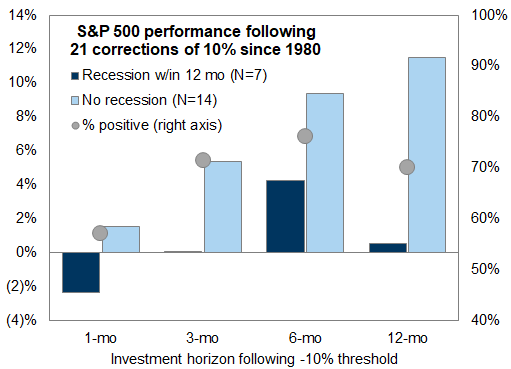

A recent presentation from Goldman Sachs showed the historical experience that investors typically profit when buying the S&P 500 index following a 5% sell-off. Since 1980, an investor buying the S&P 500 index 5% below its recent high would have generated a median return of 6% over the subsequent 3 months, enjoying a positive return in 84% of episodes. Corrections of 10% have also been attractive buying opportunities more often than not, but with weaker hit rates of outperformance than following 5% drawdowns. Note that the forward path of the S&P 500 following 10% corrections has been markedly different during environments of resilient economic growth relative to correction ahead of recessions.

Source: Goldman Sachs Global Investment Research

Throughout August, the Fed signalled that it would likely cut rates in September as inflation risks subsided. Of note, Fed Chair Jerome Powell confirmed a shift in the Fed’s focus towards the labour market during his speech at Jackson Hole. The changing interest rate landscape tends to have important implications for equities. Historically, when the Fed cuts rates in the absence of a recession, the S&P 500 tends to rise strongly in the following twelve months, compared to remaining flat during a recession scenario. As concerns about economic growth diminished, market expectations began to favour a 0.25% cut over a 0.5% cut, with about 1% of rate cuts expected by year-end.

In local currency terms, the MSCI ACWI ex-Australia index gained 1.8% in August. However, the Australian dollar rally resulted in a 1.3% loss to unhedged domestic investors. Similarly, Emerging market equities returned 0.4% in local currency terms, but this translated to a 2.2% loss in Australian dollars. The same was true for the global hedge fund index, which was unable to take full advantage of higher volatility earlier in the month. Stronger performances emanated from the hedged global infrastructure and global property indices, which enjoyed returns of 3.1% and 2%, respectively.

Turning to corporate results, the Q2 earnings season in the US was relatively strong. According to FactSet, earnings per share (EPS) beat consensus nearly 80% of the time, versus the 10-year average of 74%. Financials stocks enjoyed the largest positive EPS surprise, with an average beat of 13.7%, followed by Utilities with 10.1%. However, the domestic August full year reporting season was less impressive. According to Goldman Sachs, weaker-than-expected margins (on average) meant that misses outnumbered beats (38% vs 32%), with the ratio of beats to misses (0.8x) well below the long-run average (1.4x). While dividends fell 1.9%, the decline was only around half the consensus expectation due to rising payout ratios and some unexpected special dividends from the retail sector. Outlook commentary was generally cautious, contributing to earnings revision trends being weaker than usual. Following the positive Q2 earnings season, the US S&P 500 rose 2.4% (including dividends), with the index closing the month just below its record high reached only six weeks prior. The Dow Jones Industrial Average returned 2.3% (including dividends) to end August at a new closing high.

Closer to home, the ASX 200 delivered a total return of 0.5%, eclipsing its small-cap peers, which lost 2% in August. Meanwhile, Australian listed property saw its returns muted by the weaker performance of its largest constituent, Goodman Group (ASX: GMG).

As investors gained confidence that the US Federal Reserve (the Fed) would commence its rate-cutting cycle in September, gold rallied, and the US dollar fell against most major currency crosses. Mixed economic data and the prospect of falling interest rates boosted fixed income markets, which enjoyed the fourth consecutive month of positive returns (the longest streak since 2020). Another positive sign for fixed interest investors was the return to more traditional correlations with equities, whereby bonds provided protection against an equity market drawdown. Meanwhile, cash eked out another modest return. In stark contrast, Bitcoin lost 8.4% as investor appetite for risk diminished during August.

Economic Commentary

Australia

In Australia, the Reserve Bank’s August board meeting resulted in no change to official interest rates. This didn’t come as much of a surprise, as the June quarter CPI inflation figures printed slightly below expectations. The CPI data fuelled debate among ideologically opposed economists about whether monetary policy settings were appropriate. Meanwhile, a fiscal policy debate was conducted similarly, with Treasurer Chalmers pointing to recent budget surpluses—while detractors pointed to the role increased government spending was having on the inflation front. Watch this space!

The monthly CPI rose by 3.5% y/y in late August, above consensus expectations. Elsewhere, the July unemployment rate increased to 4.2% as the participation rate hit a record high of 67.1%. A surge in jobs during July exceeded expectations and was coupled with an upward revision to June employment growth.

Rest of world

On the economic front, the US economy added 114k jobs in July 2024, well below a downwardly revised 179k in June and forecasts of 175k. It was also the lowest level in three months and below the average monthly gain of 215k over the prior year, signalling the labour market is cooling. Average hourly earnings also came in below forecast.

Increased workforce participation pushed up the unemployment rate to 4.3% from 4.1% in June. The rise in the unemployment rate triggered a famous recession indicator known as the “Sahm Rule”. However, initial jobless benefit claims remained low during August, and there was an absence of mass layoffs. These indicators would be much higher if the economy was experiencing a hard landing.

Get in Touch to Discuss Your Investment Strategy

For personalised investment advice or to understand how this information may impact your investments, schedule a chat with a Pekada financial adviser today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).