Bring Forward Non-concessional Contributions explained

To maximise the non-concessional contribution (NCC) opportunity, you may consider using the bring-forward NCC cap of up to $330,000, provided your Total Superannuation Balance (TSB) allows you to do so. If you are eligible, the bring-forward is triggered automatically when your total annual NCCs exceed the annual cap (currently $110,000).

From 2022-23 onwards, you are required to be under the age 75 on 1 July of the financial year to be able to access the bring-forward NCC cap. While age may determine whether or not a person is eligible to make NCCs above the annual cap, additional eligibility rules apply.

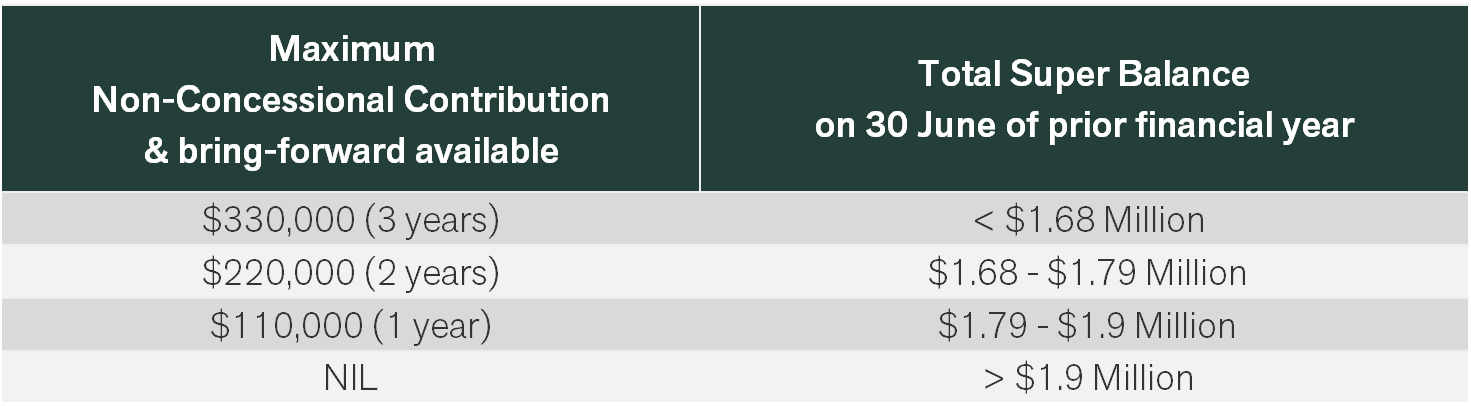

The maximum amount available under the bring-forward, as well as whether you have a 3 or a 2 year bring-forward period, depends upon your TSB on 30 June prior to the financial year in which the bring-forward is triggered. See table below.

If you make an NCC that exceeds the allowable amount based on your TSB on the prior 30 June, the contribution is assessed as an excess NCC.

Things to consider

- If you turn 75 in the middle of the next financial year, the next year will be the last financial year that you are able to use the bring-forward NCCs cap, and the super contribution must be made on or before 28 days after the end of the month you turn 75.

- Before you trigger the bring-forward NCC cap, it is important to check whether you previously triggered it and are still in a bring-forward period. Your myGov account shows whether you are already in a bring-forward arrangement.

- Once the bring-forward period has expired, you may make further contributions within the annual cap or even trigger the bring-forward provisions again.

Get in Touch to Discuss Your Superannuation Strategy

For personalised superannuation advice or to discuss putting more money into your super, schedule a chat with a Pekada financial adviser today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).