Carry-forward (catch-up) concessional contributions explained

Successfully claiming a tax deduction for personal super contributions can reduce your taxable income and the income tax payable. The basic concessional contributions cap for the 2023–24 financial year is $27,500. However, it is important to understand that you may be able to claim more than the annual concessional contribution cap in some cases by accessing the carry-forward concessional contribution cap.

What is the carry-forward concessional contribution cap?

You will have a higher available concessional contributions cap (than the basic cap) in the current financial year if you can carry forward and apply available unused concessional cap amounts from previous financial years.

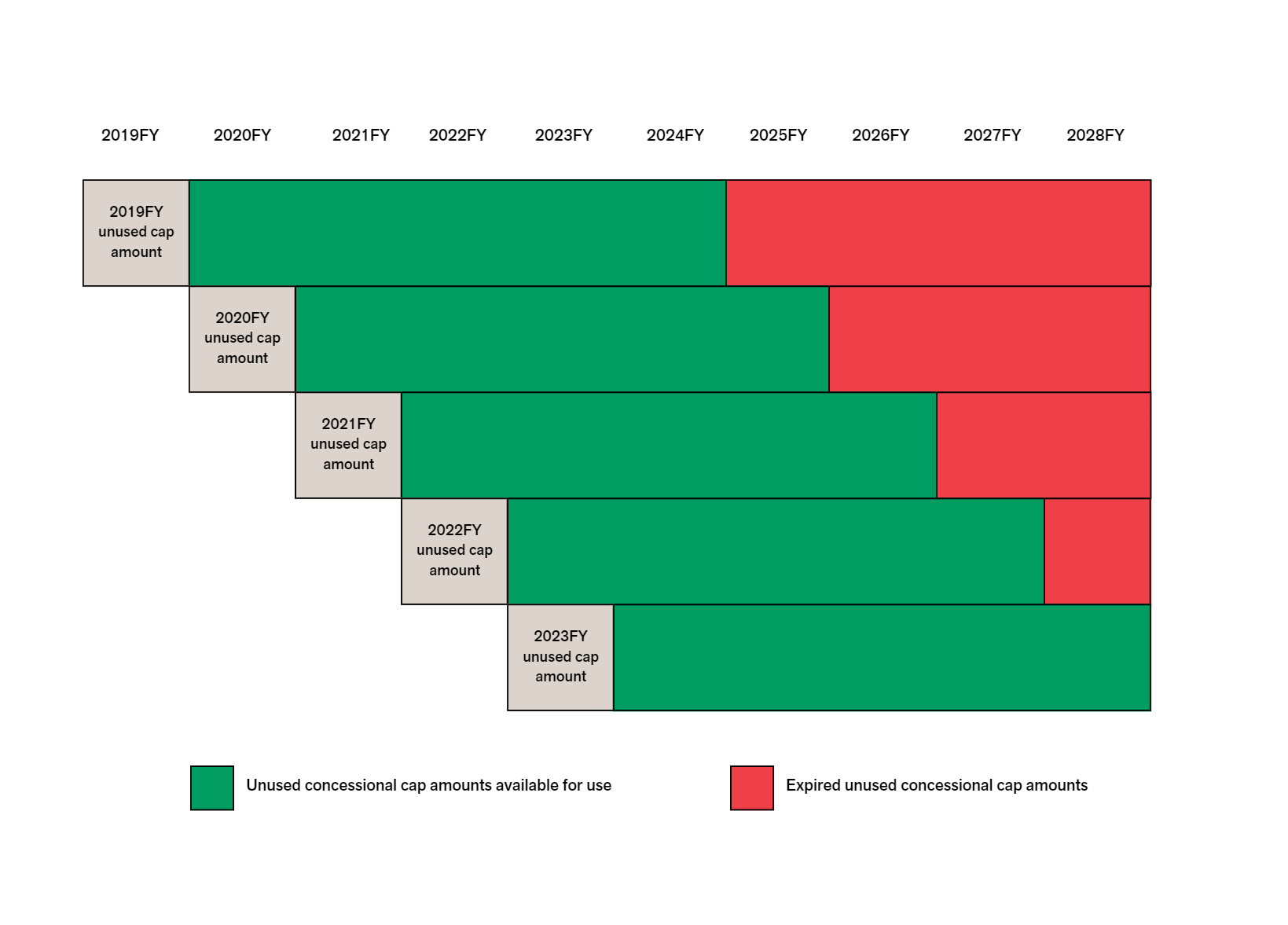

From July 2023, individuals can look back and carry-forward their unused concessional contributions for the previous five financial years. As the measure started on 1 July 2018, individuals could only look back to the ‘start’ and carry forward one previous year from FY2020, then two years from FY2021 and so on.

You are eligible to carry forward unused concessional cap amounts from previous years, and effectively increase your contribution caps in later years, if you have a total superannuation balance of less than $500,000 at 30 June of the previous financial year, and have unused concessional contributions cap amounts from up to five previous years.

Important note for the 2024FY

Any unused cap amounts are available for five years and expire after this time. If an individual has an unused cap amount from the financial year ending 2019 and does not use that amount by the end of June 2024 it will expire.

Quick tips

- If you are not eligible in the current year due to exceeding the $500,000 total super balance threshold on 30 June 2023, you may be eligible next year if your total super balance on 30 June 2024 is reduced to less than $500,000.

- Your total super balance and their unused carry-forward CCs can be found through your myGov account.

Get in Touch to Discuss Your Superannuation Strategy

For personalised superannuation advice or to discuss putting more money into your super, schedule a chat with a Pekada financial adviser today

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).