December 2022 Economic & market review – Financial market woes return

Talking points

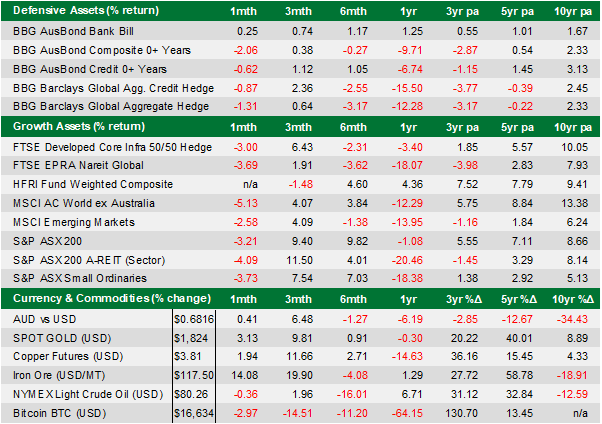

- Financial market woes returned in December as investors experienced losses across most asset classes. In the US, a rally in the final hour of trade for the year meant that the S&P 500 price index fell 19.4% in 2022 in local currency terms. This is just shy of the -20% bear market mark that only six other calendar years since 1928 have seen. The Dow Jones Industrial Average finished the year nearly 9% lower, while the Nasdaq shed close to a third of its value as investors abandoned long duration growth stocks.

- After accounting for dividends, the benchmark S&P/ASX 200 lost just 1.1% in domestic shares and easily outperformed global peers. However, small caps lagged most of the year, losing more than 18%, with industrials experiencing the brunt of the damage. Meanwhile, listed property had a forgettable 2022, as A-REITs shed more than 20%, followed closely by global peers.

- Cash was one of the best performers in 2022. But, unlike other significant share market drawdowns, fixed interest failed to mitigate losses as bonds posted some of the worst returns in modern history. This translated to atrocious performance for traditional 60/40 Balanced portfolios. While domestic bonds fell nearly 10% over the year, US bonds plummeted 16% as the 10-yr Treasury yield surged to 3.83% from 1.52% a year earlier. The Australian dollar finished the year lower, while crypto investors were hit hard as Bitcoin lost nearly two-thirds of its value.

Financial Market Commentary

Markets returned to earth with a thud in December as the final bear market rally of 2022 reversed course after the US Federal Reserve (the Fed) reiterated its willingness to fight inflation throughout 2023. In a unanimous decision, the Fed raised rates by 0.5% to 4.5%, with officials projecting higher inflation for longer and higher interest rates as a result.

The Fed now projects raising rates to 5.1%, up by 0.5% from the September meeting, before falling back to 4.1% in 2024. Across the S&P 500, more than 70% of constituents finished the year lower. Volatility jumped in 2022, as 219 of the 251 trading days had at least a 1% intraday high/low spread, compared with just 95 days a year earlier.

Despite finishing the year with four consecutive weeks in the red, domestic shares outperformed global peers. Losses were relatively muted in 2022 as the major banks benefited from rising interest rates, and the big miners enjoyed strong commodity prices throughout most of the year. As a result, resources delivered investors a 13% return in 2022 as cash flows boomed. Meanwhile, the war in Ukraine boosted oil and gas prices, catalysing an Energy sector return of nearly 50%, while Utilities gained 30% (all inclusive of dividends). However, double-digit losses befell the Telecoms, Consumer Discretionary, A-REITs and Info Tech sectors, with the latter losing a third of its value over the year.

Among growth asset classes, hedge funds with low market exposure were among the best performers in 2022, while cash easily outperformed bonds among the defensive asset classes. In the credit space, listed hybrids delivered a small positive return in 2022, largely due to the strength of the underlying issuers, which is largely comprised of the major banks. Elsewhere, gold ended the year flat but performed strongly in the final quarter. The Australian dollar lost ground in 2022 in what was mostly a risk-off environment. Meanwhile, Bitcoin returned to 2020 levels.

Economic Commentary

The Reserve Bank continued to lift interest rates in December on the domestic front. The 0.25% hike took the official cash rate to 3.1%, after commencing the year at 0.1%, accompanied by guidance in late 2021 that rate rises were unlikely before 2024. The labour market boomed in November as the number of people in the workforce surged to a record high. Employment increased by 64,000, and the jobless rate remained steady at a 48-year low of 3.4%.

In the US, falling energy prices helped keep consumer inflation at bay, with the headline CPI rising less than expected in November and by 7.1% annually. Excluding food and energy, the core CPI rose 6% on an annual basis, driven by shelter costs. Used vehicle prices, which had been a major contributor to the initial inflation burst, fell 2.9% for the month and are down 3.3% from a year ago. Despite inflation slowing, market interest rates remain elevated. The 30-year US Mortgage Rate finished 2022 at 6.4% (the highest year-end rate since 2001), and the 3.3% increase in mortgage rates throughout the year was the largest annual rise on record.

The Eurozone Composite PMI again contracted, following five straight months of falling private sector activity and the second-sharpest drop since May 2013 (ex Covid).

In China, the sudden relaxation of Covid-zero policies led to a surge in infections and deaths. However, authorities hope to boost activity in 2023 after a collapse in the housing sector stifled growth throughout 2022.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).