December 2024 Economic & Market Review – Volatile Markets, Surging Real Yields, and a Slumping Australian Dollar

Talking points

- Market volatility surges amid inflation and policy uncertainty: December saw markets react sharply to concerns about inflation tied to Trump’s proposed policies. The US dollar strengthened, while the Federal Reserve adopted a more cautious tone on rate cuts.

- Global equities stumble as real yields rise: Hedged equity markets struggled in December, with steep losses in global property and infrastructure driven by rising real yields.

- Australian dollar slumps while local fixed interest holds steady: The Australian dollar dropped 5% in December, extending its decline for the year. Meanwhile, domestic fixed interest saw modest gains, supported by the Reserve Bank’s dovish rhetoric.

- Commodities mixed as iron ore edges higher but gold falls: Iron ore prices were up slightly in the month, but slumped 27.3% over the year. This mirrored a slight fall in spot gold prices in December and a 27.2% gain in 2024. These movements highlight shifting dynamics in global commodities amid economic and geopolitical uncertainty.

- Central banks signal their intentions for 2025: The US Fed telegraphed slowing rate cuts, signalling a cautious approach despite a strong job market. In Australia, the Reserve Bank’s softer tone and improving CPI data hint at potential rate cuts in 2025. Meanwhile, China is pivoting towards more aggressive fiscal and monetary policies to boost growth.

Market Commentary

Market volatility jumped in December as markets took increasing notice of the likely inflationary impacts from the incoming Trump administration’s key policy proposals. The US dollar continued its strong appreciation, and crude oil also staged a rebound, following an extended period of weakness. Meanwhile, the US Federal Reserve (the Fed) lowered the benchmark interest rate for a third consecutive time but lowered the number of cuts it expects in 2025, signalling greater caution over how quickly borrowing costs can be reduced.

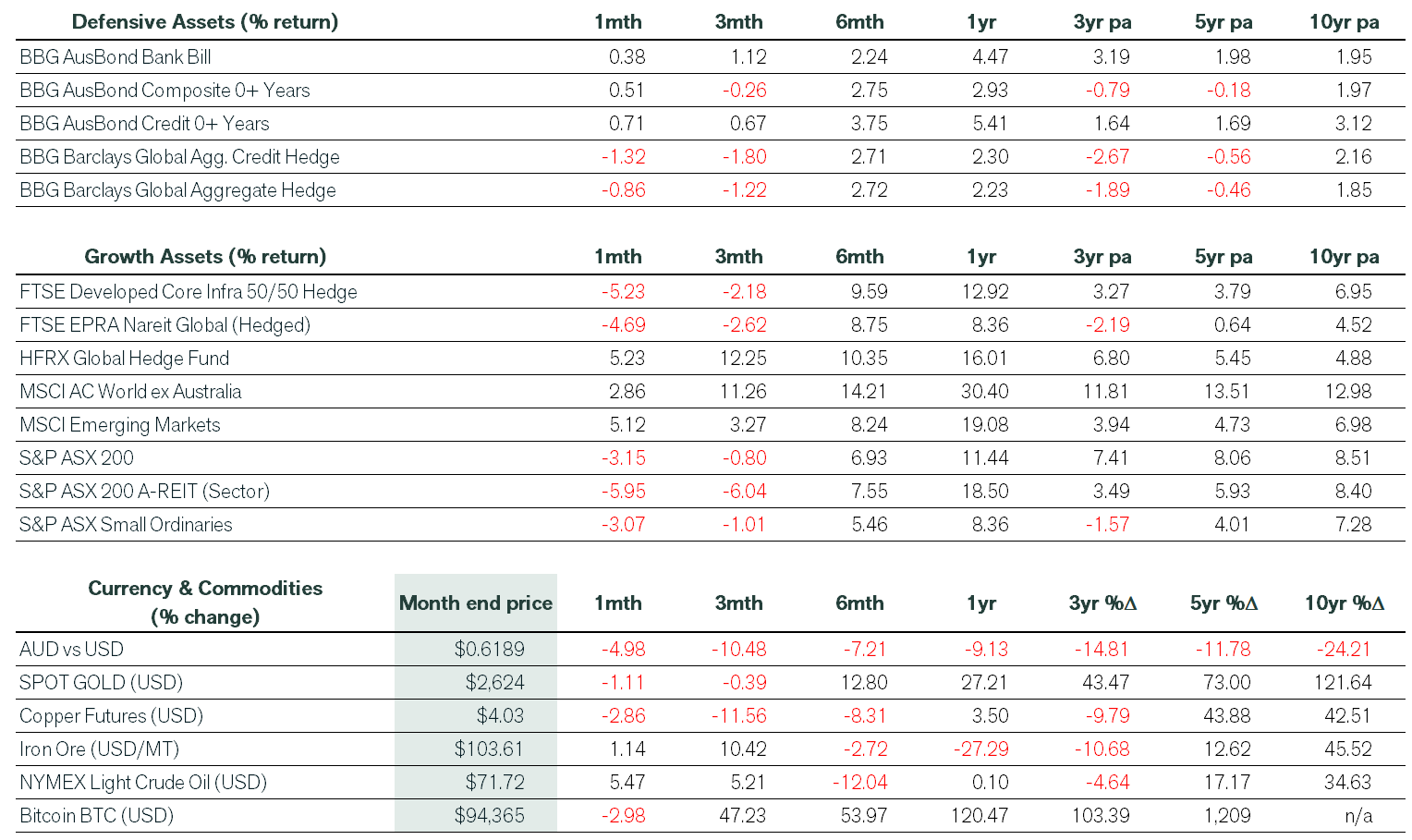

The MSCI ACWI ex-Australia index delivered a total return of 2.9% to unhedged domestic investors in December, as a much weaker Australian dollar outweighed losses in global equities (-1.6% in local currency terms). Hedged equity returns were broadly negative during the month, as evidenced by steep losses in global property and infrastructure, where a sharp rise in real yields added to these sectors’ woes.

In the US, the benchmark US S&P 500 index was down 2.5% in December, bringing its 2024 return to 23.3% in US dollar terms and excluding dividends. The Dow Jones Industrial Average lost 5.3% for the month and was up 12.9% in 2024. The Nasdaq Composite rose 0.5% in December and posted a 28.6% gain in 2024—this followed a more than 40% gain in 2023. Also of note, the S&P MidCap 400 decreased 7.3% for the month, bringing its 2024 return to 12.2%. The S&P SmallCap 600 fell 8.1% in December, with a 6.8% rise over the year.

Closer to home on the ASX, Consumer Staples, Utilities, Industrials and Energy all posted positive returns in an overall negative month for the ASX 200. Listed Property, Gold and Materials (which contains resources) had a particularly tough time during the month. Overall, the ASX 200 delivered a negative total return of 3.2% in December but gained 11.4% over 2024. Small cap peers lost 3.1% in December (up 8.4% for the year), while listed property gave back 6.5% in the month, bringing its annual gain to 18.5%. Across 2024, the Info Tech sector was the lead performer, up almost 50%—following similar outcomes from the US mega techs. Returns for Financials increased by 33%, led by the big banks (most notably CBA). At the bottom of the heap were the Energy and Materials sectors, each delivering losses of nearly 14%.

Returns were mixed across defensive assets. Global fixed interest suffered losses as bond yields were driven upward by a combination of rising inflation expectations and firmer real yields on solid economic data. Global credit returns were weaker as corporate default rates crept higher, such as in the office space.

On the domestic front, fixed interest returns were positive in December as the Reserve Bank (RBA) moved towards more dovish rhetoric at its board meeting. Improving CPI data and potential political pressure from the 2025 federal election see markets positioning for a rate cut in early 2025. Domestic credit had a solid December, up 0.7%, taking its 2024 return to 5.4%. Cash (bank bills) posted an annual return just shy of 4.5%, while the composite bond index added 0.5% in December, for a return of 2.9% in 2024.

Elsewhere, the Australian dollar lost more than 9% against the greenback in 2024, following a 5% depreciation during December. Iron ore prices were up slightly in the month, but slumped 27.3% over the year. This mirrored a slight fall in spot gold prices in December and a 27.2% gain in 2024.

The standout performer for the year however, was Bitcoin, up 120% as the crypto space warmed to the election of Donald Trump to his second term as president.

Economic Commentary

Australia

Closer to home, Australia’s economy expanded at an anaemic 0.3% in the September quarter, below expectations. Year-on-year, the economy expanded 0.8%, compared to the 1.1% consensus forecast. Rapidly rising government spending was the single biggest driver of growth in the September quarter, as fixed asset investment, public servant pay rises and household energy bill subsidies pushed state and federal expenditure to a record share of GDP. Total government spending climbed 8% over the year – far higher than the 5.3% average annual growth rate in the decade before the pandemic. Separately, the November jobs market figures were much better than expected, with the seasonally-adjusted unemployment rate printing at 3.9%.

Global

On the economic front, the Fed cut the funds rate by 0.25% in December, as expected. New quarterly forecasts showed several officials pencilled in fewer rate cuts for 2025 than in their September meeting estimates. The median official now sees the benchmark rate just below 4% by year-end, implying only two further cuts but with upside risks to their inflation projections. At the post-meeting press conference, Fed chair Jerome Powell adopted a hawkish tone, indicating that some officials had tried to predict the inflation impact of Trump’s potential policy moves. Asked why Fed officials are looking to slow their cuts, Powell pointed to how the job market looks to be performing well overall and how recent inflation readings have picked up. Notably, Powell also said that the US Fed does not want to be involved in any government effort to hold large amounts of Bitcoin.

Elsewhere, China’s politburo said that it would embrace a “moderately loose” stance for monetary policy in 2025, its biggest pivot in strategy since the aftermath of the GFC in 2009. It also vowed to have a “more proactive” fiscal policy at its monthly meeting, raising expectations that Beijing will widen the fiscal deficit from 3% at the annual parliamentary session in March. Finally, China’s Premier Li Qiang said China would strengthen countercyclical measures and step up macroeconomic policies.

Do you have any questions or want to chat about your personal investment strategy?

If you want to discuss any of the above information or your personal investment strategy, then book a chat with your financial adviser here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).