Economic & investment market commentary – September 2022

Talking points

- Global share markets faced further volatility during September, which saw the US S&P 500 close out the month and quarter at a new 2022 low, experiencing its worst month since March 2020. Markets lurched lower after the US Federal Reserve’s (the Fed’s) updated its view and plan to tackle persistent inflation with higher interest rates for longer than some investors hoped. This saw several investment banking analysts slash year-end price targets for important benchmarks ̶some by as much as 20%.

- In local currency terms, for the September quarter, the S&P 500 and Nasdaq wrapped up their first three-quarter losing streak since 2009, losing 5.3% and 4.1%, respectively. The Dow dropped 6.7% in the third quarter and saw a third-straight losing quarter for the first time since 2015.

- Domestic shares also suffered, with the ASX 200 ending the month of September losing 6.2%, but posting a small quarterly gain and managing to trade just above its June lows.

- In fixed interest, the hawkish Fed decision and a shocking mini-budget out of the UK saw yields move sharply higher as the newly led government announced it would slash taxes and increase borrowings. This saw the British pound hit a record low and elicit an emergency move by the Bank of England to buy long-dated bonds (gilts) to restore order to bond markets, as a number of leveraged pension funds came close to collapse.

- Elsewhere, the Australian dollar fell 6.5% versus the greenback to US64c, while crude oil prices continued to retreat on economic growth concerns, falling 12% in September. Finally, iron ore prices held steady as the Chinese economy began to rebuild its stockpiles.

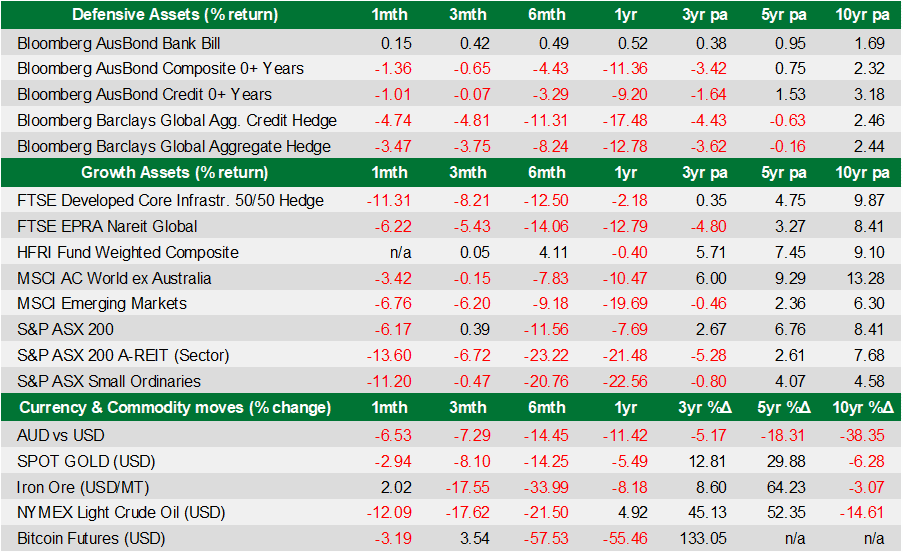

Market data

Market Commentary

September was a difficult month for markets as the US Fed raised interest rates by 0.75% and implied that further large increases remain a possibility. The Fed also slashed its economic growth projections, with investors losing faith that a ‘soft landing’ could be achieved and pricing for a higher likelihood that the US economy would go into recession. During September, the Dow tumbled 8.8% in local currency terms, while the S&P 500 fell 9.3%, and the Nasdaq lost 10.5%.

Similar significant losses extended across most parts of the globe. However, unhedged domestic investors were partly insulated by the falling Australian dollar. The weaker Australian dollar was largely driven by tighter US monetary policy and its outlook, with the sharply upward trajectory of official interest rates attracting safe-haven flows from around the world. This strong US dollar dynamic was especially impactful on emerging markets, which risk crushing their economies with higher interest rates to stem outflows of financial capital.

Domestic shares also struggled during the month, ending September just 1% above the June low. The listed property sector was particularly hard hit by rising long-term yields. Small caps were more sensitive to the change in market conditions and again underperformed their larger peers. Elsewhere, infrastructure was hit hard by rising real yields as market expectations of longer-term inflation were revised lower, consistent with updated views around weaker activity levels.

Finally, fixed interest markets had another negative month ̶ one of many during 2022, which is shaping to be the worst year on record, and by some margin. Most indices are posting double-digit losses this year and there are rising fears the higher-risk credit space could suffer further hits.

Economic Commentary

The US Fed raised interest rates by 0.75% for the third consecutive time, stepping up its fight to curb inflation that’s persisted near the highest levels since the 1980s. Markets were shocked when Fed officials revised their expectations for the benchmark Interest rate to rise to 4.4% by year-end and 4.6% during 2023. That indicates a fourth-straight 0.75% hike could be on the table for the next gathering in November, about a week before the US mid-term elections. Of note, Fed officials now expect core inflation, which excludes food and energy, to remain above 3% in 2023. This is despite also anticipating the US economy to stop to a crawl by the end of this year.

On the domestic front, the Reserve Bank again hiked the official cash rate in September by 0.5%, as it continued its record pace of tightening, with high inflation the key concern. However, despite recent rate rises, both personal and business loans grew in August, marking the fastest pace of credit growth in around 14 years. On the inflation front, the first batch of official monthly data was released, showing that the CPI rose 6.8% in the year to August, having peaked at 7% in July. Construction costs and high fuel prices were the most significant contributors to the surge. Finally, retail sales posted the eighth consecutive rise in August as consumers dipped into a substantial savings buffer.

Elsewhere, Germany reported September consumer inflation accelerated to 10.9% over the year as the world’s fourth-biggest economy faced a “double whammy” on spiking utility prices. Meanwhile, German producer prices jumped by nearly 8% in August and are 46% higher over the year.

Our experienced financial planners provide tailored strategies and guidance to suit your unique needs and financial goals. If you’re seeking expert investment advice and management, book a chat with a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).