Extreme uncertainty, volatility and opportunity?

Pete discusses the current volatile environment we find ourselves in.

Extreme uncertainty, volatility and opportunity?

Extraordinary barely describes the movement on share markets over recent days. The daily changes of more than 10% down and 9% up across global markets are largely unprecedented. The only explanation for such extreme volatility is that market participants are faced with extreme uncertainty over how current events will impact on the earnings and ongoing financial viability of companies. Financial markets hate uncertainty, and at the moment that is the dominating theme.

What is causing the jump in volatility?

Triggering the step-up in volatility has been the rapid introduction by Governments across the globe of new measures to contain the spread of COVID-19. These new measures, involving more significant restrictions on human movement and interaction, will have the effect of further slowing economic activity, thereby limiting the normal operations and profitability of individual businesses.

Not only are the new containment measures more significant in terms of impact, but the approach now being taken in countries such as Australia and the U.S. appear likely to be in place for a longer duration than may have previously been envisaged. Integral to the strategies now being adopted is the attempt to “flatten the curve” of the virus spread, which implies lengthening out the time taken for the normal bell curve of virus spread and reduction to take place.

Data from the World Health Organisation showed the number of confirmed cases as at 18 March 2020 was 207,860 across 166 countries. Italy’s fatality count surpassed that of China’s, while the number of cases across Europe continues to grow. The UK has partially shutdown London’s underground system while Israel is requiring citizens to self-isolate for 7 days. However, China has reported no new locally transmitted cases. The US advised citizens living overseas to arrange for an immediate return to the US, unless they are prepared to remain abroad for an unknown period.

From an Australian perspective, we are entering unchartered territory with events and policies as follows:

- Many of the working population are working from home, with business locations largely vacant.

- Major cities are eerily quiet and resembling ghost towns.

- Australia’s borders will be closed to non-Australian citizens and non-permanent residents.

- Tasmania has implemented a 14-day self-isolation policy for those travelling to Tasmania.

- Record Federal government stimulus amounting to $17.6bln

- Schools are on the verge of being shut down, and some have already closed.

- RBA has cut interest rates to 0.25% and offered a $90 billion lending facility to banks for small business.

- Banning of gatherings of 100 people or more, and venues will now be limited to four square metres provided per person in an enclosed space.

This approach is deemed necessary to minimise the extent to which the peak in infections overwhelms the capacity of the healthcare system. Understandably, no politician or healthcare official wants to be in a position whereby they are forced to implement policies that effectively turn away ill-patients due to a lack of healthcare facilities.

What do the new containment measures mean for share markets?

With the impact of the containment measures now more significant for an extended duration, it was logical that equity markets would fall further in response. However, as the volatility of the market response implies, assessing the magnitude of the impact is extremely difficult. Although the effect of a temporary loss of revenue for individual companies can be estimated, what is not known is how significant and long-lasting a broader economic downturn will be – potentially involving a spike in corporate bankruptcies and a material lift in unemployment. It is unclear how much of these risks have been priced into share market values in the drop since the 20th February peak.

What we do know about share markets based on past behaviour is that they will tend to overreact or “overshoot” in the downward direction in periods of heightened risk and uncertainty. Consequently, higher than normal returns are often experienced once the uncertainty disappears.

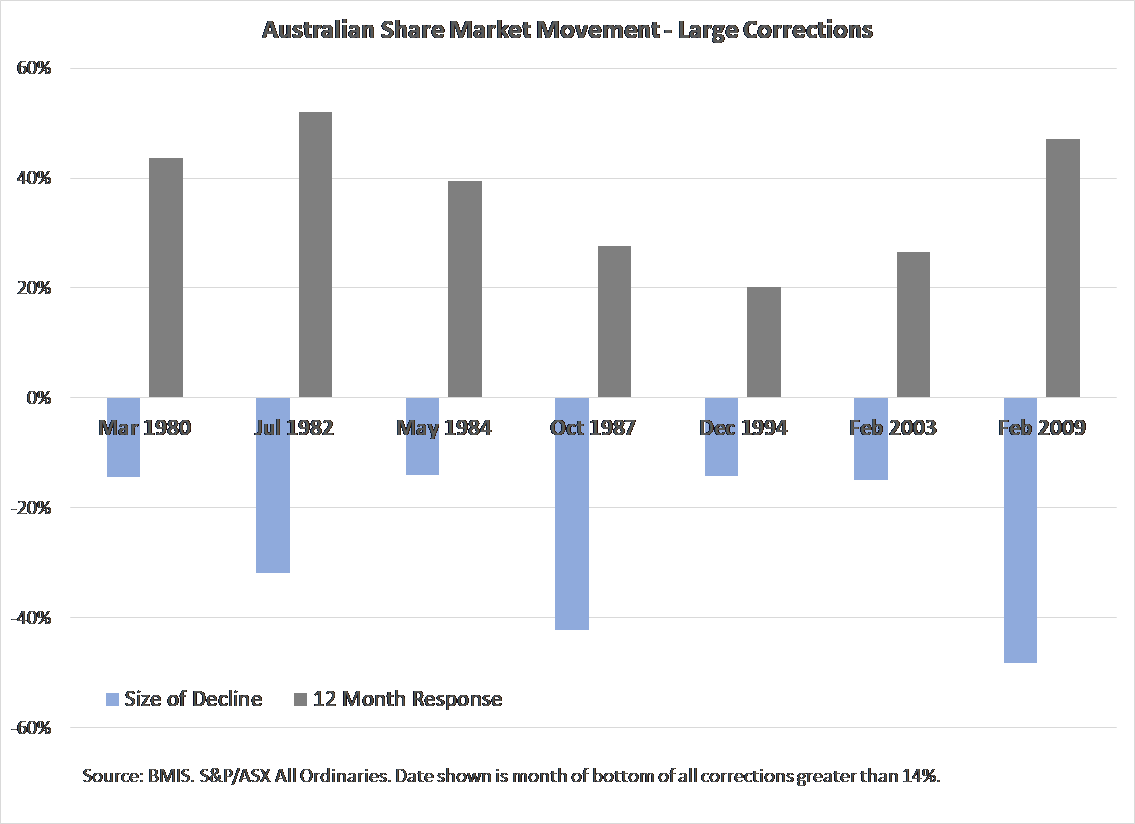

The below chart shows the return produced on the Australian share market in the 12 months following the bottoming of a significant correction. As indicated, returns subsequent to market corrections have been well over longer-term average rates of return.

However, whether or not the latest downward adjustment on equity markets has taken us to the bottom of this current cycle remains to be seen. At the time of writing (20th March 2020), the Australian share market had declined by 33% from its late February peak. This places the correction amongst the most significant experienced over the past few decades. At face value, share prices now appear better value but care should be taken as future dividends and earnings are far from guaranteed. For example, the large Australian banks are now trading at fully franked dividend yields of around 12% (assuming historical dividend levels stay which is uncertain). At this level, even if dividends were cut materially, the banks could still provide shareholders with handsome relative returns from this point forward. However, it is the uncertainty and unprecedented nature of current events that makes valuing shares in this environment so tricky – hence the extraordinary volatility we are experiencing. Given this volatility and uncertainty surrounding earnings, any assessment of value should be revisited as new information comes to hand before making any investment decisions. This is not the time to be complacent.

There is a glimmer of hope

It will be the duration of the current containment period that ultimately determines how much medium-longer term damage is done to company earnings and the broader economy. Once there is more widespread consensus on this duration and impact, then share markets will switch their focus to the recovery period. History suggests that share markets are very willing to “look through” short term impacts once they are known. This is why speculation as to whether or not there will be a recession is mostly irrelevant for equity investors. By the time we have confirmation (in September) of whether the economy entered into a technical recession in the first half of 2020, the focus of share markets will be firmly on the period ahead and, hopefully, on the recovery from the current crisis.

Although it remains early days, there is hope that the carnage caused by COVID-19 will be a one-off event. Human trials of a vaccine have commenced in Seattle, creating the possibility of a successful vaccine rollout in approximately 12 months. Also, the scale of the virus containment action now in place around the globe may be successful at slowing the virus spread, enabling a lower peak economic impact than is now entrenched in worst-case scenario forecasts. Efforts in other countries such as China, South Korea and Japan appear to have significantly shortened the period of exponential growth in the virus spread.

It is impossible to predict with certainty where we head from here in the short term, and a myriad of scenarios could play out. Investors should apply discipline through this period and refer back to their long term plan. It would be extremely risky to be overly optimistic or overly pessimistic with any response to the current market conditions, and a balanced approach should be applied. What we do know is that sticking to your longer-term investment strategies has proved to be a successful approach in past periods of heightened risk, and there is little to suggest that this period justifies a different approach

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).