Federal Budget 2024/2025: Financial Planning Summary

Treasurer Jim Chalmers delivered the Labor Government’s 2024-2025 Federal Budget and we have summarised what we feel are the key points which impact financial planning strategies.

For our ongoing service package clients, your adviser will be in contact to provide guidance on changes which may impact your strategy.

IMPORTANT: Please remember that these measures are subject to becoming law, so be sure to confirm this before taking any action.

Taxation

Stage 3 Tax Cuts

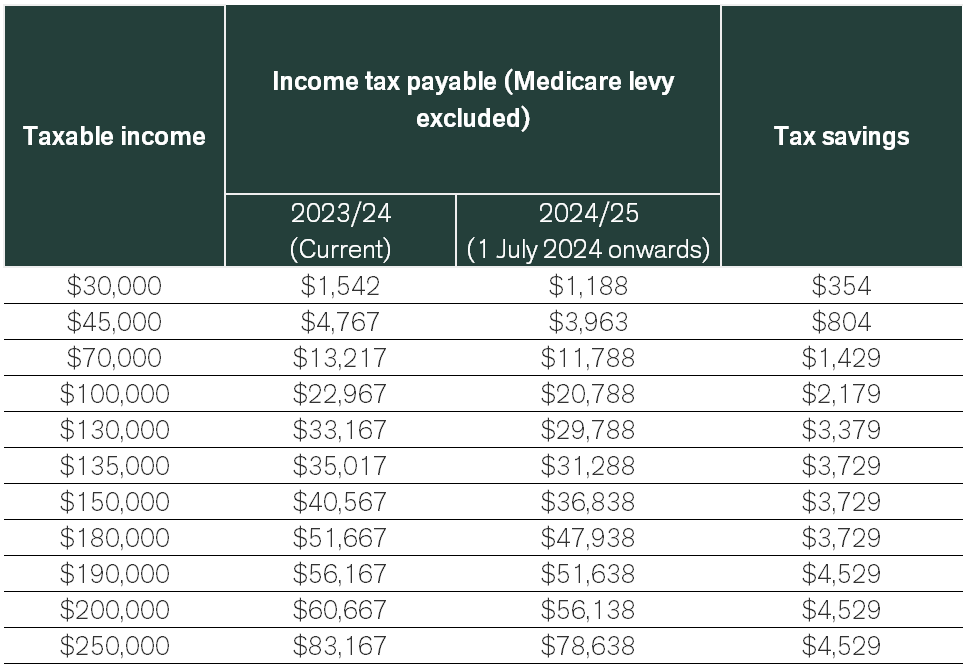

Starting 1 July 2024 Stage 3 tax cuts will deliver savings of $4,529 per annum for those in the highest tax bracket. The average taxpayer will save $1,888 a year.

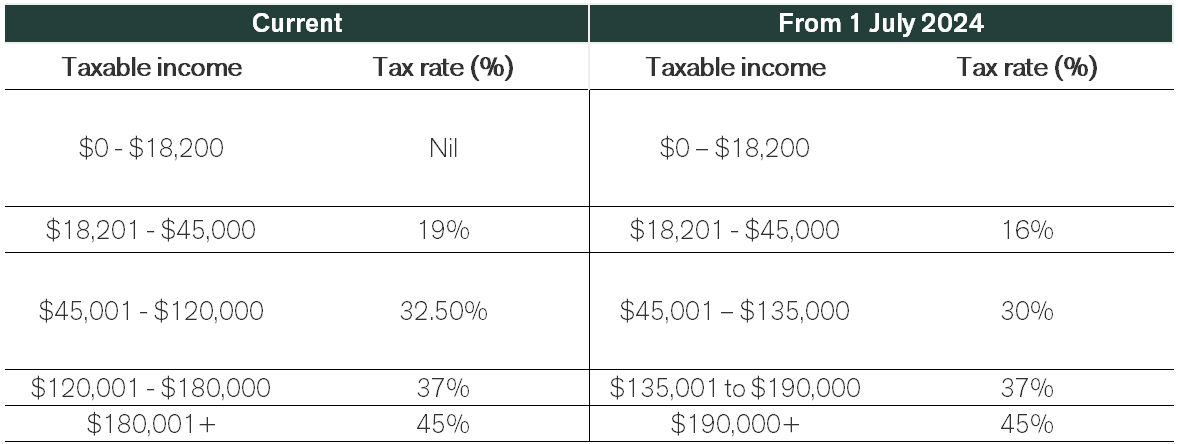

The Stage 3 tax cuts will make the following changes from 2024/25:

- reduce the 19% tax rate to 16%

- reduce the 32.5% tax rate to 30%

- increase the 37% tax rate threshold from $120,000 to $135,000

- increase the 45% tax rate threshold from $180,000 to $190,000

The table below shows the changes to tax brackets. Note, these amounts do not include Medicare levy.

The table below compares the amount of tax payable in 2023/24 to the amount payable under the new tax rates from 2024/25. The last column shows the amount of tax saved.

Increasing the Medicare Levy Low-Income Thresholds

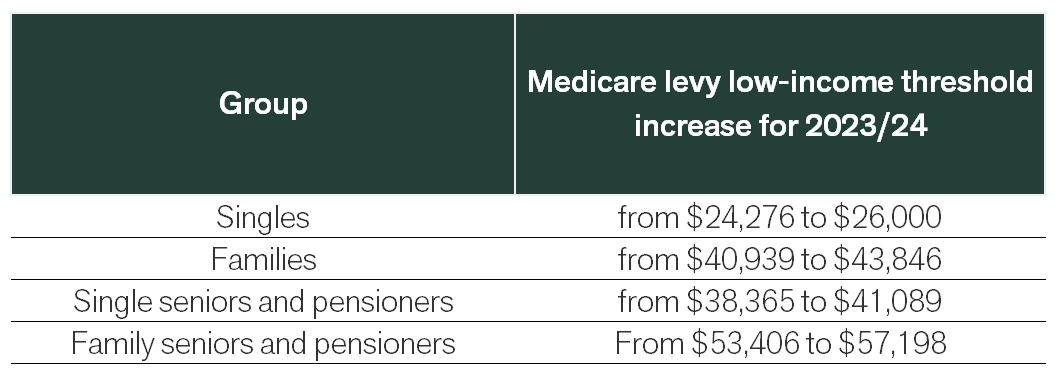

The Government has increased the Medicare levy low-income thresholds for singles, families, and seniors and pensioners from 1 July 2023 to provide cost-of-living relief. The increase to the thresholds ensures that low-income individuals continue to be exempt from paying the Medicare levy or pay a reduced levy rate.

The family income thresholds will now increase by $4,027 for each dependent child, up from $3,760.

This measure has already been provisioned for by the Government and will apply retrospectively from 1 July 2023.

Superannuation

Parental leave superannuation

The Government has announced that it will pay super on the Government funded Paid Parental Leave for babies born or adopted on or after 1 July 2025.

Eligible parents will receive an additional 12% of their Government-funded Paid Parental Leave as a contribution to their superannuation fund.

Payday Super

Starting from July 1, 2026, employers must pay superannuation at the same time they pay salary and wages to employees. Currently, employers are required to pay their employees’ superannuation guarantee contributions on a quarterly basis.

Cost of Living Relief

Power Bill Relief

Energy bill relief will be extended to every Australian household, with $300 automatically credited to their electricity bills next financial year. This is not means tested.

Debt Relief for Higher Education Loan Program (HELP)

HELP/HECS debt will now be indexed either to the Consumer Price Index (CPI) or the Wage Price Index (WPI), whichever is lower, and that change will be backdated to 1 June 2023.

This means that about 3 million Australians with student loans are set to receive an average $1,200 reduction in their HELP, HECS, VET Student Loan, Australian Apprenticeship Support Loan and other student support loan accounts that existed on 1 June last year.

The reduction aims to offset steep increases in student debt last year when student loans were indexed to inflation at the rate of 7.1%, but wage growth remained low. The 2023 indexation rate based on WPI would only have been 3.2 per cent.

Extending cheaper medication

The Government has announced a one-year freeze on the maximum Pharmaceutical Benefits Scheme (PBS) patient co-payment for everyone with a Medicare card and a five-year freeze for pensioners and other concession cardholders.

This change means that no pensioner or concession card holder will pay more than $7.70 (plus any applicable manufacturer premiums) for up to five years.

Social Security

Social security deeming rate freeze extended

The current freeze on deeming rates, which are used to determine the amount of income a person is deemed to earn from their financial investments, will be extended for another year. This means that the deeming rate will stay at 0.25% for the lower rate and 2.25% for the higher rate.

This will ensure income support recipients, such as age pension recipients, will not see a reduction to their payments due to an increase in the deeming rates over the next year. It also means there will be no negative impact for Commonwealth Seniors Health Card holders and means-tested aged care recipients.

Rental assistance maximum lifted by 10%

Commonwealth Rent Assistance maximum rates will be increased by 10% from September 2024, with the aim of helping address rental affordability in the housing market.

Higher Rate of JobSeeker Payment – Partial Capacity to Work

The Government has announced that from 20 September 2024, it will extend eligibility for the existing higher rate of JobSeeker Payment to single recipients with a partial capacity to work of between zero and 14 hours per week.

The higher JobSeeker Payment rate is currently provided to single recipients with dependent children and those aged 55 and over who have been on payment for nine continuous months or more. This measure extends the higher payment rate to those with a partial capacity to work.

The higher JobSeeker Payment rate is currently $833.20 per fortnight (compared to the standard rate for single recipients without dependant children of $771.50 per fortnight).

Increased flexibility for Carer Payment recipients

From 20 March 2025, the existing 25 hour per week participation limit for Carer Payment recipients will be amended to 100 hours over four weeks. The participation limit will no longer capture study, volunteering activities and travel time and will only apply to employment.

The Government has also announced that Carer Payment recipients who exceed the participation limit or their allowable temporary cessation of care days, will have their payments suspended for up to six months instead of cancelled. Recipients will also be able to use single temporary cessation of care days where they exceed the participation limit, rather than the current seven day minimum.

Aged Care

Improving Aged Care Support

The Government has now announced a new start date of 1 July 2025 for the new Aged Care Act, however no details have yet been provided as to how fees and charges for aged care residents and home care recipients will work under the new Aged Care Act.

Also, the Government has announced it will provide funding over five years from 2023–24 to deliver a range of key aged care reforms and to continue to implement the recommendations from the Royal Commission into Aged Care Quality and Safety. These measures are proposed to include:

- the release of 24,100 additional home care packages in 2024–25

- changes to increase the regulatory capability of the Aged Care Quality and Safety Commission and to implement a new aged care regulatory framework from 1 July 2025

- additional funding to attract and retain aged care workers and improve the outcomes for people receiving aged care services through existing aged care workforce programs

- investment to reduce wait times for the My Aged Care Contact Centre due to increased demand and service complexity

- money to extend the Home Care Workforce Support Program for an additional three years to facilitate the growth of the care and support workforce in thin markets.

Small Business

Extension of $20,000 instant asset write-off

The Government has announced it will extend the $20,000 small business instant asset write-off by a further 12 months until 30 June 2025.

Under these rules, small businesses with aggregated annual turnover of less than $10 million will continue to be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2025. The Government also confirmed the $20,000 asset threshold will continue to apply on a per asset basis, allowing small businesses to instantly write off multiple assets.

Energy bill relief for small businesses

Similar to households, the Government announced it will provide direct energy bill relief for small businesses.

The government will provide additional energy bill relief of $325 to eligible small business in 2024-25. Rebates will automatically be applied to electricity bills and will be rolled out in quarterly instalments.

How can we help?

If you have any questions or would like further clarification in regards to any of the above measures outlined in the 2024-25 Federal Budget, please feel free to book a chat with your adviser.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).