New stimulus package announced

Summary of the second part of the Coronavirus stimulus package

Government announces second stimulus package

Prime Minister Scott Morrison has unveiled another $66 billion worth of stimulus measures in an effort to help keep businesses going and workers in jobs during the coronavirus crisis.

The new package takes Australia’s total stimulus to a massive $189 billion, or the equivalent of 9.7 of our GDP. This is a big step as Canada’s stimulus is 4.5 per cent of its GDP and South Korea’s is 4 per cent.

Here are the main measures announced as part of the stimulus package:

- Cash payments for small to medium businesses. This is the biggest part of the package. All employing small businesses will receive at least $20,000, and larger small businesses will receive up to $100,000. This is to make sure that small businesses that employ people are able to retain staff and help manage cashflow.

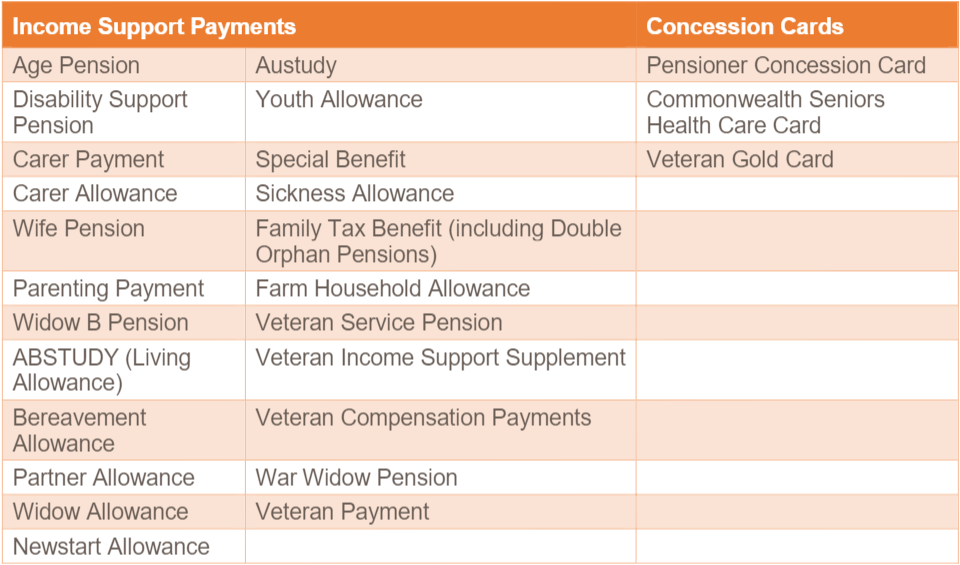

- Doubling the income support payment. Over the next six months, the Government is temporarily expanding eligibility to income support payments and establishing a new, time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight. This will be paid to both existing and new recipients of JobSeeker Payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit.

- A further $750 payment – on top of the first one – for those on income support who are not eligible for the coronavirus payment. The Government is providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession card holders. The first payment will be made from 31 March 2020 and the second payment will be made from 13 July 2020. Around half of those that benefit are pensioners. This payment will help to support confidence and domestic demand in the economy. The second payment will not be made to those eligible for the Coronavirus supplement.

- The ability to withdraw super, for those who are facing financial hardship due to the Coronavirus. The Government is allowing individuals affected by the Coronavirus to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

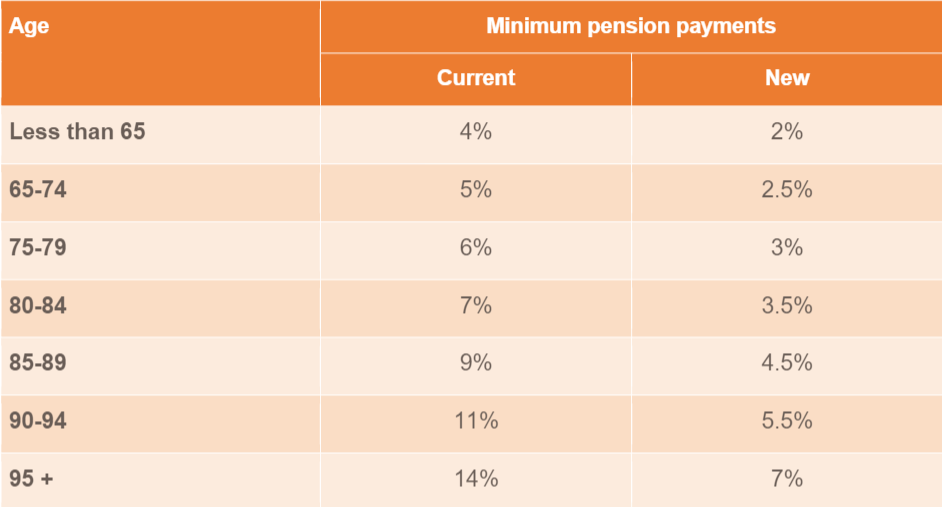

- Reducing the minimum drawdown rate for pensions. The Government is temporarily reducing superannuation minimum drawdown requirements for account-based pensions and similar products by 50 per cent for 2019-20 and 2020-21. This measure will benefit retirees holding these products by reducing the need to sell investment assets to fund minimum drawdown requirements.

- More money into the economy. The government would guarantee in a 50/50 partnership more lending to small-to-medium businesses. This would include loans of up to $250,000 over 3 years – with no payments required for 6 months.

- Reduction in deeming rates. On 12 March, the Government announced a 0.5 percentage point reduction in both the upper and lower social security deeming rates. The Government will now reduce these rates by another 0.25 percentage points.

- Increased flexibility in insolvency and bankruptcy law. This includes increasing the threshold at which a creditor can pursue insolvency proceedings – from $2,000 to $20,000 – and giving people up to six months to respond, over the current 21 days. Most significantly, businesses will be able to trade while insolvent.

Some quotes from the Prime Minister Scott Morrison today:

“There is a lot of pain coming, but we’re going to cushion the blow as best we can,”

“We’re already seeing the devastating economic impact coronavirus is having for Australia’s local businesses. Unfortunately, it is going to get worse before it gets better but it will get better.”

“We want to help businesses keep going as best they can or to pause instead of falling apart. We want to ensure that when this crisis has passed, Australia can bounce back,”

“In the event that someone does regrettably lose their job because of the coronavirus, it’s very important that businesses give their workers the confidence that this is just temporary. And that when they reopen their doors and get back to business, that they will want to get them back on the payroll as soon as possible.”

“This is all about getting through the next six months or longer as the virus takes its course. Our support is all about building an economic bridge to get us to the other side, so together, we get through this.”

At the moment conditions are constantly changing and therefore so are the proposals being made by the government so to make sure everything is up to date be sure to check the treasury’s Coronavirus page at https://treasury.gov.au/coronavirus

As always, if you have any questions please don’t hesitate to email me at zac@pekada.com.au

Zac is a qualified financial planner at Pekada and host of the Wealth Collective Podcast. Living in Melbourne, Zac has six years of experience in advice and specialises in wealth accumulation and protection strategies. He loves to keep his finger on the pulse for the best strategies for wealth accumulators looking to build and protect their wealth tax effectively. Zac has been featured as an expert in Money Magazine.