How to invest during COVID-19

How should we go about investing during these volatile times?

How To Invest During COVID-19 (Coronavirus)

I’m currently writing this blog from home as our office is self-isolating to try and stop the potential spread of COVID-19, something that I didn’t think would be on the cards a few months ago or maybe my entire lifetime. This is the case for a lot of workplaces around the country and the world. These are no doubt, pretty crazy times and we’re not entirely sure what could happen next but if you believe in the idea that the market will eventually recover and we’ll get through this like I do, then potentially there is money to be made.

I want to show you two quotes from famous, successful investors that sum up how I’m feeling at the moment in regards to investing.

Sir John Templeton

- “The first rule of investment is ‘buy low and sell high’, but many people fear to buy low because of the fear of the stock dropping even lower. Then you may ask: ‘When is the time to buy low?’ The answer is: When there is maximum pessimism.”

Warren Buffett

- “You pay a very high price for a cheery consensus. It won’t be the economy that will do in investors; it will be the investors themselves. Uncertainty is actually the friend of the buyer of long-term values.”

It certainly feels like we are living in pessimistic and uncertain times and those two quotes show us that these are the times in which we can potentially profit if we are brave enough. The old Warren Buffett saying is to be greedy when others are fearful but that is easier said than done at times like this when volatility is so high.

If you’re already invested, it’s important to remind yourself of why you invested in the first place and not to get caught up in short term panic. If you haven’t invested yet but have been thinking about it then you need to ask yourself if you still believe in the long term future of the market then now could be looked at as an opportunity to buy assets at a discount compared to a month or two ago.

When will the volatility end?

The short answer is no one really knows, but in all likelihood we are in for some volatile times ahead. In times of high volatility it’s important to decide whether or not you are a trader or an investor. An investor looks to generate returns over the medium to long term (5-7+ years) where as a trader makes decisions based on short term news.

At Pekada we are investors, not traders. This means that we’re aware of the short term risks but position ourselves for the long term. Volatility, fear and uncertainty can create opportunities for investors to buy companies at a discount to their intrinsic value.

What does history tell us?

We’ve been through market drops like this before and each time we have recovered. In more recent times through the GFC in 2007/08 if you’d have sold out and moved to cash you would have been considerably worse off in the next few years in which we experienced solid growth, therefore it’s important not to panic and to be patient.

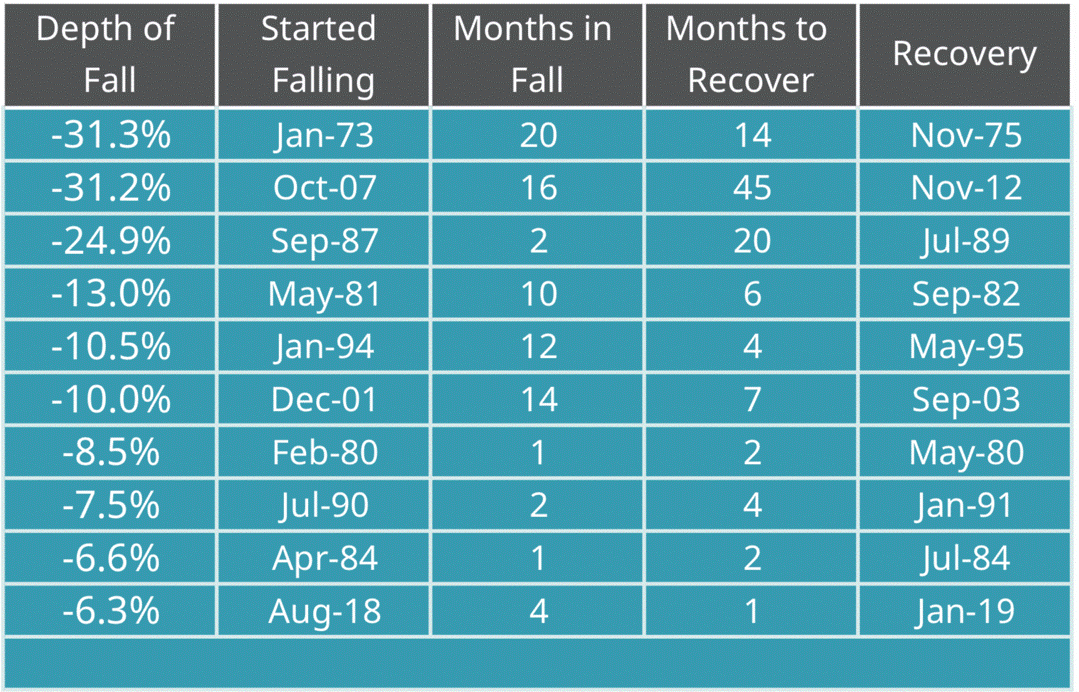

The graph below shows us historically what has happened for a 70% growth portfolio (meaning that the portfolio has an allocation of 70% towards assets such as shares and property and a 30% allocation towards defensive assets such as cash and fixed interest). COVID-19 is different to anything we’ve been through before from a human impact perspective but the drops are something the market has seen before and each time we’ve bounced back. The amount of time it takes to bounce back is always different but the constant is that we have always bounced back.

Source: PlanPlus Global

What should I be doing?

We don’t try and time the market and a lot of studies show that on average people who try and time the market usually end up worse off than if they would have stayed invested over the long term. This means you need to try not to be tempted to move to cash and jump back in when markets are stable, chances are by the time you feel its right to jump back in, you’ve already missed a lot of the upside.

If you are working and contributing to a regular savings plan then it’s important that you continue it, times like these are the reasons that we do a regular savings plan, so that we are continuously buying at a discount during volatile times.

If you have wanted to get started investing then now could be a good time to start as you’re potentially getting assets at a 30% discount to what they were on the 20th of February this year. If you’re nervous about putting in a big lump sum at the moment during these uncertain times then you may look to dollar cost average those amounts in over time. For instance instead of putting $200k in right now, you might do $20k per month over 10 months. A dollar cost averaging strategy minimises the risk and smooths out the purchase price of the asset over a period of time, meaning in volatile times like this you won’t be fully vulnerable to the volatility by investing everything at once.

As always if you have any questions, feel free to email me at zac@pekada.com.au

Zac is a qualified financial planner at Pekada and host of the Wealth Collective Podcast. Living in Melbourne, Zac has six years of experience in advice and specialises in wealth accumulation and protection strategies. He loves to keep his finger on the pulse for the best strategies for wealth accumulators looking to build and protect their wealth tax effectively. Zac has been featured as an expert in Money Magazine.