Now is not the time to try and time the markets

Impact of COVID-19 (coronavirus) and investing through it

After showing great resilience, and perhaps a degree of complacency, equity markets have fallen sharply in recent days. A relatively sudden surge of confirmation of COVID-19 outbreaks outside of China has been the main trigger for the correction. However, Apple’s removal of previous earnings guidance and a deterioration in some leading economic indicators (such as the preliminary reading of the US Purchasing Managers Index and the Baltic Dry Index) have also played a role in the share market sell-off.

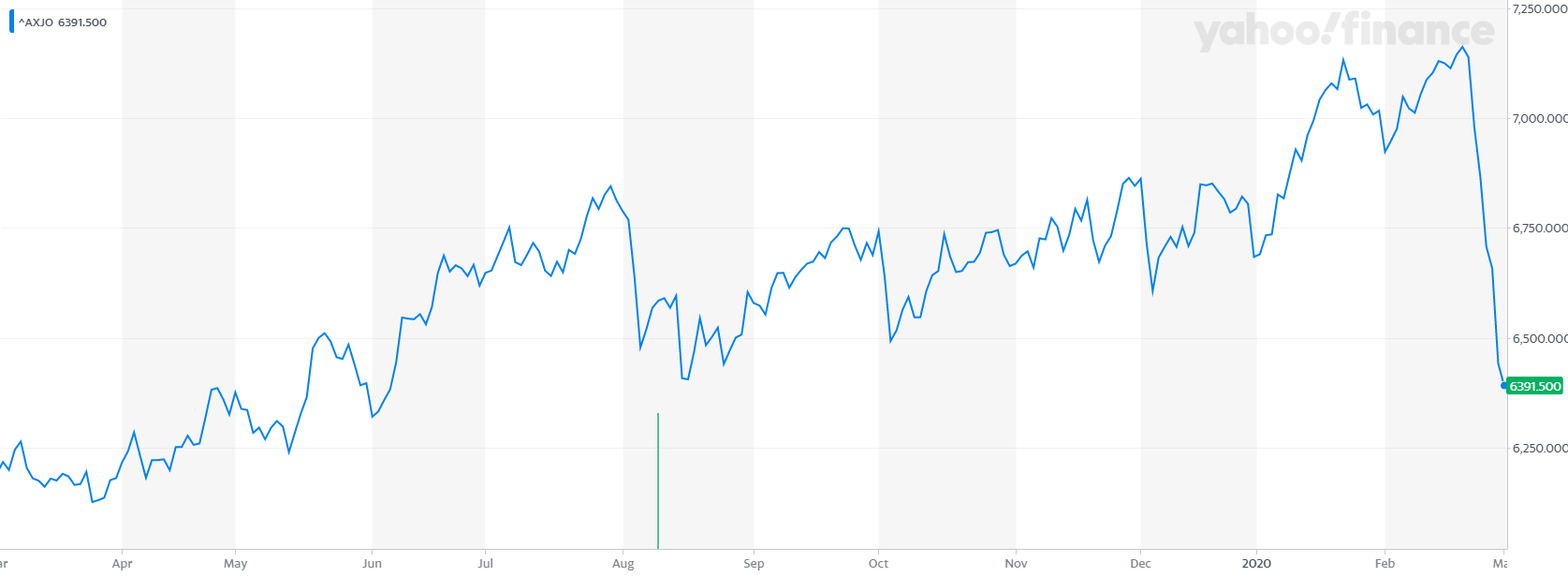

At the time of writing (March 2nd), the Australian share market, as measured by the S&P ASX 200 Index, has fallen by 12.8% from its high of February 20th. This is similar to the 12.9% decline recorded by the US S&P 500 Index over the same period. Although these corrections are material, they do need to be viewed in the context of the strong appreciation of share markets over recent weeks. For example, the fall on the Australian market only takes valuations back to where they were last August.

Unlike bond markets, which reacted to the COVID-19 much faster, equity markets have only recently acknowledged that the virus may have more than short term effects on company earnings and the broader global economy – in addition to the known tragic human toll. The spread of the virus beyond China has increased the expected economic impact and, importantly, increased the degree of uncertainty over the duration and severity of the crisis. Uncertainty and negative impacts on economic growth are not welcomed news to investors!

What is the challenge for investors?

It is this uncertainty over the future progression of the COVID-19 impact that makes it particularly challenging for investors. A virus of this nature, combined with the significance of the mitigation actions, has few precedents.

Although it may be tempting to respond to the heightened risk by lowering exposure to assets such as equities which are sensitive to this risk, such a response may be problematic. Ultimately, if longer-term wealth accumulation objectives require exposure to equity-like returns, then a shift to defensive assets can only be profitable if the re-entry into equity markets can be made at a lower price than the exit price.

Now while a further decline in share market values in the current climate of uncertainty is highly possible, the task of timing a re-entry into markets at a lower point than exit value may be very problematic. With markets primarily focused on a single source of concern, any dilution or elimination of this concern could result in a very rapid reversal of the recent price correction. The development of a vaccine, the onset of the Northern Hemisphere Spring season or simply evidence of a decline in new infections are examples of catalysts that could result in a sharp “relief” rally on share markets, which would be difficult for investors to action ahead of the market movement.

While market timing in the current environment is fraught with danger, using the correction in share market valuations as an opportunity to execute strategies consistent with longer-term objectives may be highly appropriate. For example, investors that had been holding higher cash or more defensive positions than prescribed by their longer-term risk profile could use the current period of lower share prices as an opportunity to at least partially add equity assets. Similarly, investors that were looking to adjust their geographical exposures due to changes in the longer-term earnings growth outlook of different markets may find opportunities to purchase desired assets at more attractive valuations.

What should investors do to their investment strategy?

Good investing is often dull, but in times like these, it finds a way to test your resolve. Stay the course and trust in the work you did on your investment strategy. If this is the first time you have experienced a market fall like this, then remember it is not a loss until you sell. Also, it is a reminder that capital gains are not locked in until you realise it – so don’t obsess over the peak of what your portfolio reached.

What is most crucial from an investors perspective, however, is that long term strategies are not abandoned due to the current spike in investment risk. History shows that investors who hold their long term strategies through periods of apparent adversity are ultimately rewarded; whereas looking to time an exit and re-entry into markets is extremely difficult to execute successfully consistently. History also shows that each period of heightened risk is unique, and the COVID-19 is undoubtedly very different from the majority of risks faced by investors over recent years. The balance of probability remains, however, that this crisis will ultimately be managed or eradicated in some form and the resilience of holding a portfolio of diversified and well-managed investments will be proven once again.

Investing is long term game, and there is no rush to make a move one way or another. Have a plan and stick to it!! If you want to add to your portfolio, then perhaps stagger this investment across several weeks or months to reduce your timing risk. Don’t try and time the sell-off and pick the bottom in one hit. It is near impossible.

Well, that’s all from me for now, and I look forward to seeing what the coming days bring in terms of investment markets. If you have any questions or want to chat about your portfolio, then please contact me directly at pete@pekada.com.au.

Happy investing!

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).