January 2022 Investment Review: Sharemarket falls in response to interest rate outlook

January 2022 Investment Review: Sharemarket falls in response to interest rate outlook

Talking points for January 2022

- Sharemarkets shifted sharply lower over January in response to expectations of higher interest rates.

- Higher inflation prompted the US central bank to indicate an imminent policy tightening, causing bond yields to rise.

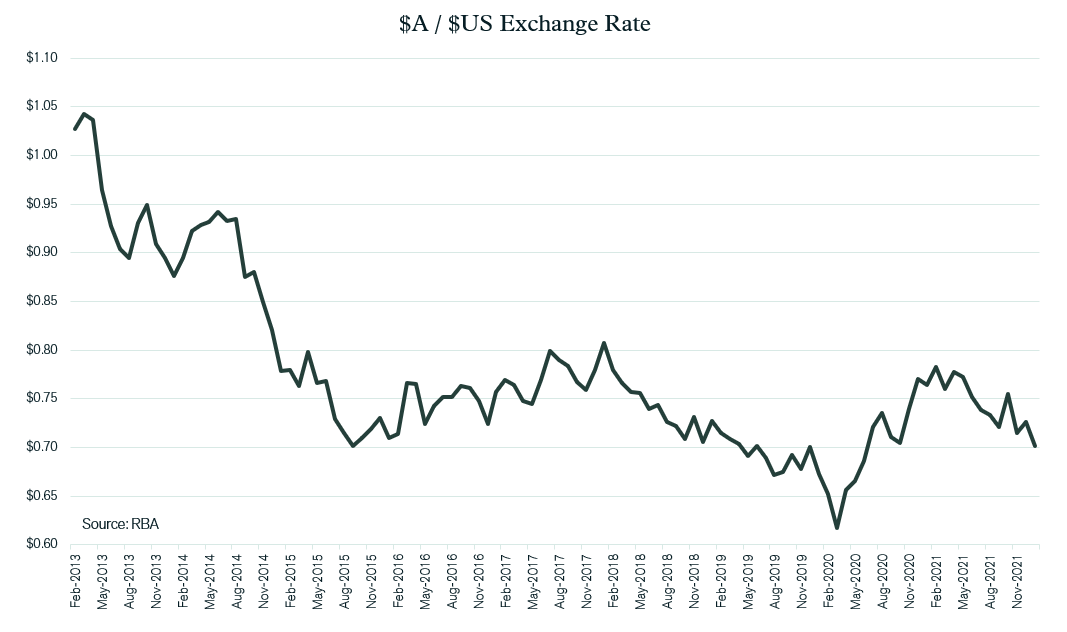

- Despite stronger iron ore prices, the $A declined against the $US and Euro.

International equities

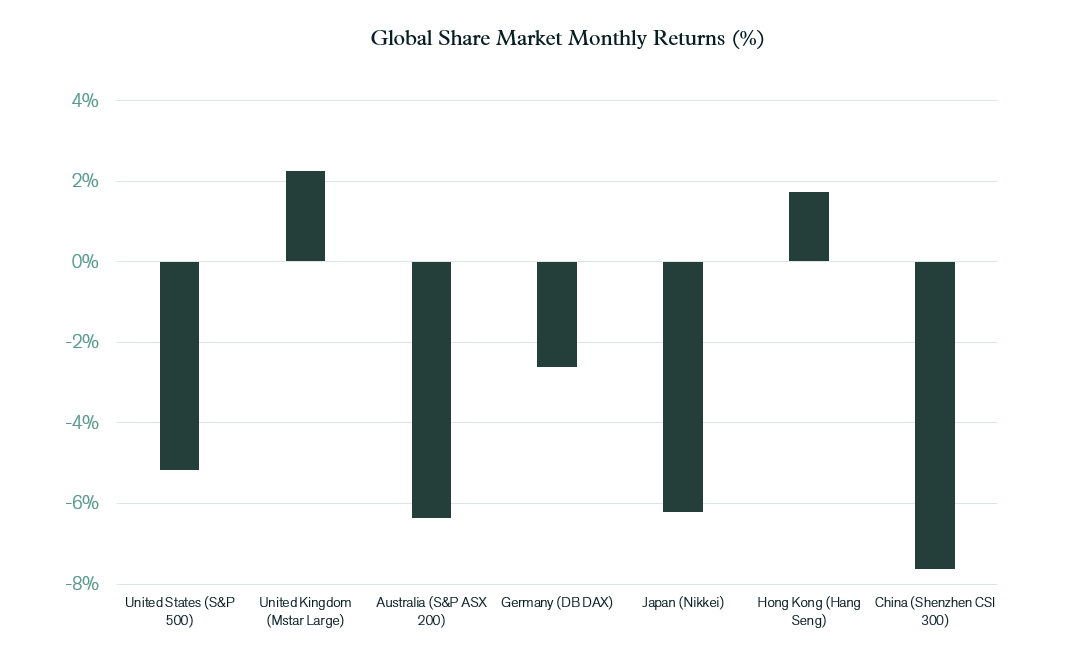

Significant losses were recorded across most major developed share markets last month. Although the declines marked the largest monthly fall since the COVID-19 crisis-related drop in March 2020, share markets remain well ahead of where they were 12 months ago. Indications from the US Federal Reserve Bank that it was likely to raise rates in March, following further evidence of inflation, appeared to be the main trigger for the January decline. Inflation has reached 7.0% in the US, the highest rate recorded since 1982. Also weighing on sentiment was the ongoing build-up of Russian military presence on the Ukraine border.

Earnings reporting season and ongoing evidence of strong economic growth failed to outweigh the inflation and interest rate concerns on the US market, with the S&P 500 Index dropping 5.2%. The heavy weighting of the US market to both Information Technology stocks and companies previously bid up in price due to higher earnings prospects explains some of the weakness in the US market. In addition, higher interest rates reduce the present value of earnings expected to be made in future years and therefore company valuations more reliant on future years (rather than current year) earnings were sold down more heavily. This rotation away from “growth” stocks had less of an impact on markets like Germany (down 2.6%) and France (down 2.4%). The UK market actually finished in positive territory (up 2.3%), with its higher exposure to energy benefiting from rising oil prices over the month.

Within emerging markets, share market performance was generally stronger as the strength in oil prices, which jumped 17%, boosted Middle Eastern markets, whilst increases in other commodity prices supported South American returns. China, once again, recorded a significant price decline, although Hong Kong’s Hang Seng Index rose 1.7%, with that market’s orientation to financials shielding it from losses.

Australian equities

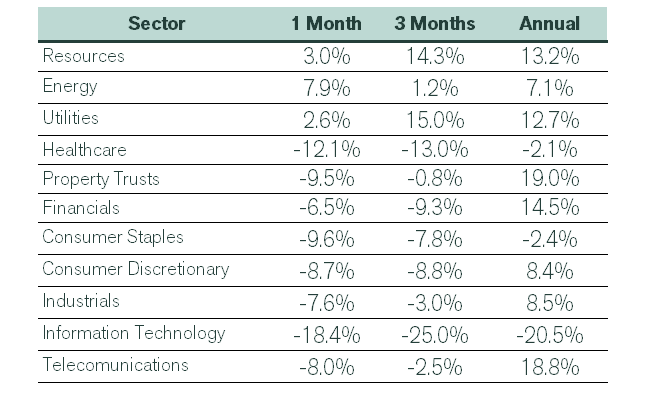

Despite a continuation in the bounce in iron ore prices (up 21%), the Australian market underperformed the global average over January. Amidst the broader market sell-off, resources (up 3.0%) and energy (up 7.9%) did show a price increase.

As was the case globally, the Information Technology sector declined sharply, falling 18.4% in January, which followed a 5.3% drop in December. Other key contributors to market weakness were the healthcare sector, where a 10.5% fall in the price of CSL weighed heavily, and the financial sector, which dropped 6.5%. The fall in banking stocks may have been considered a little surprising given rising interest rates provide scope for banks to improve interest rate margins.

There were mixed results within Property & Infrastructure, with the Australian listed property sector sold down more than global counterparts, with a decline of 9.4% following a period of strong recovery. Infrastructure proved to be more stable, with global stocks broadly flat and the Australian utilities sector rising 2.6%.

Fixed Interest & Currencies

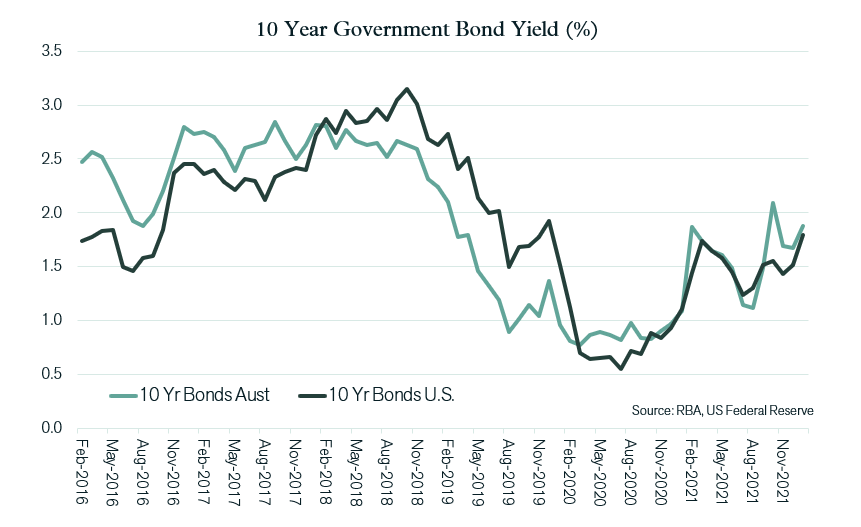

Higher inflation was the key focus of bond markets. Annual inflation readings of 7.0% in the US and 5.4% in the UK were prime examples.

The higher inflation in these economies has prompted a response by central banks, with the Bank of England raising the cash rate twice in recent months, from 0.1% to 0.25%. Although the US Federal Reserve Bank has yet to change cash interest rates, it has started to wind back its bond purchase program. In January, the Chairman, Mr Powell stated that “the committee is of a mind to raise the federal funds rate at the March meeting.”

With inflation evidently higher in various overseas economies than in Australia (where our December quarter CPI showed annual inflation at 3.5%), global bond yields rose by more than domestic yields last month. The US 10-year Treasury bond yield jumped by 0.27% to 1.79% over January, with the Australian equivalent rising from 1.67% to 1.88%. These higher yields saw bond prices fall, creating negative returns for fixed interest investors.

The higher global interest rates, and the lack of indication from the Australian Reserve Bank of any short term plans for a rate rise, may have contributed to some weakness in $A last month. Despite the strength of commodity prices, the $A dropped from US 72.6 cents to US 70.1 cents and was also approximately 2% weaker against the Euro. This currency depreciation helped cushion the fall in global equity valuations for investors with unhedged currency exposures.

Outlook

The sizeable correction on equity markets over January was clearly a response to a change in expectations around inflation and interest rates, rather than any deterioration in the outlook for the real economy and company earnings. This view is re-enforced by credit markets, which held up particularly well and implied liquidity remained abundant and the financial health of corporates generally sound. This continued favourable outlook for the real economy is driven by very strong labour markets, where further employment growth provides the promise of ongoing addition to already strong household spending capacity and appetite. With this backdrop, the risks of a global recession, or major deterioration in economic growth rates, in the near term remain remote.

January’s share market sell-off, therefore, was all about a change in the way the market valued company earnings rather than any change in earnings expectations. Given the extent to which a prolonged period of exceptionally low interest rates had caused a disproportionate growth in the valuation of “growth” orientated stocks, it was logical that a change in interest rate outlook would trigger some correction in that part of the market that had most benefited from this period of low interest rates. However, January’s sell-off went beyond just a rotation away from “growth” styled equities, with few sectors or styles immune from price fall. The broader nature of the correction creates a question as to the extent to which equity valuations can be maintained at current levels should interest rates continue to rise.

Certainly, investors should be considering the ramifications of further increases in interest rates. Despite the recent rise, longer term bond yields are still below longer term inflation expectations (in Australia for example long term inflation expectations are at 2.3%, whereas 10-year bond yields are just below 2%). These negative real interest rates are not sustainable into the longer term and further upward adjustment to interest rates is likely unless inflation retraces sharply from here. No doubt, higher interest rates may cause shorter term stress and losses on equity markets. However, fundamentally, both the real economy and equity valuations are well positioned to accommodate the 1% to 2% rise in longer term interest rates that is required in order to return normality or equilibrium to real interest rate levels.

Existing interest rates are still exceedingly low relative to inflation, economic growth trajectory and historical norms. They are not a constraint on growth and are also well below the underlying earnings yield available from equities, property & infrastructure. Due to this margin between earnings yields and interest rates, there is capacity for interest rates to rise further without de-railing the investment case for holding growth assets. If inflation does prove to be persistent, then the natural growth in earnings and real asset valuations resulting from inflation, becomes a more important component of the justification for holding growth assets.

Want to chat about your investments?

Book a chat with us today to discuss your investment strategy with a Pekada adviser.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).