January 2023 Economic & market review – A scintillating start to the year

Talking points

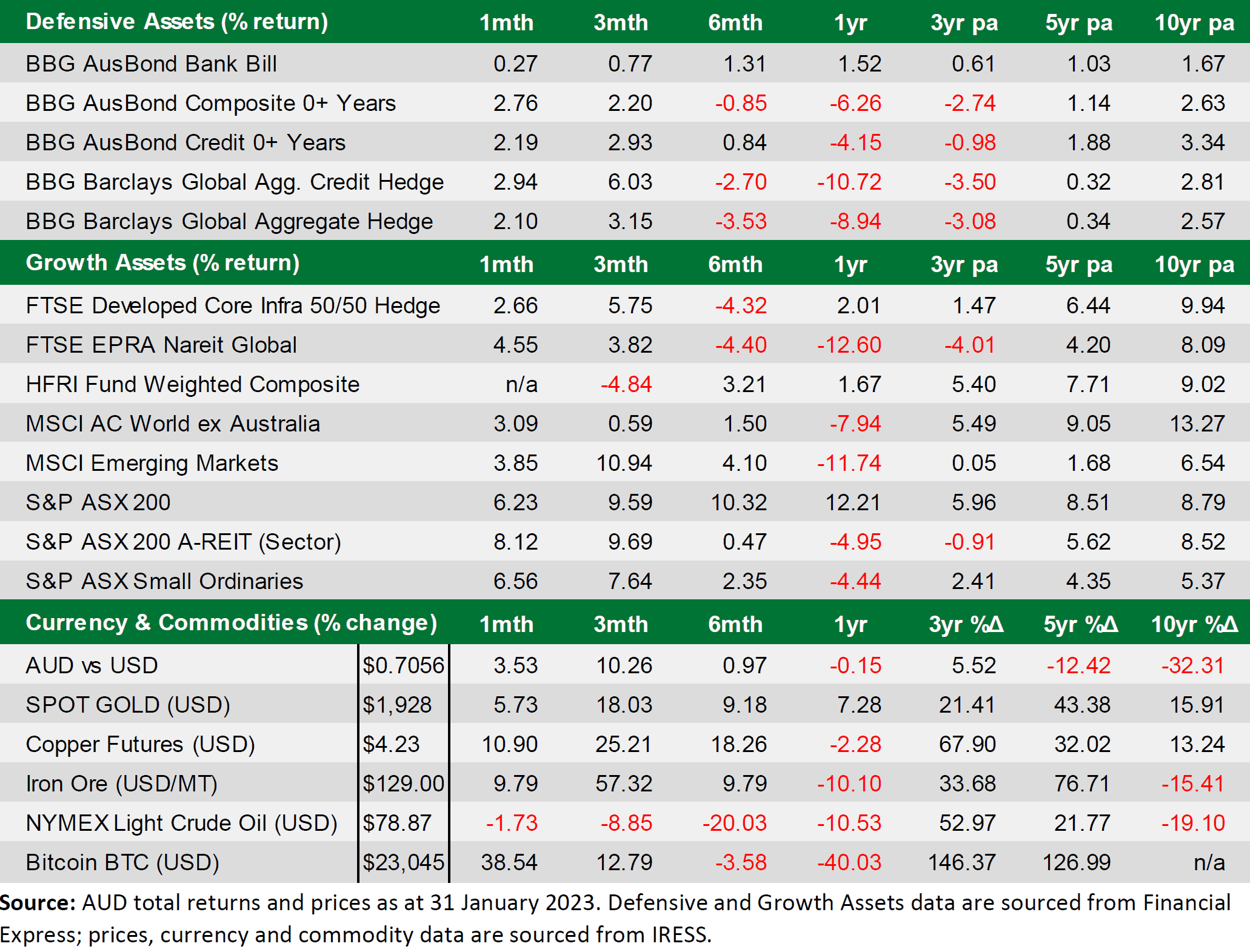

- Financial markets shook off the woes of 2022 to begin the year in spectacular fashion. A combination of falling bond yields, bullish sentiment and a short squeeze set fire to the investment landscape.

- On the domestic front, the ASX 200 ended January 6.2% higher to entirely recoup last year’s losses. Energy and Utilities, which outperformed in 2022, were the only GICS sectors to post losses during the broad-based rally. Consumer discretionary was by far the strongest performer, up nearly 10%.

- In US markets, the S&P 500 had its best month since October, while the Nasdaq 100 rallied the most since July, recording its best start to the year since 2001. Historically, a more than 5% gain in January for the S&P 500, following a negative year (as was 2022), tends to be a positive sign. Under those circumstances, on each of the previous five occasions, the full year has finished higher every time and by an average of 30%. As the rally gathered momentum, widespread short covering meant that several lower-quality stocks were pushed higher, including those that lacked positive earnings and have poor balance sheets. This is variously known as a ‘junk rally’ or ‘dash for trash’.

- Among defensive assets, the closely watched US 10yr Treasury rallied strongly, driving its yield down to 3.52% by month’s end after starting the year at 3.83%.

- Elsewhere, copper and iron continued to rally, reflecting hopes that China’s reopening would stimulate global growth.

Market Commentary

Investment markets had a scintillating start to the year, with solid gains posted across the major asset classes. Developed market equities quickly shook off their December woes, and the rally broadened as the month unfolded.

Improving economic sentiment became more evident as calls for recession began to fade. As a result, some analysts expect the US Fed to pause its tightening agenda in the coming months on slowing inflation.

Markets also happily ignored the poor tone of the Q4 earnings season that featured falling margins and ominous outlooks but pointed to signs that revenue was often on par with the previous quarter.

The S&P 500 was up 6.2% in January in US dollar terms, bringing its one-year losses to 9.7%. The Dow Jones Industrial Average gained 2.8% for the month and was nearly 3% for the one-year period. Eight of the eleven S&P 500 sectors were up (compared with December 2022, when all eleven declined), with Consumer Discretionary leading the way. Its 15% gain comes after last year’s 38% thumping. Meanwhile, Utilities lost 2%, after a decline in 2022 of less than 1.5%.

Elsewhere, cash returns continued to inch higher and markets priced for an additional hike in official rates after a stronger than expected inflation print.

Bond markets also continued to fight back following an atrocious 2022, where returns were the worst in modern history. Sovereign bond yields moved sharply lower, and credit spreads remained tight throughout January.

The risk-on environment pushed the Australian dollar higher against most currencies and breathed life back into Bitcoin, which finished the month nearly 40% higher.

Economic Commentary

On the domestic front, December quarter CPI inflation printed well above expectations, rising by 1.9% over the quarter and 7.8% through the year. More importantly, the underlying ‘trimmed mean’ measure of inflation came in at 6.9% for the year, easily exceeding the RBA’s 6.5% revised prediction. This led money markets to price for higher interest rates than previously and steepened the inversion recently observed at the front end of the domestic yield curve. Also, December’s retail sales fell surprisingly by 3.9% – the biggest monthly fall since August 2020. This may signify that November’s Black Friday sales continue to gain significance. Finally, unemployment remained at 3.5%.

In the US, stronger than expected job gains and a fall in the unemployment rate to 3.5% in December matched its 53-year low. Average hourly earnings rose by a less than expected 4.6%—a sign that price pressures are continuing to ease. Headline CPI fell to 6.4% in December, driven by falling energy and vehicle prices, and lower airline fares. In a worrying development, credit card debt rose by 15.2% across 2022, while the Leading Economic Indicators index breached levels over consecutive months that have always resulted in some kind of recession.

Over in Europe, the Eurozone Composite PMI surprised to the upside as sentiment improved. The relatively mild winter has calmed the energy crisis in Europe. Gas storage across the EU was still 75% full at the end of January, compared to 35% a year ago. The average purchase price for natural gas in January was 55% lower than the average over the second half of 2022. Finally, in Japan, its central bank kept the 0.5% cap for bond yields, surprising expectations of a higher yield target.

Our experienced financial planners provide tailored strategies and guidance to suit your unique needs and financial goals. If you’re seeking expert investment advice and management, book a chat with a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).