January 2025 Economic & Market Review – Markets Rebound, Rate Decisions and Trade Tensions

Talking points

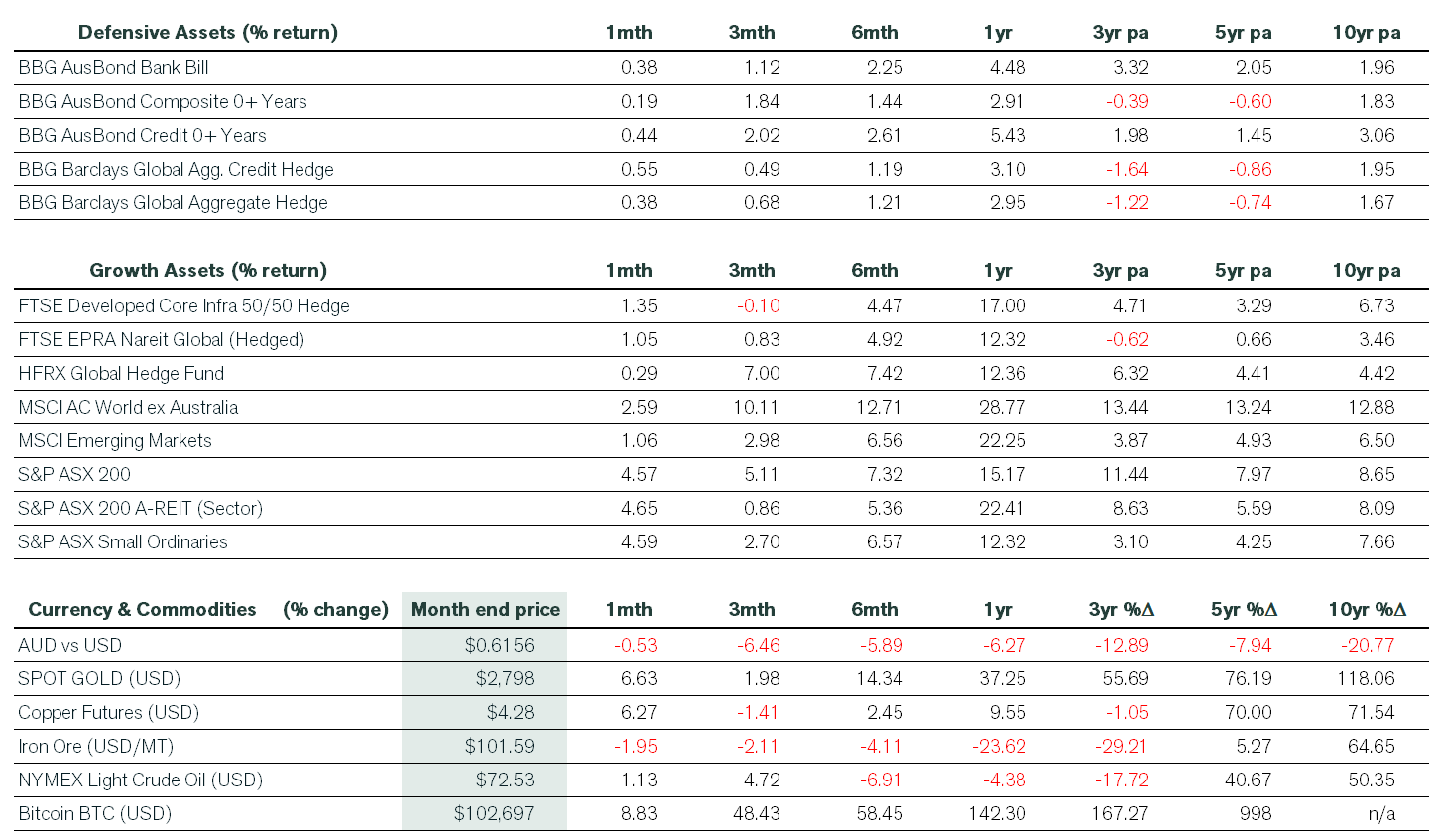

- Markets Rebounded in January – Despite a shaky start to the year, financial markets saw strong gains. The S&P 500 rose 2.7%, the Nasdaq climbed 1.6%, and the Dow Jones surged 4.7%. The ASX 200 also performed well, up 4.6% including dividends.

- Fed Holds Steady on Inflation Target – At its January meeting, the Federal Reserve reassured markets by sticking to its 2% inflation goal and keeping rates steady at 4.25%-4.50%. Investors are watching closely for signs of potential rate cuts.

- Nvidia’s Historic Drop – AI investment concerns led to a massive sell-off in Nvidia, erasing $589 billion in market value—the largest single-day loss in stock market history. Investors worried about the sustainability of AI infrastructure spending.

- US Tariffs Stir Global Uncertainty – Trump’s announcement of tariffs on Canada, Mexico, and China led to market volatility. While some tariffs were later adjusted, China responded with retaliatory measures, adding to global trade tensions.

- Australia’s Economy Shows Strength – Job growth exceeded expectations, and inflation continued to moderate. The RBA’s preferred inflation measure slowed to 3.2% annually, raising speculation about possible rate cuts in the near future.

Market Commentary

Following an uncertain beginning to the new year, January reversed course and delivered bumper returns across financial markets. The US Federal Reserve (the Fed) disappointed investors in its December meeting and was keen to avoid a repeat performance at its January meeting. Chairman Jerome Powell achieved this by avoiding using Trump’s name during his speech and announcing that the Fed was not entertaining an increase to its 2% inflation target. Powell also avoided directly engaging with Trump’s statements about his desired interest rate moves and economic policy.

The MSCI ACWI ex-Australia index delivered a total return of 2.6% to unhedged domestic investors in January, as weakness early in the month gave way to rising investor sentiment.

In US dollar terms and excluding dividends, the benchmark US S&P 500 index was up 2.7% in January, and the tech-heavy Nasdaq rose 1.6%. Meanwhile, the Dow Jones Industrial Average gained 4.7% for the month.

In specific stock news, DeepSeek’s extraordinary AI-related announcement raised fears that US companies might be overspending on AI infrastructure and that Nvidia’s premium pricing for GPUs could be challenged. Investors were worried that the demand for Nvidia’s high-performance AI chips might decrease if more cost-effective solutions become readily available. The news triggered a sell-off and Nvidia experienced a US$589 billion reduction in market capitalisation, marking it the largest single-day decline in stock market history.

Elsewhere, returns in MSCI Emerging Market equities were weaker than Developed Market peers as investors contemplated the disruptive impact of the potential US tariffs. Indeed, Trump wasted little time and announced tariffs on Canada, Mexico and China in late January. This resulted in an immediate surge in the US dollar. Subsequent announcements in early February delayed or watered down the new import taxes for Canada and Mexico. China retaliated by announcing tariffs on a suite of US goods.

Closer to home, the ASX 200 rebounded in January, rising 4.6%, including dividends, with similar performances across small cap peers and the listed property sector. The best ASX returns in January were seen among the gold miners and small cap resources space. The opposite end of the spectrum also witnessed positive (albeit much weaker) performances among the small cap industrials and large cap resource names. Across the GICSs sectors, outperformance was most noticeable in Consumer Discretionary and Financials (on the hope of lower interest rates), while Utilities was the only sector that finished in the red, given its more defensive nature.

Returns were broadly positive across defensive assets. Fixed interest enjoyed gains as bond yields ceased the upward shift observed in late 2024. Cash returns continued to tread a steady path as investors awaited the February Reserve Bank meeting. Meanwhile, December quarter CPI data released late in the month increased market enthusiasm that official interest rates would be cut in a matter of weeks.

Iron ore prices moved lower in January. However, gold strengthened as investors speculated about the timing and potential for global supply chain disruption around the implementation of Trump’s proposed policy platform. Finally, Bitcoin posted another strong month.

Economic Commentary

Australia

Australia’s labour market remained strong in December as jobs growth smashed expectations. A significant rise in workforce participation resulted in a slight increase in the unemployment rate. Meanwhile, a separate report showed that job vacancies rose 4.2% in the three months to November, marking the first increase since May 2022, when the RBA began to hike interest rates. There are now 1.7 jobless people per job vacancy, down from 1.9 in August and compared to about 3.0 before the pandemic.

In other news, quarterly CPI data showed a further moderation in underlying inflation. Trimmed mean inflation – the RBA’s preferred measure – slowed to 0.5% versus the September quarter and to 3.2% annually, just below consensus. Of note is that annual non-discretionary inflation printed below discretionary inflation for the first time in nearly four years.

Global

In the US, the Fed kept the funds rate at 4.25%-4.50%, following 100 basis points of cuts since September, stating it was in no hurry to cut rates further and is looking to see further progress on inflation. “We don’t know what will happen with tariffs, with immigration, with fiscal policy, and with regulatory policy,” said Chairman Powell.

In other news, in December, the US economy added the most jobs since March while the unemployment rate fell slightly, capping a strong year and supporting the case for the Fed’s rate pause. Meanwhile, the core CPI (ex-food and energy) increased 0.2% in December, just below expectations. Due to rounding, this marked the first step down in the core inflation rate in six months. Also, initial estimates for US GDP in the fourth quarter came in weaker than expected, dragged down by reduced investment spending and business inventories.

Finally, the European Central Bank (ECB) lowered its key interest rates by 0.25% in January, reflecting its updated inflation outlook, with price pressures easing in line with projections. While domestic inflation remains elevated due to delayed wage and price adjustments, wage growth is moderating, and corporate profits are absorbing some inflationary effects.

Do you have any questions or want to chat about your personal investment strategy?

If you want to discuss any of the above information or your personal investment strategy, then book a chat with your financial adviser here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).