July 2024 Economic & Market Review – Bond Rally, Small-Cap Surge, and Geopolitical Tensions

Talking points

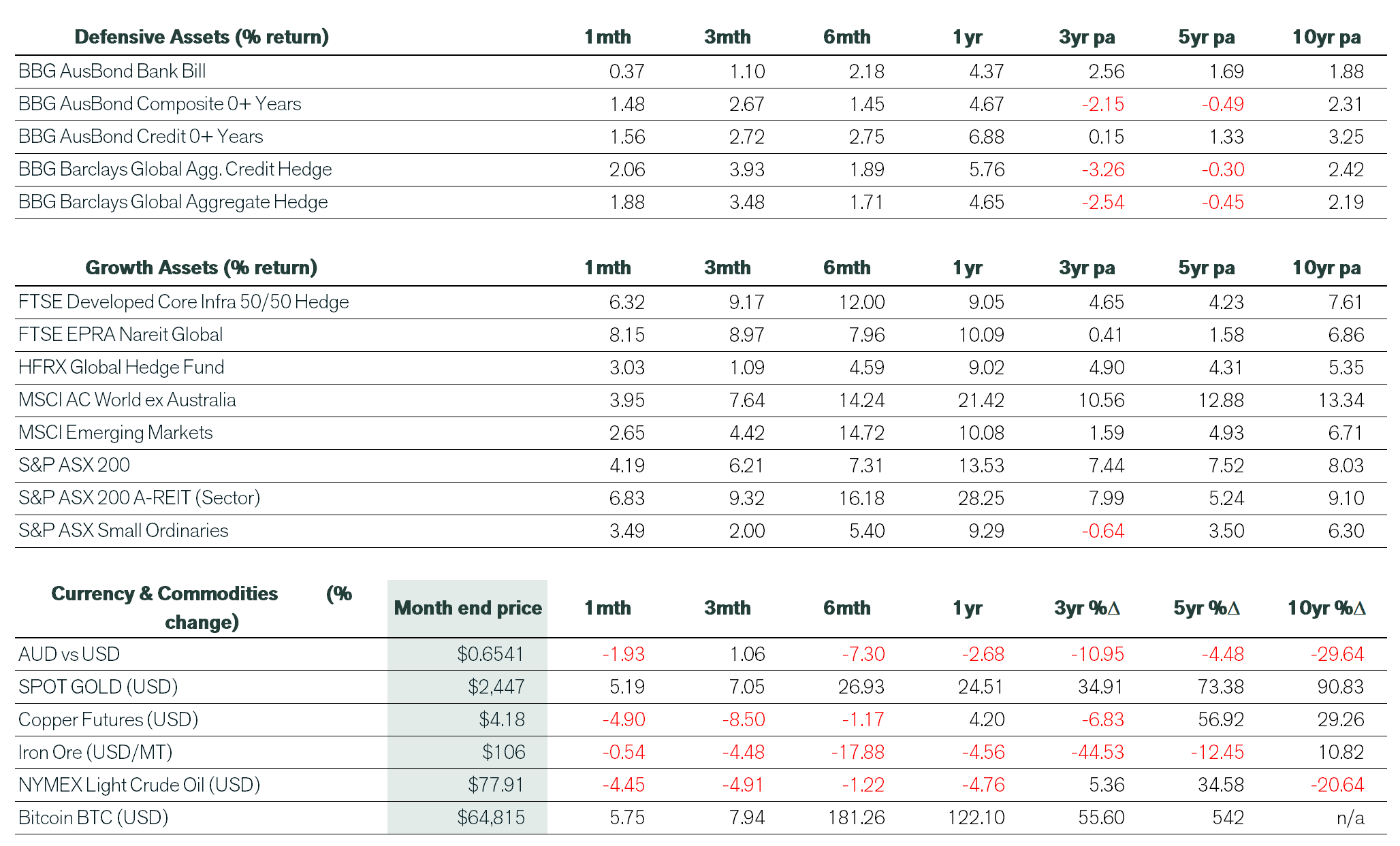

- Bond Market Rally and Equity Rotation: July saw a notable shift in interest rate expectations, sparking a bond market rally and a rotation from mega-cap tech stocks into small- and mid-cap (SMID) stocks. This shift was driven by weaker US jobs data and better-than-expected consumer inflation figures, raising confidence in a potential Federal Reserve rate cut in September.

- Surge in Small-Cap Stocks: The Russell 2000, dominated by small-cap stocks, surged by 10.2%, significantly outperforming the S&P 500. This movement, termed the “great rotation,” saw investors favoring smaller companies likely to benefit from lower funding costs, as these companies are highly exposed to variable rate loans.

- Fed Signals Potential Rate Cut: The US Federal Reserve left its policy rate unchanged in July, but Fed Chair Jerome Powell indicated that a rate cut could be on the table for September, contingent on data trends and maintaining a strong labor market. This bolstered market confidence in a “soft landing” for the US economy.

- Positive Corporate Earnings and Market Breadth: The Q2 corporate earnings season in the US started strong, with 80% of S&P 500 companies reporting positive surprises. Market breadth improved significantly, with 364 S&P 500 stocks seeing price rises compared to 201 in June, and the Dow Jones Industrial Average setting three new closing highs.

- Geopolitical Tensions and Defensive Asset Gains: Rising geopolitical risks, including conflicts involving Hamas and Hezbollah, led to a surge in defensive assets. Gold prices jumped 5.2%, while crypto assets gained momentum with the potential introduction of new ETFs. The Bank of Japan raised its benchmark interest rate to 0.25%, the highest since December 2008, responding to the weak yen.

Market Commentary

July witnessed significant changes in the interest rate outlook by markets, resulting in a bond market rally and equity market rotation away from mega-cap tech into the small- and mid-cap space (SMIDs). The latter was most noticeable globally, where a softer patch of US data boosted confidence that the Federal Reserve (the Fed) would likely commence its interest rate cutting cycle in September. A weaker jobs report and better-than-expected consumer inflation figures were the main catalysts, adding to a surprise contraction in the services sector.

Sharemarkets were broadly higher, the MSCI ACWI ex-Australia index posted a gain of almost 4% in July, as investors gained confidence that the Fed would deliver its first rate cut in September.

Industrials, value stocks, SMID-caps and bond proxies performed strongly in a period that saw a fierce rotation out of mega cap tech stocks, where valuations are seen to be stretched.

Market breadth improved for the S&P 500 as 364 stocks enjoyed price rises, compared to just 201 in June. Meanwhile, the Dow Jones Industrial Average set three new closing highs during the month. The Q2 corporate earnings season got off to a solid start. Of the 60% of S&P 500 companies that reported, 80% announced a positive surprise, implying an overall annual earnings growth rate of 10.2% (versus the 8.9% consensus expectation at the end of June).

Total returns in US dollar terms included a 1.2% rise in the benchmark S&P 500; a 4.5% increase in the Dow Jones Industrial Average; and a 1.6% loss in the NASDAQ 100. Meanwhile, the small-cap dominant Russell 2000 spiked by 10.2%, outperforming the S&P 500 by the largest margin in history. This move out of the large tech stocks, in particular, into unloved small-cap names has come to be known as the “great rotation”. Smaller companies are expected to disproportionately benefit from lower funding costs, as the broader sector is highly exposed to variable rate loans. More broadly, value again outperformed growth during July, as several mega caps derated.

In Australia, where the macro landscape features a stalling economy and stubbornly high inflation, investors were less enamoured with small caps, where strong returns (nonetheless) failed to keep pace with the ASX 200’s 4.2% increase. Meanwhile, domestic listed property spiked 6.8%, but this lagged global property, which surged 8.2%.

The ASX finished the month on a strong note after the June quarter CPI data came in better than expected, thereby erasing any chance of a potential August increase in the official cash rate. The Australian dollar slumped in response to the news. The retailing, gold, banking and property sectors were the strongest performers during July. Of note, on July 12, Commonwealth Bank shares hit a record high, with the bank overtaking BHP as the largest company on the domestic market. Elsewhere, the increase in market volatility was a welcome development for the hedge funds sector, which saw the HFRX global hedge fund index post its strongest return since January.

Bond markets rallied strongly, as yield curves shifted lower and steepened (so-called bull-steepening, where short-term yields fall by more than their longer-term equivalents). Defensive assets benefited from rising geopolitical risks, with Hamas announcing that Israel had killed its political leader. Just hours earlier, Israel said it had killed a senior Hezbollah commander with an airstrike on Beirut in response to an attack in the Golan Heights.

Elsewhere, gold jumped 5.2% on rising geopolitical risks, while oil prices declined on the prospects of increased output. Finally, crypto assets followed risk markets higher, with investors buoyed by the possibility of new ETFs entering the market.

Economic Commentary

Australia

In domestic news, the main focus was on the CPI data for the June quarter, which was not as high as feared. Underlying trimmed mean inflation – the RBA’s preferred measure of inflation – on an annual basis cooled to 3.9% in the June quarter from 4%. For the quarter, underlying inflation came in at 0.8%, down from 1%. The consensus was for both figures to hold steady. Many economists quickly ruled out the prospect of a rate rise at the upcoming August RBA board meeting. The inflation data also saw traders bring forward their expectations of a rate cut by several months to February 2025. In other news, the June unemployment rate inched up to 4.1%, as a substantial increase in workforce participation outweighed robust employment growth.

Rest of world

On the economic front, the US Fed left its policy rate unchanged in its July meeting, but in the ensuing press conference, Chair Jerome Powell indicated that a rate cut could be on the table at its September meeting if: “…the totality of the data, the evolving outlook, and balance of risks are consistent with rising confidence and maintaining a solid labour market.” Previously, US central bankers have said it would be appropriate to reduce borrowing costs before inflation actually returns to their target to account for lags in monetary policy. Weaker data releases during July suggested that the US was headed for a ‘soft landing’ instead of a severe slump. US Q2 GDP exceeded expectations on solid consumer spending, while price rises were contained, but jobless claims were again starting to rise.

Finally, the Bank of Japan raised its benchmark interest rate to 0.25% from 0.10% and unveiled plans to halve its bond purchases by the first quarter of 2026. While the BoJ’s interest rate remains low by global standards, it is now at its highest level since December 2008. Some saw the move as a response to the persistently weak yen, as pressure has been mounting from Japan’s government to boost the currency.

Get in Touch to Discuss Your Investment Strategy

For personalised investment advice or to understand how this information may impact your investments, schedule a chat with a Pekada financial adviser today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).