June 2023 Economic & market review - Mixed Results for Investors as AI Boom Drives Equity Returns and Bonds Falter

June 2023 Economic & market review – Mixed Results for Investors as AI Boom Drives Equity Returns and Bonds Falter

Talking points

- Mixed results for investors in June: Bond markets lost ground due to underlying inflation, while the AI boom drove returns in equity markets.

- Strong performance of US stocks: For the quarter, the benchmark S&P 500 added 8.3%, the Dow Jones rose 3.4%.

- Notable performance of tech stocks: The Nasdaq jumped 12.8% for the half, registering its strongest first-half performance in forty years. Apple surged 50% and surpassed $3 trillion in market cap, while Meta (Facebook) and Tesla more than doubled.

- The Fed hits the pause button: Improving inflation data allowed the Federal Reserve (the Fed) to finally hit the pause button on official interest rates at the June FOMC meeting. This was the first such move in fifteen months.

- Cash returns and interest rates: Australian cash returns continued to grind higher as the Reserve Bank raised the cash rate to 4.1% in June, with economists forecasting a peak rate of 4.6%.

Summary

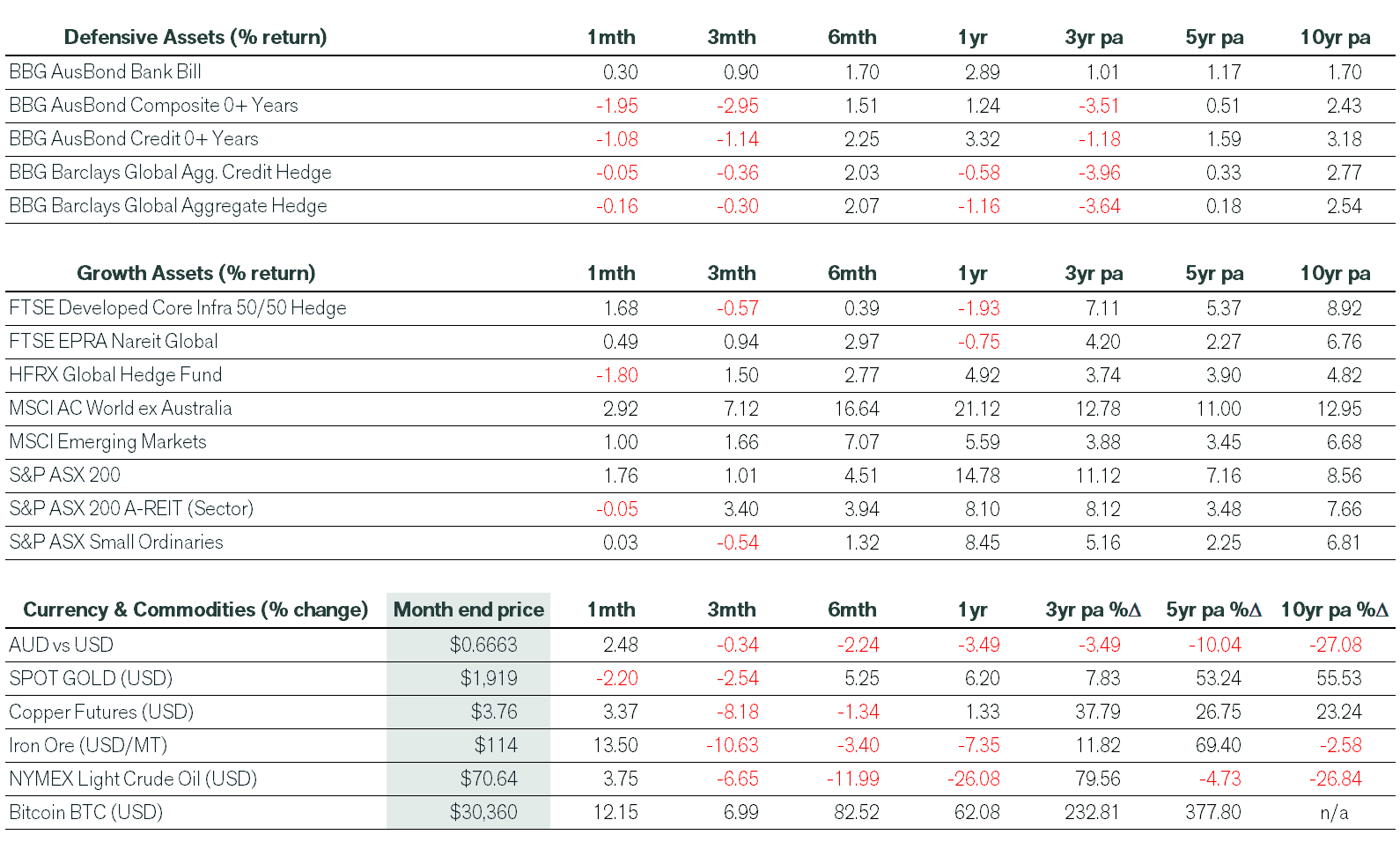

Investors experienced mixed results in June as bond markets lost ground on sticky underlying inflation while the AI boom continued to drive returns across equity markets. For the quarter, the benchmark US S&P 500 added 8.3%, while the Dow Jones rose 3.4%. The Nasdaq jumped 12.8% to register its strongest first-half performance in forty years, soaring more than 30%. Notably, Apple leapt 50% in the first half and surpassed $3 trillion in market cap, while Meta (i.e., Facebook) and Tesla both more than doubled.

Closer to home, the S&P/ASX 200 returned 1.8% inclusive of dividends, easily outperforming its domestic small-cap peers. While global property and infrastructure stocks produced a solid monthly gain, the same could not be said for A-REITs as valuation concerns continued to permeate the sector. Over the quarter, domestic shares underperformed global peers on banking and resource sector weakness. Nearly two-thirds of the quarterly 1% total return came from dividends. For the financial year, domestic shares delivered a 14.8% return to investors, including income of 5.1% (plus ~1.5% in franking credits).

Cash returns continued to grind higher as the Reserve Bank raised the cash rate in June to 4.1%. This prompted economists to raise their forecasts for the peak rate to 4.6%, with money markets behaving in a similar fashion. Meanwhile, surging tax receipts have swollen the Federal Government’s budget surplus to $19 billion and boosted the prospect of a second straight surplus being delivered next year.

Market Commentary

Global shares enjoyed a solid first half to 2023, with the MSCI AC World ex-Aus index delivering over 16% to Australian investors, led primarily by gains in the US and Japan. Most notable was the AI-led rally in a handful of tech names. The so-called “Magnificent Seven” mega-tech stocks staged a strong reversal of the weakness experienced at the end of 2022, in which the Nasdaq lost a third of its value, with the focus on cost-cutting and efficiency. Chipmaker Nvidia led the way, riding the AI boom to a 190% rally and a $1 trillion market cap. Not since 1983 have tech stocks performed so strongly in an opening half to a year. For context, Apple was then touting its Lisa desktop computer, IBM was the most valuable tech company in the US, and Microsoft had yet to list on the sharemarket.

In local markets, the ASX 200 began the year 4.5% higher, with nearly half of that return coming as dividends. Banks and materials stocks comprise about half of the ASX 200 and traded sideways in 2023. For the banks, investors feared that steepling interest rates would sharply increase debt provisioning. At the same time, the resource-heavy materials sector stalled on a failure for China’s recovery to gain more substantial traction. The latter also led to more muted returns in emerging markets. This year, the tech and gold sectors have been the clear standouts, delivering double-digit returns.

In the more defensive asset classes, 2023 has seen cash outperform the domestic bond sector due to sticky underlying inflation. However, traditional fixed interest has had a solid year overall and has recouped some of its steep losses from the previous calendar year. Elsewhere Bitcoin had an astonishing start to 2023, gaining more than 80% in USD terms. The rebound in the Nasdaq and the regional banking crisis saw risk-loving investors re-enter the crypto space after a shocking 2022.

Economic Commentary

Improving inflation data allowed the Federal Reserve (the Fed) to finally hit the pause button on official interest rates at the June FOMC meeting. This was the first such move in fifteen months. Fed officials, on average, now expect two more rate rises in 2023 and upgraded their estimates for the economy’s growth prospects. Official data later in the month revealed large upward revisions for first quarter GDP on stronger household spending. Meanwhile, Fed chairman Jerome Powell reiterated that interest rates will need to move higher to contain price pressures over the medium term.

On the domestic front, the Reserve Bank of Australia (RBA) raised the official cash rate by 25 basis points in June for the second consecutive month, having paused in April. The RBA remains concerned about the negative impact of high inflation on the economy, family budgets and savings, as well as business planning and investment. Poor labour productivity was again highlighted by the RBA, with strong rises in labour costs per-unit-of-output an ongoing risk to the inflation outlook. Elsewhere, March quarter GDP slowed significantly and missed expectations. GDP also contracted on a per capita basis due to Australia’s surging population. Both discretionary consumption spending and household savings also contracted due to the impact of rising debt repayments on disposable income.

In Europe, Germany moved into recession as its industrial sector contracted and, notably, its lower import spending flowed through to weaker exports from China, where the reopening continues to miss expectations. China remains one of the few large economies where inflation is close to zero.

Our experienced financial planners provide tailored strategies and guidance to suit your unique needs and financial goals. If you’re seeking expert investment advice and management, book a chat with a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).