June 2024 Economic & Market Review – Sharemarket rebound continues, Central Banks Adjust Rates and Inflation Trends Evolve

Talking points

- Market Rebound Led by Large-Cap Equities: June saw a strong rebound in share markets, driven by large-cap equities and companies with robust earnings growth. Central banks in Europe and Canada cut interest rates, while the RBA and Fed held steady. Improved global inflation data benefited fixed-interest markets, despite concerns over rising oil prices and shipping costs.

- Strong Performance in Emerging Markets and AI-Exposed Companies: The MSCI ACWI ex-Australia index gained 1.8% in June, with emerging markets showing strong growth. Companies focused on artificial intelligence, such as Apple with its new AI system, significantly outperformed, though high-flying stocks like Nvidia saw late-month declines.

- US Market Optimism Despite Late-Month Concerns: US indices, including the S&P 500 and Dow Jones, saw upward revisions in target prices, with the Nasdaq 100 posting a 6.3% gain. However, concerns emerged as some high-performing stocks experienced sharp declines, indicating potential market exhaustion.

- Australian Economic Challenges and Inflationary Pressures: The Australian economy grew by just 0.1% in the March quarter, driven by higher government spending and household outlays on necessities. The RBA governor signalled the possibility of future rate hikes if inflation remains high, emphasizing that interest rates would only be cut once inflation sustainably falls into the 2-3% target range.

- Global Inflation Trends and Rate Adjustments: Inflation in the US eased in May, with core inflation and PCE price index showing slower growth, leading to hopes for potential rate cuts. In Europe, the ECB lowered rates, but inflationary pressures persist, with upward revisions for future inflation and growth projections.

Market Commentary

Sharemarkets continued to rebound in June, led by large-cap equities and companies with strong earnings growth profiles. The major central banks of Europe and Canada cut interest rates in June. Meanwhile, the Reserve Bank of Australia (RBA) and the US Federal Reserve (the Fed) continued to remain on hold. Improving global inflation data was welcomed by fixed-interest markets, but higher oil prices and shipping costs could hamper further improvements over the coming months.

The MSCI ACWI ex-Australia index posted a gain of 1.8% in June, as growth again outperformed value. Emerging markets rose strongly, with investors focusing on improved economic data releases and the prospect of lower interest rates in developed nation peers, thereby reducing risks to capital flows for EM countries.

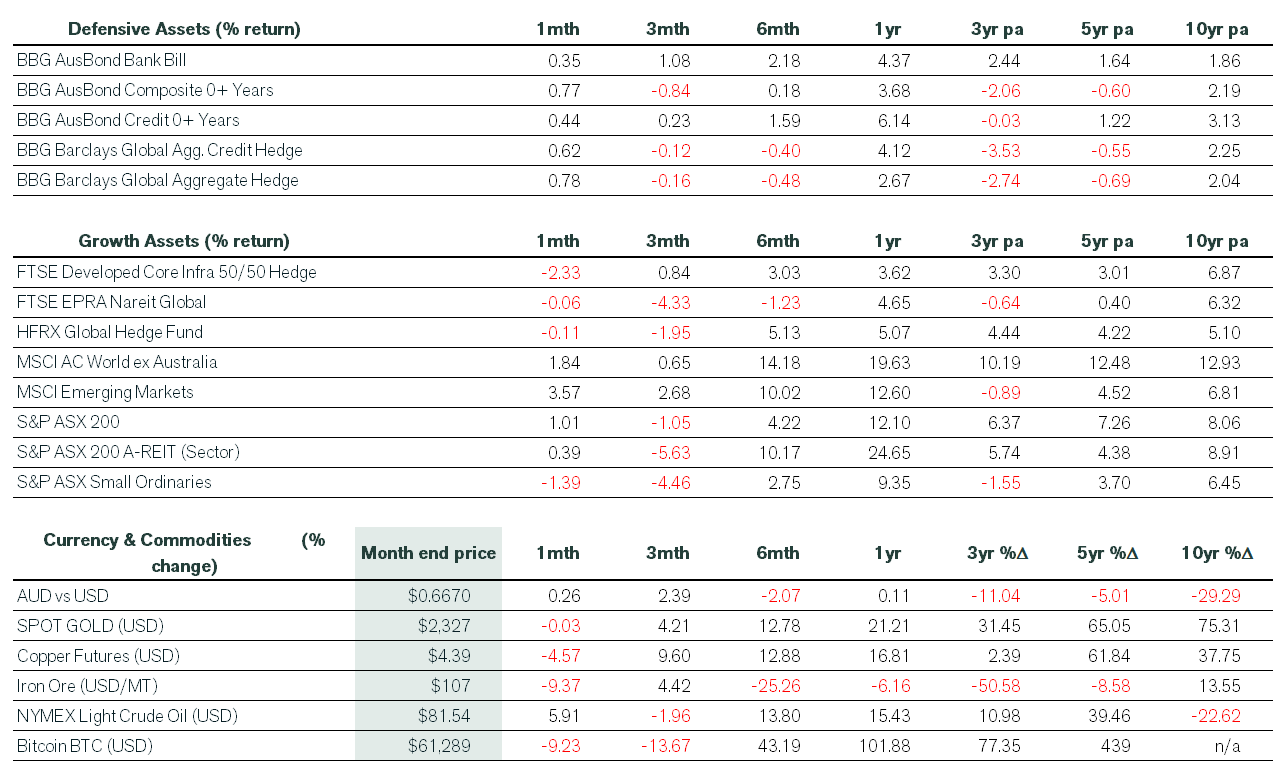

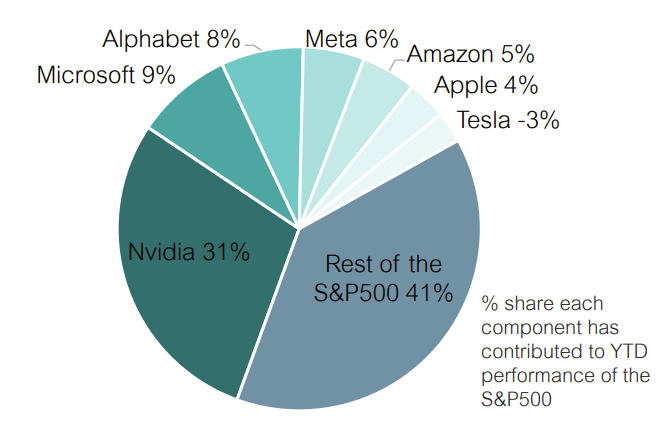

More broadly, at the global level, companies exposed to artificial intelligence continued to outperform other areas of the market, which has been a defining theme throughout the year. Notable events included Apple’s unveiling of its custom AI system, “Apple Intelligence,” which helped push its stock to new record highs. Despite the US market’s overall positive performance, some concerns emerged towards the end of the month. High-flying stocks, such as Nvidia, fell sharply in late June on signs of potential market exhaustion. “Magnificent Seven”, which refers to the seven largest technology companies listed in the US. These companies, including NVIDIA, Apple, Microsoft, and Amazon, have significantly skewed the market’s performance—and these 7 businesses account for 59% of the S&P500’s ~15% rise year to date (YTD).

Source: Bloomberg, Lonsec estimates.

US indices benefited from ambitious upward revisions to consensus target prices. The S&P 500’s one-year price target increased for a seventh month to nearly 6,000. The Dow target price also increased for the seventh month, after two months of declines, to more than 43,000. Both indices would need to rise by around 10% over the next twelve months to meet these targets. The US S&P 500 posted seven new closing highs throughout June to finish 3.6% higher (including dividends), while the Dow Jones Industrial Average gained 1.2%. However, it was again a stellar performance by the tech-heavy Nasdaq 100, which jumped 6.3% in June and posted another record high during the month.

On the ASX, in a repeat of the prior month, Financials, Staples and Utilities produced strong performances in June, while the resource-heavy Materials sector was deeply negative. Lithium and gold stocks sold off heavily, while the diversified mining giants such as BHP Group and Rio Tinto lagged the market on sharply lower iron ore and copper prices. Overall gains on the domestic front were solid, with the ASX 200 accumulation index gaining 1.0%. While the strength of large-cap names was notable, the opposite was true in the small-cap space, where most indices finished in the red. The ASX Small Ords gave back 1.4%, while the US S&P SmallCap 600 posted a 2.5% decline.

Fixed interest markets benefitted from the move lower in yields. On the local front, Australian 10-year yields decreased by 10 basis points over June to 4.31%. However, bonds with shorter maturities, such as for 2 and 3 years, saw yields finish the month flat or slightly higher than in May. This reflects ongoing uncertainty about the RBA cash rate outlook as domestic inflation remains sticky. Credit markets enjoyed another positive month as spreads (a risk indicator) remained low. However, as in May, investors favoured investment-grade issuers with resilient business models and conservative balance sheets.

Elsewhere, gold, copper and iron ore were lower in June, while Bitcoin reversed some of its huge gains so far in 2024.

Economic Commentary

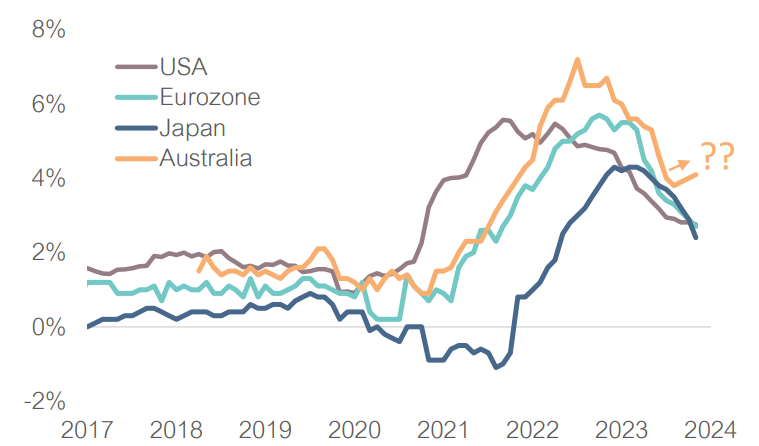

Inflation remains sticky, but the direction is down as collective monetary policy settings have tightened fiscal conditions and COVID-era stimulus wanes. Australia is the exception, recent figures show inflation still running well above the Reserve Bank of Australia’s target band of 2-3%, and the impact of the Stage 3 tax cuts has yet to manifest.

Source: Lonsec estimates, Bloomberg.

Australia

On the economic front, the Australian economy barely grew in the March quarter, expanding by just 0.1% on the back of higher government spending and household outlays on necessities such as electricity and rent. Concerns that households are saving much less than previously, combined with the disposable income boost from the stage 3 tax cuts, prompted some economists to push back rate cut expectations into 2025.

Meanwhile, the May monthly CPI data was again worse than expected. Appearing before a Senate committee, RBA governor Michele Bullock said she “won’t hesitate to move and raise interest rates again” if underlying inflation proved stickier than expected and confirmed state and federal government energy rebates would not affect the timing or direction of interest rates. Bullock also added interest rates would only be cut when the board was convinced that inflation was falling “sustainably” into the 2-3 percent target band.

Australia’s CoreLogic Home Value Index climbed 0.7% in June 2024, registering the 17th consecutive month of expansion.

Rest of world

Elsewhere, inflation in the US eased in May, with headline consumer prices recording zero growth, pushing the annual rate down to 3.3% from 3.4%. Core inflation – which excludes food and energy costs – rose just 0.2% in May, taking the annual rate down to 3.4% from 3.6%. Both readings were better than expected and left financial markets pricing in a higher chance of a cut to US interest rates in September. Also, on the US inflation front, the May core personal consumption expenditures (PCE) price index rose by 0.1% in May and declined to 2.6% growth over the last twelve months. Personal spending and income increased solidly in May, while the saving rate edged up to 3.9%.

In Europe, the European Central Bank (ECB) lowered interest rates by 25bp in June, which was in line with expectations, marking a shift from the previous nine months of stable rates. However, domestic price pressures remain elevated, suggesting inflationary challenges remain and have seen Eurosystem staff projections for headline inflation and growth being revised up for 2024 and 2025.

UK retail sales in May were much stronger than expected as consumers took advantage of heavy discounting.

Get in Touch to Discuss Your Investment Strategy

For personalised investment advice or to understand how this information may impact your investments, schedule a chat with a Pekada financial adviser today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).