March 2023 Economic & market review – Banking Crisis, Market Turmoil, and Systemic Concerns

Talking points

- A US banking crisis in March caused initial financial market rattles, with the collapse of Silicon Valley Bank followed by Signature Bank, leading to concerns of a systemic crisis.

- Regulators took immediate and decisive action, including the reversal of the Federal Reserve’s quantitative tightening regime, to contain the fallout and prevent the crisis from becoming systemic.

- Credit Suisse in Europe was forced into a takeover by UBS to prevent further instability in the global banking system, as it was considered too big and interconnected to fail.

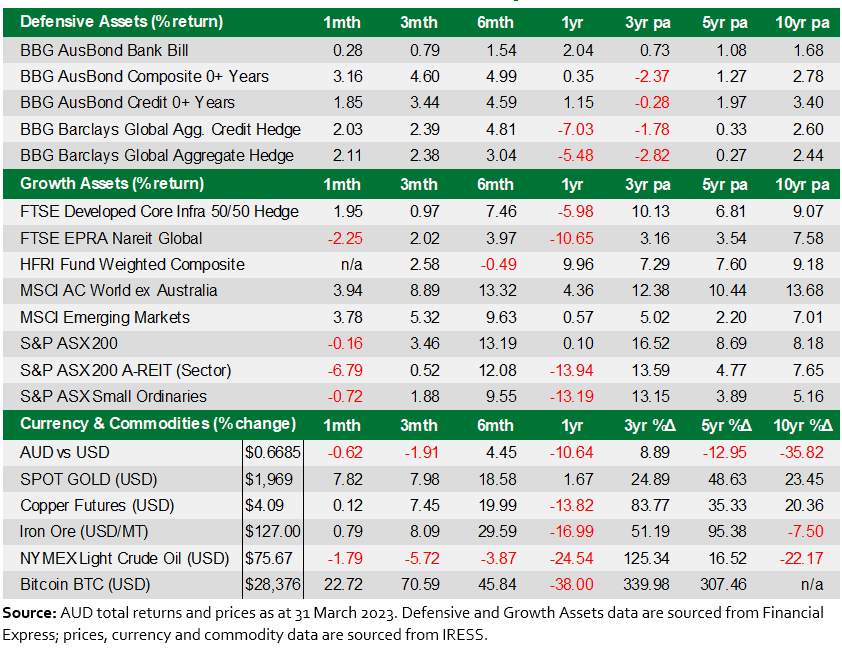

- Despite the banking crisis, equity markets recovered quickly, with the S&P 500, Nasdaq, and Dow all posting gains for the month, but Australian shares were broadly flat to negative, and listed property showed weakness.

- Bond market volatility reached levels not seen since the Global Financial Crisis (GFC), with flight to safety across all maturities, and the banking crisis also breathed new life into the crypto sector and reinvigorated gold investors.

Summary

The sudden development of a US banking crisis in March initially rattled financial markets before regulators took immediate and decisive action to contain the fallout. Signature Bank promptly followed the light-speed collapse of Silicon Valley Bank. With the growing possibility of a systemic crisis, extreme supportive measures were implemented by key authorities, including the effective reversal of the Federal Reserve’s quantitative tightening regime.

The events sparked further uncertainty in Europe, leading to the swift demise of Credit Suisse. UBS was forced into a takeover of the ailing institution, as an outright collapse would have destabilised global banking, given its size and interconnectedness.

As markets became more comfortable that the crisis would not become systemic, this sparked a fierce relief rally to the end of the month. In March, the US benchmark S&P 500 closed 3.5% higher, while the Nasdaq added 6.7% and the Dow rose 1. 9%. While the weaker Australian dollar benefited domestic investors, local shares were broadly flat to negative. The listed property market showed more cracks as the strong rise in interest rates continued to wreak havoc across commercial real estate.

In fixed interest, bond market volatility reached levels not seen since the GFC, with significant weakness early in the month swamped by a subsequent flight to safety across all maturities. The hint of systemic banking issues breathed new life into the crypto sector and reinvigorated gold investors.

Market commentary

Just as markets were focused on inflation, interest rates and renewed economic strength, Silicon Valley Bank experienced a torrent of depositor outflows to become the second-largest bank failure in US history. Its highly concentrated business model and an extraordinary mismatch of liquid assets and liabilities were ultimately a recipe for disaster.

And when Signature Bank quickly became the second domino to fall, the regulatory authorities intervened in a bid to prevent the crisis from becoming systemic. Uninsured depositors were bailed out, and the setup of a special lending facility for other banks helped stem the crisis. But before long, falling confidence beset Europe’s banks, and Credit Suisse was required to be taken over by UBS. Unusually, this wiped out low-ranking bond holders before equity holders, reversing the standard pecking order.

Overall, the banking crisis caused bond market gyrations not seen since the height of the GFC. And volatility measures along key parts of the yield curve were almost unprecedented. A flight of deposits from smaller institutions throughout March wound up in the large banks and in money market funds, where returns in the latter proved attractive for yield-starved investors.

But the dust quickly settled, and equity investors wasted no time recovering their losses. For the quarter, the S&P 500 advanced 7%, and the Nasdaq rallied 16.8%, while the Dow inched higher by 0.4%, all in local currency terms. It was the best quarter since 2020 for the tech-heavy Nasdaq, buoyed by widespread cost-cutting and by slumping risk-free rates late in the piece.

Domestic shares were flat overall, but resources and particularly gold, were the strongest sectors, while the property and banking sectors were significantly weaker.

Economic commentary

On the domestic front, Australians had to endure another 0.25% rise in the RBA cash rate to 3.6%. Market expectations for future rate moves were highly volatile, beginning March well above 4% before finishing the month close to the existing level.

Elsewhere, labour market data printed much stronger than consensus and reinforced that conditions remained tight, despite huge migration inflows. And, while monthly CPI measures revealed that inflation was now slowing, unions ramped up a campaign for another large hike in wages.

In the US, the Federal Reserve’s preferred inflation gauge showed a cooler-than-expected increase in prices for February. The annual core Personal Consumption Expenditures index, which excludes food and energy costs, rose 4.6%. Meanwhile, employment measures remained strong and drove solid increases in personal income and consumer spending. Despite the uncertainty from the banking crisis, the Federal Reserve hiked interest rates by 0.25% to 5%, but refrained from a larger increase as some economists were predicting just weeks earlier.

In Europe the ECB again raised interest rates by 0.5%, to 3% in March, pushing it to a fresh high since 2008, as inflation is projected to remain too high for too long. The ECB now sees inflation returning to 2% in 2025. Eurozone inflation fell sharply in March, as energy prices across the region continued to fall from record levels reached last summer, but food prices remained stubbornly high. Spain enjoyed the most price relief, while inflation was stickier in Germany.

Our experienced financial planners provide tailored strategies and guidance to suit your unique needs and financial goals. If you’re seeking expert investment advice and management, book a chat with a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).