May 2024 Economic & Market Review – Tech giants lead market bounce back

Talking points

- Tech Giants Lead Earnings: First-quarter US corporate earnings generally exceeded expectations, led by the “Magnificent 7” tech giants. Nvidia, Apple, Microsoft, and Alphabet were significant contributors, driven by the AI trade. However, the rest of the S&P 500 displayed negative earnings growth, raising concerns about market breadth and sustainability.

- Strong Performance of US Indices:US indices had a strong showing in May. The S&P 500 rose by 4.8%, reversing April’s losses, while the Nasdaq Composite jumped 7%. Tech stocks surged, with Nvidia, Apple, Microsoft, and Alphabet accounting for more than half of the S&P 500’s monthly gains.

- Mixed Global Market Results: Global markets presented a mixed picture. The MSCI ACWI ex-Australia index gained 1.7%, while emerging markets and Japan underperformed. Despite positive economic data, Chinese equities struggled due to property sector concerns, and Japan faced rising yields affecting market sentiment. Domestically, the ASX 200 Accumulation Index rose by 0.9%. Utilities, Staples, and Financials, including property stocks, performed well, benefiting from lower long-term bond yields. However, Materials, especially large resources companies, dragged on returns, causing the ASX to underperform compared to most developed markets.

- Inflation stays sticky: Australia’s April CPI rose to 3.6% annually, driven by food and housing costs, prompting markets to push back the timing of expected interest rate cuts. Meanwhile, the US Federal Reserve noted that inflation remained sticky, with April CPI exceeding expectations for the third consecutive month, highlighting persistent inflationary pressures.

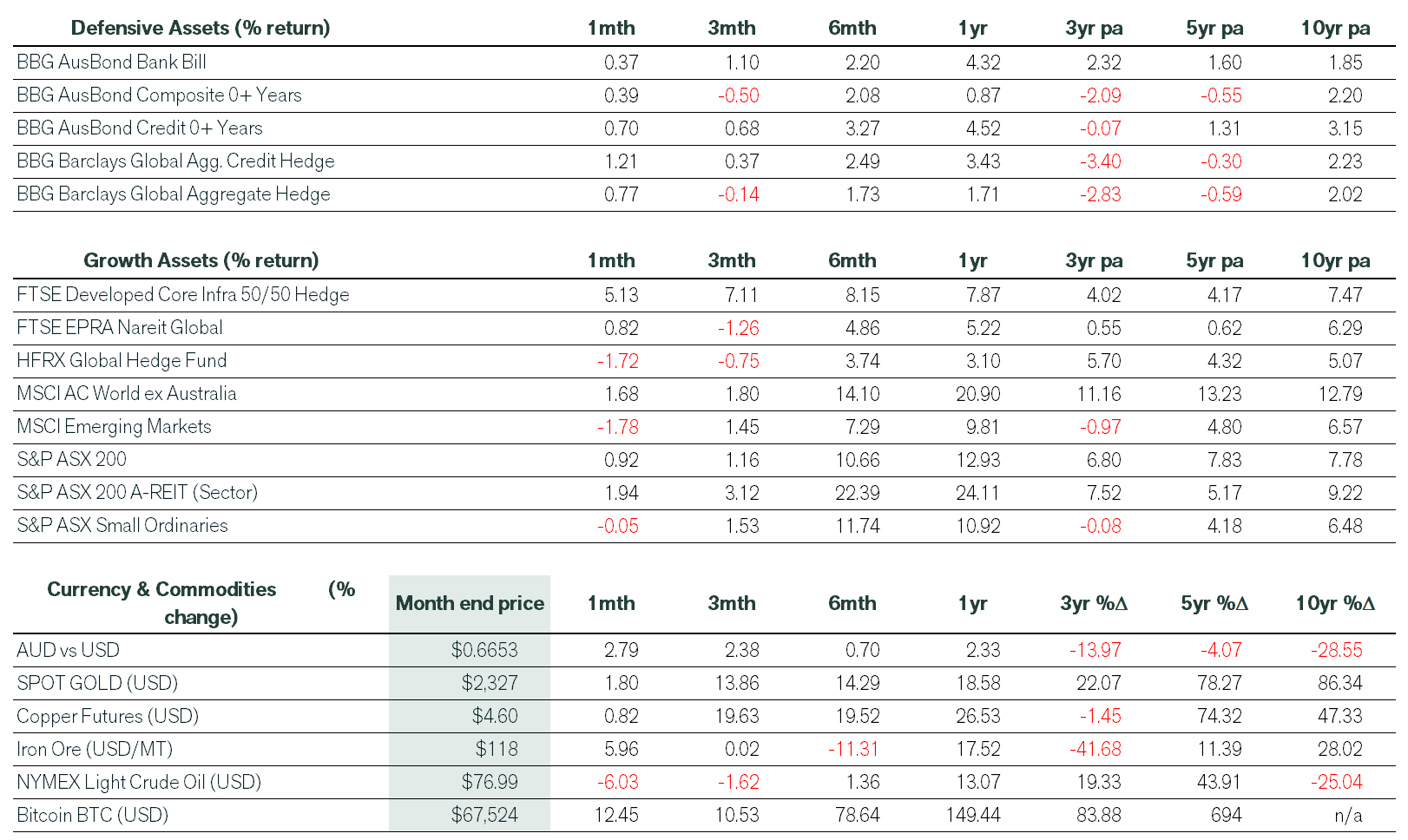

- Fixed Interest Market Relief:Fixed interest markets saw relief in May as bond yields fell, easing valuation pressures. Credit markets benefited from lower corporate borrowing costs, boosting returns. Global and domestic fixed interest benchmarks posted gains, while cash returns continued to inch higher, outperforming most defensive asset classes over the past twelve months.

Market Commentary

Financial markets bounced back in May, following heavy falls in April. At the beginning of the month, the US Federal Reserve (the Fed) signalled that interest rates would likely stay higher for longer because of sticky inflation but dismissed any chance of a rate rise this year. Bonds and equities responded favourably, which set the scene for positive returns in May.

Bond yields fell sharply, easing some of the sharemarket valuation pressures built throughout the year. Investors also focused on first-quarter US corporate earnings during the month, which continued to surprise to the upside but by less than historical averages. The upside was led by the Magnificent 7—however, the remaining S&P 500 stocks displayed a negative blended earnings growth rate. This has raised concerns around so-called ‘market internals’ such as market breadth, with some commentators warning about increased risks to future returns. Interestingly, FactSet pointed out that 38% of S&P 500 companies mentioned “AI” on their earnings calls.

US indices performed strongly. The S&P 500 closed 4.8% higher in US dollar terms, more than reversing its April losses. The Dow Jones Industrial Average gained 2.3%, while the Nasdaq Composite jumped 7% in May, with these indices also posting record highs during the month. Tech gained 10%, and Utilities rose 9%, both on the back of the AI trade and strong earnings. At the opposite end of the spectrum, Energy declined by 0.4% due to falling oil prices, and consumer discretionary was broadly flat as Consumer Spending concerns were highlighted on multiple corporate earnings calls. Of note, Nvidia +26%, Apple +13%, Microsoft +6.8% and Alphabet +6%, accounted for more than half of the S&P 500’s 4.8% monthly gain.

The MSCI ACWI ex-Australia index posted a gain of 1.7% in April, with unhedged domestic investors impacted by a stronger Australian dollar over the month. While emerging markets were one of the few bright spots during the April sell-off, their fortunes turned negative in May as Chinese equities underperformed despite better-than-expected economic data releases. Markets remain unconvinced that China can stage a sustainable turnaround until it resolves the malaise surrounding its property sector. Elsewhere, Japan also posted a negative return in May as rising yields began to impact sentiment. The Japanese 10-year government bond traded above a 1% yield for the first time in over a decade.

Gains on the domestic front were more modest. The ASX 200 Accumulation Index gained 0.9% in May, well ahead of its small-cap peers, which fell 0.1% during the month. The AREIT sector returned 1.9%, as long-term bond yields moved lower. On the ASX, Utilities, Staples and Financials (including property stocks) performed the strongest in May. However, Materials (which includes large resources companies) weighed on returns and drove underperformance relative to most developed market peers.

For fixed-interest markets, falling yields allowed investors to breathe a sigh of relief. Credit markets fared best as corporate borrowing costs moved lower during the month, benefiting returns. The broader global and domestic fixed interest benchmarks also posted gains. Cash returns continued to inch higher. Over the last twelve months, cash has easily outperformed most defensive asset classes and is just 20 basis points behind investment-grade credit returns. Elsewhere, gold, copper and iron ore were slightly higher in May, while crude oil finished in the red. Bitcoin jumped 12.5%, as crypto behaved like a proxy for geared sharemarket exposure and maintained its volatile return profile.

Economic Commentary

On the economic front, Australia’s April monthly CPI printed well above expectations, with markets and economists revising their cash rate outlook. Markets expected the monthly CPI to slow to 3.4% annually, but it instead rose to 3.6%, driven by food and housing costs. This was the second month in a row where annual inflation posted a small increase. The monthly CPI indicator, excluding volatile items and holiday travel, remained unchanged at 4.1% in April. Money markets responded by pushing back the timing of any interest rate cuts until July 2025, while several economists called for the RBA to raise interest rates to close to 5% (currently 4.35%) to tame inflation.

Earlier in the month, domestic labour market data was weaker than expected, with unemployment rising as more workers entered the jobs market. However, the data may have been a statistical quirk that could unwind due to an unusually large increase in the number of unemployed people waiting to start a new job.

Turning to the US, the Fed kept interest rates steady at its May meeting and was relatively dovish in its language but noted that inflation was not slowing as quickly as expected. US economic growth slid to just 1.3% on an annualised basis during the March quarter, below the expectations of analysts and the Fed’s economic projections. As the month progressed, the April CPI data exceeded expectations for the third consecutive month, highlighting that inflation was indeed sticky. However, retail sales figures provided more evidence of moderating activity and that households were becoming increasingly stressed.

In Europe, the European Central Bank (ECB) paved the way for an interest rate cut over the next few months, noting that wage growth had slowed and inflation was likely to moderate further, notwithstanding a stronger-than-expected CPI read in May. UK inflation is also moderating, but the services component remains close to 6%, potentially stifling any plans the Bank of England might have to cut interest rates.

Want to chat about what this means for your investments?

Thanks for reading. If you want to discuss any of the details or your investment strategy, please book a chat here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).