November Market Update

We run through what investment markets did in November

November Market Update

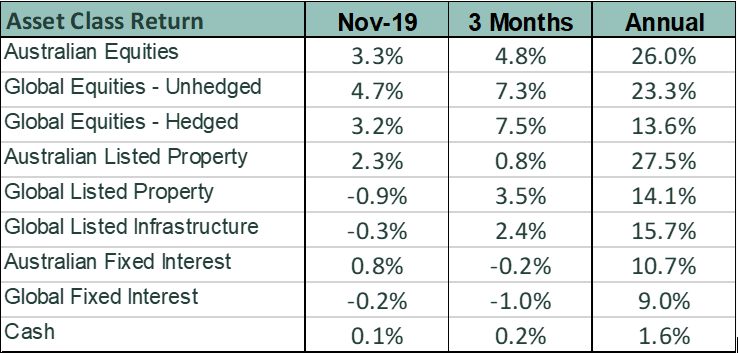

Equity markets in November were stronger as commentary around trade negotiations tended more positively and in Australia company Annual General Meeting season resulted in fewer earnings downgrades. Equities maintained strong annual returns, whereas global fixed interest weakened, with bond yields rising, dragging down interest rate sensitive sectors.

Some notable developments for the month included:

- In a key speech by the Australian Reserve Bank Governor, Mr. Lowe, the possibility of further interest rate cuts was confirmed if the bank’s economic growth expectations are not met. It was also confirmed that the bank does not envisage reducing the cash rate below the functional minimum of 0.25%. Although remaining a possibility, the Governor suggested that central bank buying of government bonds through a “quantitative easing” program was unlikely.

- Australian economic news was generally benign, with little to indicate that growth would strengthen from current low rates. House prices appear to have bottomed, but housing construction approvals continue to decline, suggesting little chance of additional stimulus from that sector.

- The US/China trade negotiations continued, with the usual rumours and grandstanding, but no announced tangible progress on reducing tariffs was forthcoming. This process continues to drive short-term market sentiment. We are not confident of a substantive resolution before the US election next year.

- The “Brexit Election” (voting on 12th December) campaign in Britain has produced no clear direction to date. The Conservative party appears to lead at present, which is generally taken as a positive for equity markets.

- Looking forward to 2020, some commentators are starting to suggest that the current global slowdown may be nearing an end as easier monetary policy starts to impact. Recent strong employment data in the United States has reinforced this view.

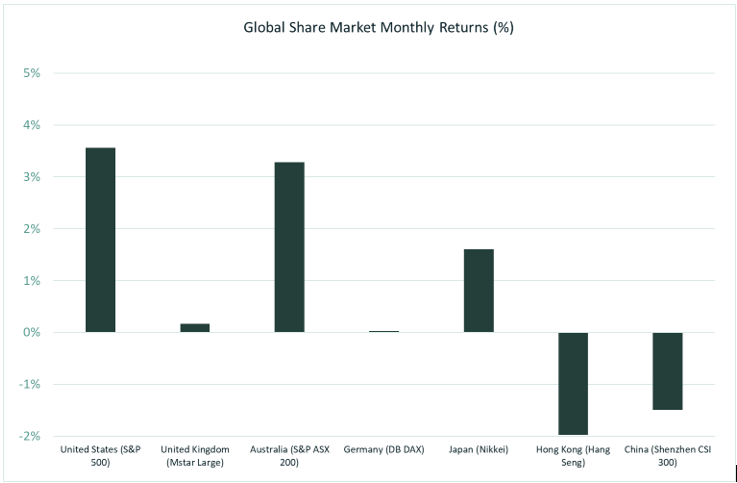

Despite more subdued earnings forecasts, US equities rose 3.6% (S&P 500) last month, helped by optimism around trade talks. IT and economic cyclical sectors were the strongest, with bond yield sensitive Real Estate and Utilities under-performing. European markets also strengthened overall (the S&P Europe 350 Index was 1.5% higher).

Chinese markets were weaker despite stronger indicators of economic activity late in the month. Ongoing political protests in Hong Kong have continued to impact on market sentiment in the region.

Commodities

With the more positive mood on equity markets, precious metal prices declined (silver down 6.2% and gold down 3.2%). For the second consecutive month, the Reserve Bank’s Commodity Price Index declined, moving 3.5% lower (in SDR currency terms). Weaker natural gas prices contributed to this fall. However, it was a positive month for other commodities, with iron ore rising 2.3% and Brent Crude Oil 2.7% higher.

Australian Equities

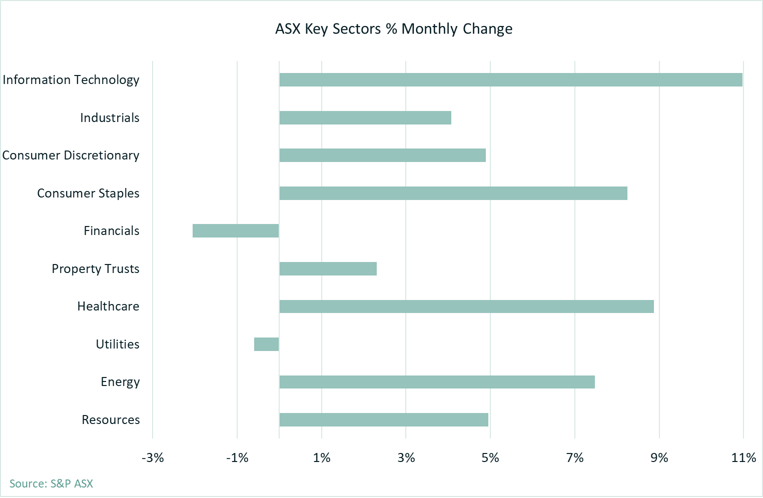

The Australian market rose 3.3% (S&P/ASX 200) driven by strong performances from IT stocks and another jump in the price of CSL Limited, which pushed the Healthcare sector up 8.9%. Financials had a poor month (down 2.1%) as revelations that Westpac had systematically breached the Anti-Money Laundering and Counter-Terrorism Financing (AML-CTF) Act weighed heavily on the sector. Westpac experienced a 13.1% price decline as a result. Other significant company events included a takeover bid for Caltex (up 26.7%) and a strong earnings result announced by James Hardie (up 16.4%).

Fixed Interest & Currencies

US and Japanese bond yields generally rose, but Australian 10- year government bond yields again declined, leaving the Australian yield curve still quite flat. In contrast, bond yield curves globally seem to be moving away from inversion (where short term rates are higher than long). This suggests markets are becoming less concerned about possible recession. The Australian 10-year government yield dropped from 1.14% to 1.04%, with its U.S. counterpart rising from 1.69% to 1.78%. The widening in the interest rate differential between Australia and overseas contributed to a weaker Australia dollar, as foreign investors could earn less on Australian domiciled investments. Against the $US, the $A declined U.S. 1.5 cents to US 67.8 cents.

Outlook and Portfolio Positioning

Although global equity markets have experienced a period of optimism since the brief early August correction, there has been little evidence that the outlook for company earnings growth has improved. The lack of resolution to the US / China trade dispute continues to provide a source of uncertainty for growth forecasts, with the election in the U.S. likely to magnify uncertainties in the year ahead. It is also less likely that equity markets will be supported by declining bond yields in the same way they have repeatedly over recent years. Hence, whilst the underlying earnings yield of the equities asset class remains attractive relative to interest bearing assets, the ongoing impetus for near term price growth appears somewhat challenged. As such, we are maintaining a cautious, but close to benchmark, equity exposure.

Notwithstanding the decline in bond yields experienced in Australia last month, we remain of the view that it is likely bond yields have bottomed. The Reserve Bank Governor’s assurance last month that the cash rate would not be pushed into negative territory has created a “floor” for interest rates, restricting the extent to which bond yields can reasonably be expected to fall – even in a negative economic growth scenario. Our portfolios continue to adopt a bias to variable rate fixed interest investments to avoid the potential for capital loss arising from increasing bond yields.

As always if you have any queries or want to have a chat about your personal situation then please contact me at pete@pekada.com.au

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).