October 2021 investment review – Equities bounce back despite further yield increases

Talking points for October 2021

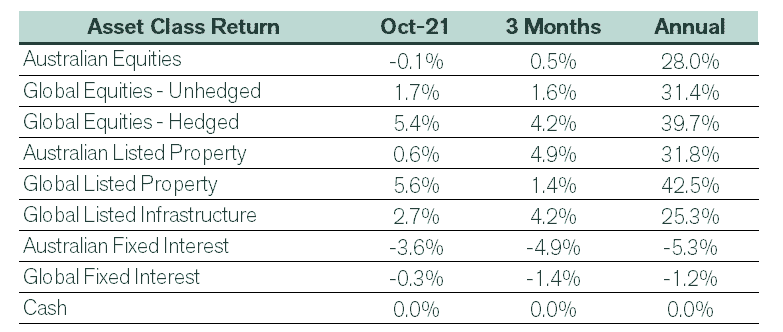

- Global equity markets recovered strongly in October from the negative returns of the previous month.

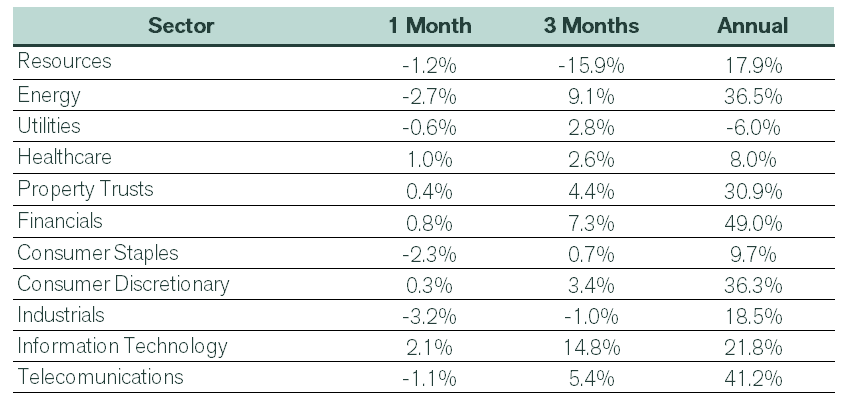

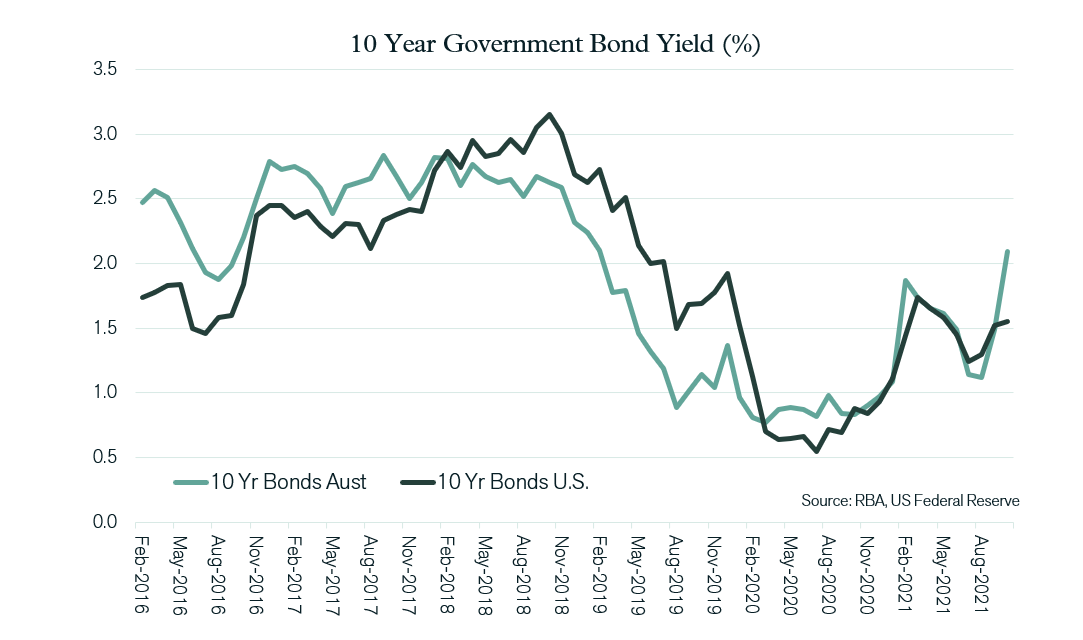

- Volatility was high on bond markets, particularly in Australia, where underlying inflation exceeded expectations.

- The $A rallied over the month, reducing the equity gains for unhedged investors.

International Equities

Following the 3.8% decline in September, global equities bounced back strongly in October, with the United States being the dominant contributor to this increase. The US S&P 500 Index rose 7.0% after falling by 4.7% the previous month. Production and employment data was positive and provided investors with confidence that the global economic cycle was still favourable, despite the inflationary pressures evident. Confirmation that the US central bank would start to wind back its bond purchase program in mid-December did little to dent this confidence. Equity markets were also positive in Europe, where there was some stabilisation in the energy demand-supply balance following the supply shortages and price hikes of September.

Japan was one of the few developed markets to post a negative equity market return, with some uncertainty over the new Prime Minister’s prospects at the general election held at the end of the month. However, the ruling Liberal Democratic Party did retain power, which may improve market confidence in November and beyond.

Gains on emerging markets were less significant than on developed markets last month, with the Chinese market posting a flat result. Chinese equities are still being impacted by a general downward shift in growth expectations for the Chinese economy. This follows a spate of new regulations aimed at reducing excessive gearing and monopoly power of businesses and improving wealth distribution across the population. There were, however, some significant gains on other emerging markets, with the Middle East region particularly strong in response to ongoing increases in the price of oil. In $ US terms, oil rose another 11.2% last month and is now well over double the price prevailing one year ago.

Australian Equities

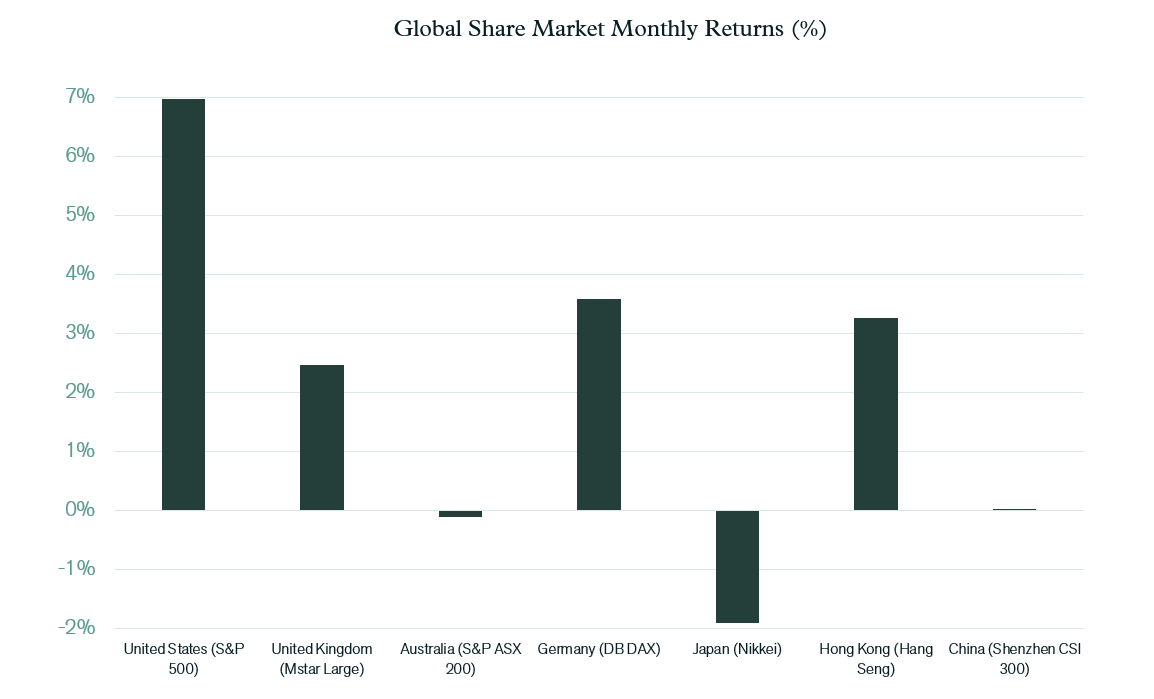

Australia underperformed the global average last month, with the S&P ASX 200 Index falling 0.1%. Further weakness in the iron ore price weighed on the resource sector, which finished the month 1.2% lower. Energy stocks also detracted with a 2.7% loss, as weaker natural gas prices offset the impact of the gain in oil prices.

Outside of the resource and energy sectors, there were some positive movements in the Australian equity market last month. The Information Technology sector responded to a pickup in appetite for growth-orientated stocks, which was consistent with the direction of global markets. Financial stocks also had a positive month, with higher bond yields benefiting the sector. Healthcare stocks also performed well, with stocks such as Ramsay Healthcare (up 3.0%) set to benefit from lockdowns being lifted and normalising elective surgery volumes.

Fixed Interest & Currencies

It was an active month on bond markets, particularly in Australia, where the September quarter inflation results triggered a sharp increase in bond yields. The Consumer Price Index (CPI) rose by 0.8% in the 3 months to September, which was the same increase as recorded in the June quarter. As a result, Australia’s inflation rate fell from 3.8% to 3.0% in annual terms. A reduction from the 3.8% annual rate recorded in June was widely anticipated given the extent to which the lower “base effect” from the previous year’s June quarter fall inflated the June 2021 annual result. The September result continued to show relatively high inflation suggests some of the increase in the rate of price growth recorded recently may be more than temporary. This result impacted the market’s future inflation expectations and also prompted speculation that the Reserve Bank (RBA) would abandon its 0.10% target for the April 2024 bond yield. At its Board Meeting in early November, the RBA did remove this target. The net result was that bond yields at the shorter end of the yield curve rose sharply, creating losses for fixed interest investors. The 3-year Australian government bond finished the month at a yield of 1.17%, after opening at 0.25%. The 10-year yield rose 0.60% to 2.09%. Australian longer-term yields are now well above those in the United States, with the US 10-year yield increase last month being a modest 0.03% to 1.55%.

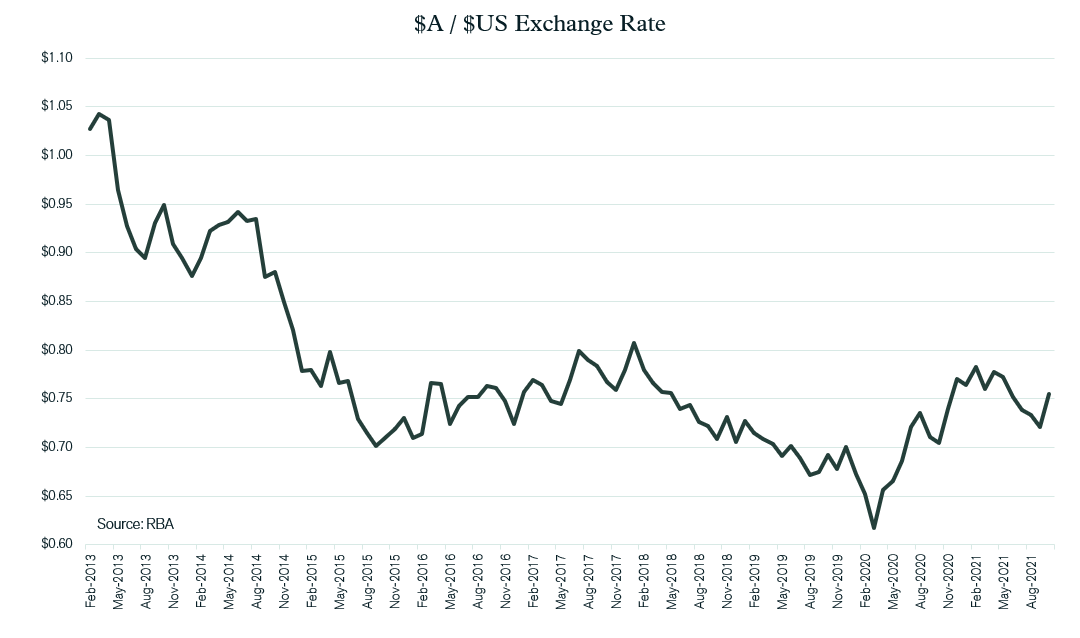

Despite the weaker iron ore price, the Australian dollar rallied strongly over October. The upward shift in the bond yield curve attracted foreign investor support, with the $A jumping from US 72.1 cents to US 75.5 cents. The stronger Australian dollar dampened share price gains to those global investors who held unhedged currency exposures, as foreign currencies declined in value in $A terms.

Outlook

The movements on financial markets over October should be viewed as being reassuring to investors. Equity markets demonstrated robustness despite recent inflationary pressures and monetary policy tightening both here and abroad. In periods past, confirmation of any reduction of central bank support has often produced negative outcomes on equity markets. This October, however, provided further evidence of fundamental strength in labour markets and the broader economy, which was enough to placate share markets, for the time being at least.

However, movements on bond and currency markets were sufficiently large to prompt at least some consideration of whether portfolios should be adjusted in response. The rise in bond yields has created an opportunity for yields to be earned on Australian government bonds that are now well in excess of shorter-term bank cash and term deposits. The higher yield comes with ongoing “duration risk” (i.e. the risk yields will increase further causing bond prices to fall), however at least now there is more reasonable compensation for this risk. As such, for portfolios that have been positioned around the shorter end of the yield curve, some increase in the duration of fixed term investments could now be considered.

The second opportunity presented by the shifts that occurred in October comes from the appreciation in the Australian dollar. At over US 75 cents, the $A is trading above its fundamental level as determined by its underlying purchasing power. This elevated currency level comes at a time when Australia’s cyclical trade prospects have potentially already peaked, with iron ore prices and Chinese economic growth appearing to be decelerating. For investors with hedged equity exposures, the current $A valuation may represent an opportunity to obtain higher foreign currency exposure via unhedged investments. Given the tendency for the $A to weaken in periods of equity price decline, a higher unhedged exposure can add to defensive qualities within portfolios and, importantly, provide some insurance against any further deterioration in the outlook for the Chinese economy.

Our experienced financial planners provide tailored strategies and guidance to suit your unique needs and financial goals. If you’re seeking expert investment advice and management, book a chat with a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).