Pension Minimums to Remain Halved for the 2021/22 Financial Year

Pension Minimums to Remain Halved for the 2021/22 Financial Year

In somewhat surprising (but welcomed) news, a weekend media release from the Government has announced that the 50% reduction in pension minimums are to be extended for the 2021/2022 financial year.

These measures were initially adopted for the 2019/20 & 2020/2021 financial years due to the impact of Covid. In the release it was noted that this measure “…continues to make life easier for our retirees by giving them more flexibility and choice in their retirement.”

Is this necessary when investment markets have recovered? I’m not convinced, but happy to provide advice on the opportunities it presents to you.

Important: Remember that the reduced minimums are an option and not a mandatory reduction to your payments. You have the choice to reduce or retain pension payments, providing they meet or are above the reduced minimum.

For our clients on an ongoing service package, we will be in touch to discuss your options in the new financial year. If you want to have a chat sooner to understand your options then please get in touch, or book a chat with your adviser at our online booking page.

NOTES:

- This media release occurred over the weekend and didn’t provide a lot of detail. We expect more information to follow, and we will continue to provide relevant updates as they come to hand.

- Also, a lot can happen in a month and we will have to wait until 1 July 2021 to assess exactly what this means for you and your minimum pension payments for the 2021/22 Financial Year. However a reasonable estimate will be possible from 1 July 2021. This estimate will become actual when your super funds 2021 accounts have been completed.

How do you work out your reduced minimum annual payment?

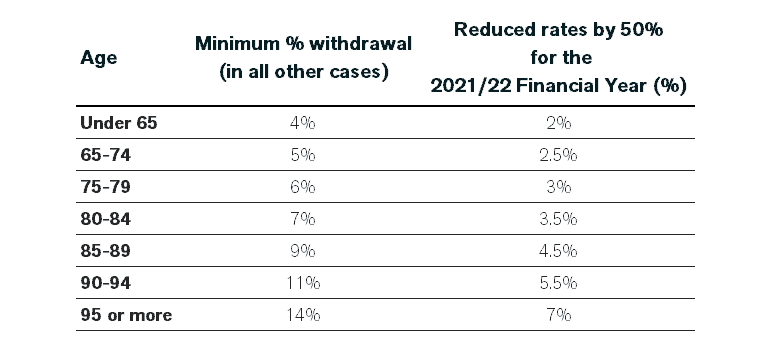

Use the percentage factors in the table below to calculate your minimum annual payment amount, using your age at 1 July of the financial year (or at the date your income account commenced, if later).

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).