Read this before you start investing in a fixed interest ETF (exchange traded fund)

Read this before you start investing in a fixed interest ETF

Exchange Traded Funds or ETF’s are one of the most popular and commonly asked about investments. Why? In large part due to their relative low cost and simplicity in getting invested, especially when compared to the incumbent wholesale managed funds, which seem outdated with the application process and minimum investment limits.

- Sidebar. If you aren’t quite sure what an ETF is or want to learn more, you can head over to the ASX for a free “ETF Course”.

Popularity and demand have led to the ETF market expanding significantly, and with greater choice comes a greater need for investigation and research before investing. Even within an asset class such as fixed interest, there are significant differences between the options, but it is common for people to get confused thinking they are all the same. I liken it to the citrus family of fruits (asset class), where they share characteristics, but as anyone who has mistakenly bitten into a slice of grapefruit when expecting an orange will tell you, they are very different.

Appreciating that not all fixed interest ETFs are the same is the best place to start. Be mindful that the name of the ETF doesn’t always tell the whole story, but terms such as high yield, unconstrained, emerging, and hybrid should make clear the need to get familiar with the detail of the investment strategy (likely higher risk). So always read beyond the label!

Why is knowing what to look for important?

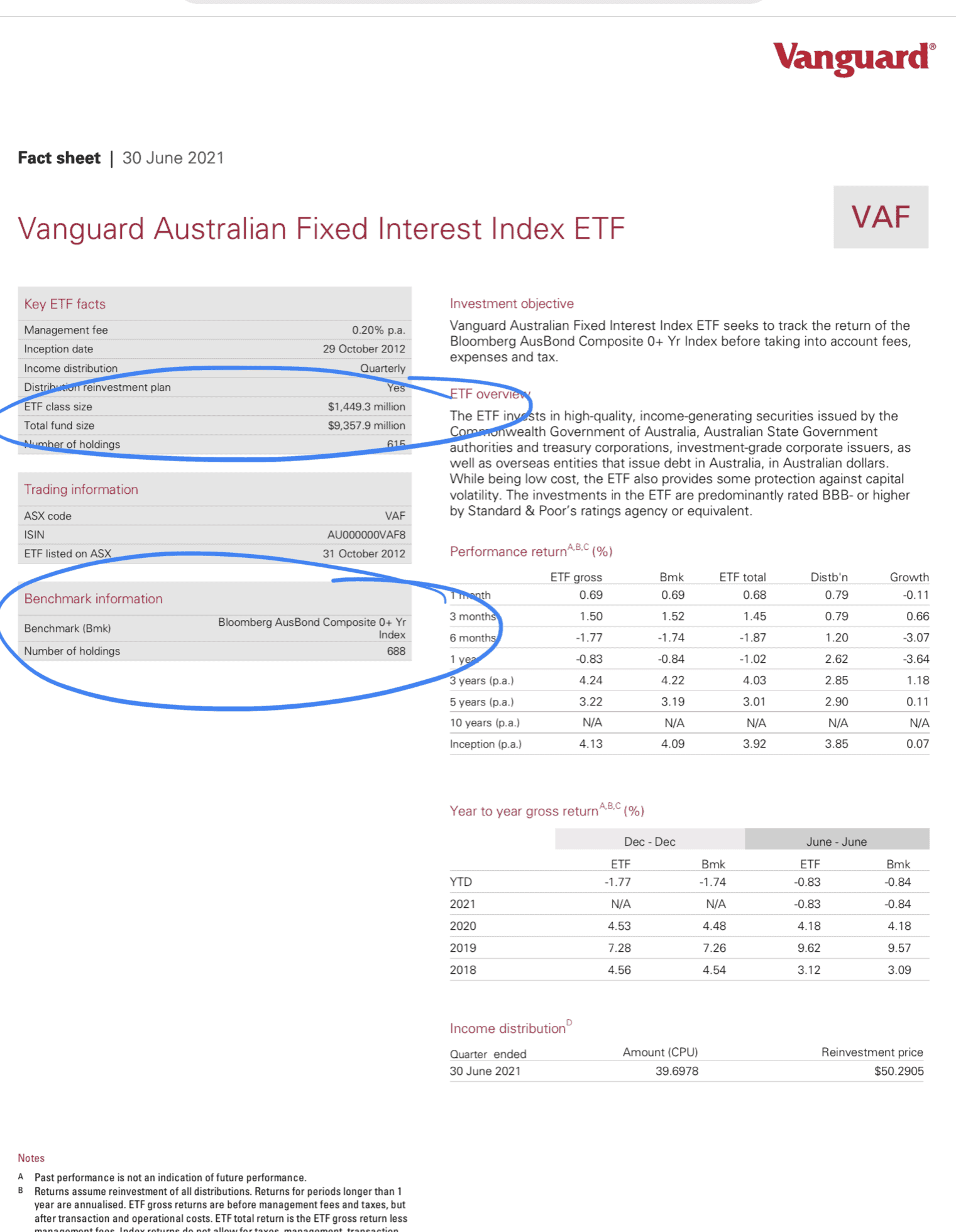

If you don’t know what to look for with fixed interest ETFs, you might cost yourself a lot of money. So, where to start? The Fact Sheet (example below) and Product Disclosure Statement are always an excellent place to start. My eyes go in search of two details first, as I find these are a good guide on whether this investment is what I am looking for and if further investigation is warranted:

- Underlying index that the ETF is tracking: This tells you what the investment performance will be mirroring and if this is what you are looking for

- Funds or assets under management: Size matters, and if an ETF is too small (especially when it has been around a while), it may point to low levels of interest and therefore pose liquidity issues when you want to trade

Your homework doesn’t stop there, and other details which are useful to understand are:

- Fees

- Tracking error

- Historical returns may also prove helpful in narrowing the options, as one of the foundation rules of investing is that higher returns indicate more risk

- Details of the company that is offering the ETF

- Liquidity of the investment (best to check the trading volumes using the ASX website or your brokerage account for this)

The details above will help you make an informed assessment on whether the ETF is right for you and your portfolio. However, it is essential to note that these individual details in isolation only tell part of the story, so bringing it all together makes all the difference.

When do you use fixed interest ETFs in a portfolio?

While fixed interest is commonly used to make up the defensive allocation of a portfolio, it doesn’t always ring true. Buyer beware, as fixed interest can also be risky. Doing your research and reading the details of the investment are critical.

A fixed interest ETF is unlikely to be the solitary investment in your portfolio, so you should consider what role it needs to fill to enhance overall performance and risk. Good portfolio construction is all about ensuring that the whole is greater than the sum of its parts.

What fees are involved?

Much the same as any investment fund, it depends on the strategy. Your passive strategies will in most cases, be between 0.15-0.40%. Active strategies will extend beyond this based on the investment manager and strategy employed but are unlikely to go above 1%.

Any innovations in this area?

Actively managed fixed interest exchange-traded products (ETPs) are becoming available in a variety of shapes and sizes now so that you can build a far more diversified portfolio within your share trading account.

Final thoughts

Not all fixed interest is the same, and the risk/return profile can vary substantially. Therefore, you must be clear on what you want your investment in a fixed interest ETF to do for your portfolio and then do your homework on what option is the best fit. Don’t get seduced by the fixed interest ETF that had the best performance last year, and don’t think that these are the same as a term deposit as there is more risk involved.

If you want to discuss how any of the above info relates to your investment strategy then you can contact a Pekada financial adviser.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).