September 2021 investment review – Inflation fears impact bond & equity markets

Talking points for September 2021

- Share market values decline across the globe for the first month since January 2021.

- Higher inflation fears were renewed as energy costs in Europe surge.

- Bond yields rose in response to inflation and expectations of a tapering of monetary policy in the United States.

International Equities

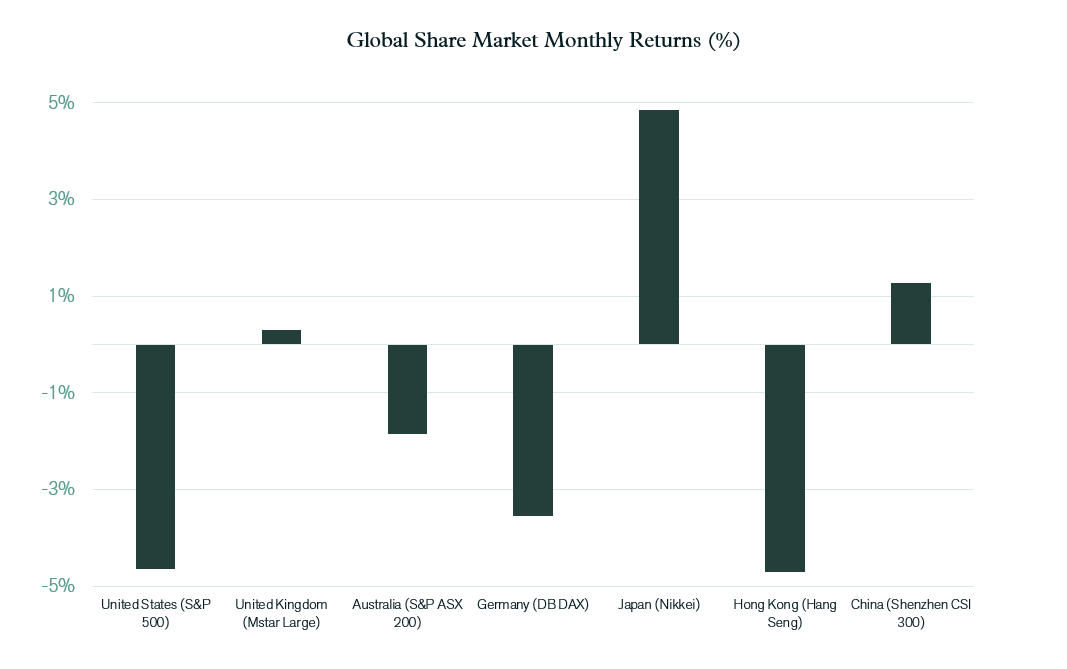

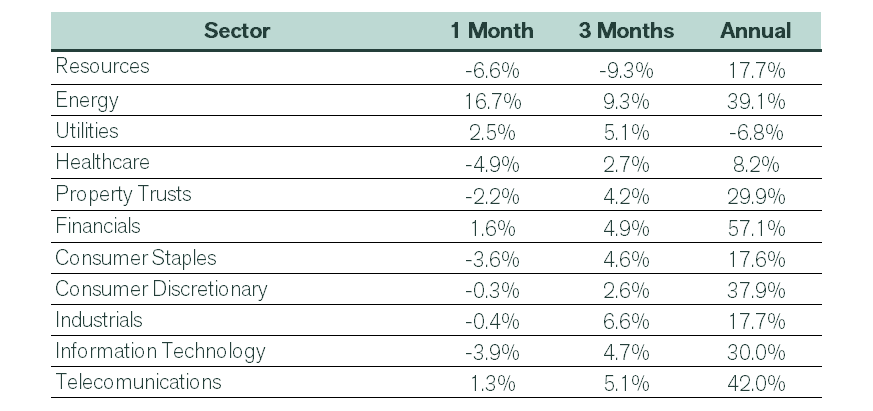

Global equities declined by an average of 3.8% over September, with the United States leading the decline as the S&P 500 Index dropped 4.7%. Losses were also significant in Hong Kong, where the outlook for growth in China once again weighed on investor sentiment. This month’s focus was the news that China’s second-largest property development group, Evergrande, was at risk of defaulting on its debts, potentially triggered by new and more stringent borrowing regulations on property developers. As a result, expectations for Chinese economic growth, and housing construction in particular, once again softened. These China-related factors, combined with surging energy prices in Europe and rising bond yields to dent investor confidence across the globe. Also adding to general uncertainty was doubt over whether the US government would pass a $550 billion infrastructure spending package, with the vote on legislation delayed due to concerns of insufficient support for the bill at a time when the US government debt ceiling requires lifting.

Japan, however, moved against the general trend, with the Nikkei Index rising by 4.9%. Japan was joined by markets such as Russia (up 5.8%) and the majority of the Middle East, where higher energy prices had a positive impact. The oil price was 9.9% higher in $ US terms over the month, with other energy commodities such as coal and natural gas rising even more elevated as supply shortages took hold in Europe in the lead up to winter.

Australian Equities

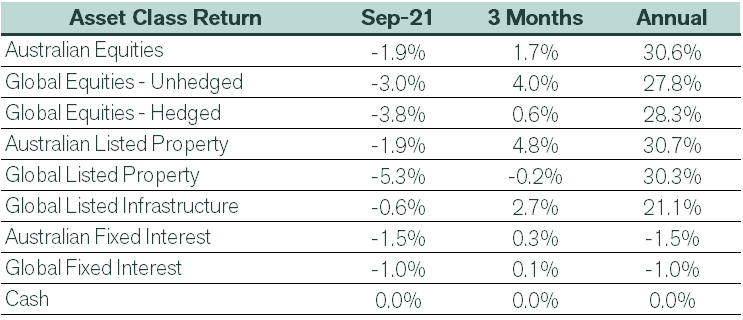

Australia, a net energy exporter, had some stocks being solid beneficiaries of the higher energy prices, with the energy sector overall rallying 16.7%. Financials also enjoyed a strong month, as higher bond yields positively impacted the expected earnings of banks and insurers. However, most other sectors were negative, with the S&P ASX 200 Index falling 1.9% over September. Annually, the asset class remains firmly in positive territory by 30.6%.

Resource stocks were the most significant contributors to the negative direction of the Australian market last month. Most notably, stocks such as BHP (down 11.6%) and Rio Tinto (down 10.6%) that have high iron ore exposures recorded sharp declines due to a drop in the price of iron ore. In $ US terms, the spot iron ore price fell by 25% over the month, which was a substantial decline in response to indications of lower steel production in China and the prospect that lower levels of construction in the property sector could weaken demand further in the months ahead. Following the substantial gains in August, the IT sector dropped 3.9%. Healthcare was also one of the weaker performers, with a 4.9% loss. The higher bond yields impacted IT & Healthcare more than others due to these sectors’ high earnings growth profile, making them more sensitive to the impact of higher interest rates on the present value of future earnings.

Fixed Interest & Currencies

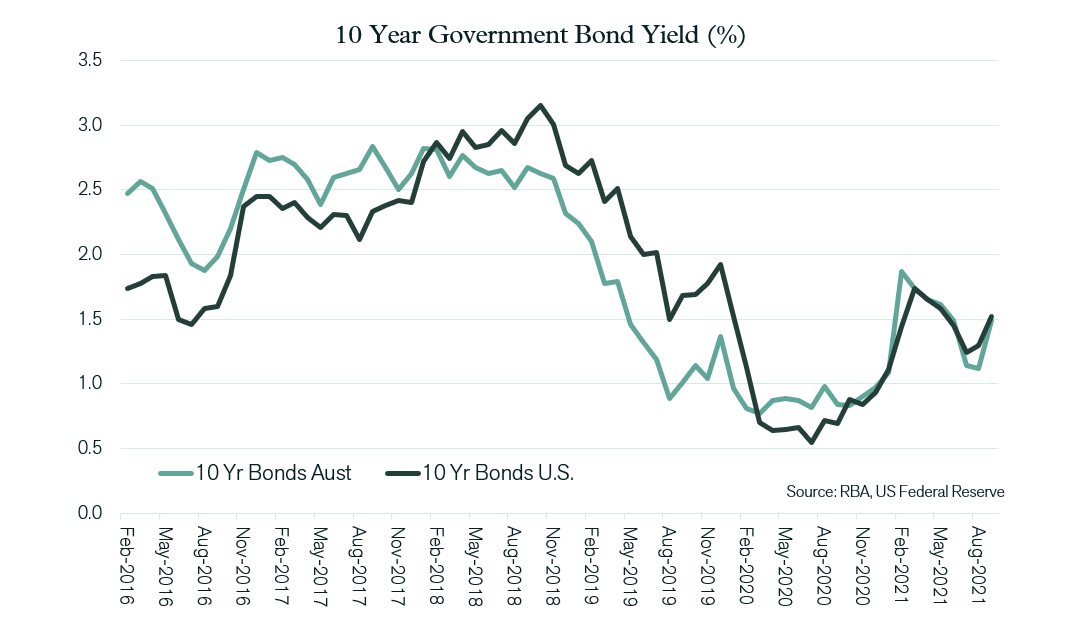

Bond yields returned to an upward trend last month. With signs that inflation may be a little more persistent than previously thought, expectations have firmed that the US Federal Reserve will commence tapering its bond-buying program this year, which could place upward pressure on yields. Over the month, the US 10-year Treasury bond yield rose from 1.30% to 1.52%. The Australian equivalent yield finished the month 0.37% higher at 1.49%. The higher bond yields resulted in falling bond prices and negative returns for the broader fixed interest asset class. Returns from corporate credit-linked investment were relatively flat over the month. Global default rates on corporate loan facilities continue to be somewhat muted, which has created a stable return profile for these securities.

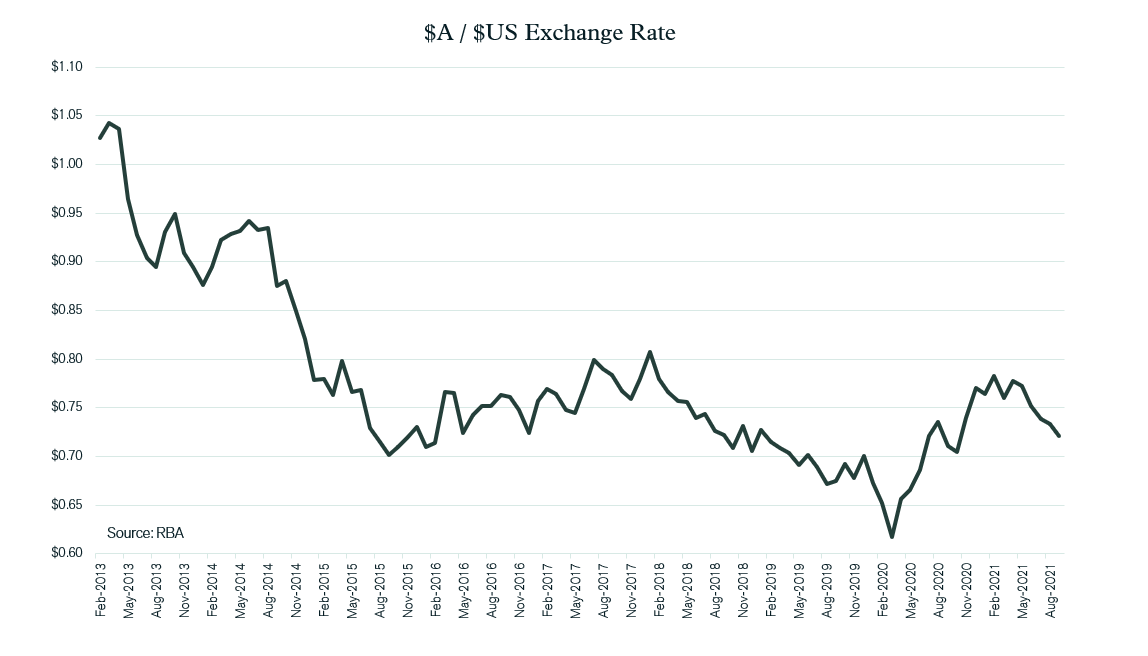

The Australian dollar continued its drift lower over September, with weaker iron prices and broader concerns over Chinese economic growth being the key contributors. Against the $ US, the $A dropped from US 73.4 cents to 72.1 cents. However, notwithstanding the lower iron ore prices, Australia’s trade surplus has continued to expand to new record highs, which provides some fundamental support for the $A at current levels.

Outlook

For those with memories of the 1970s, conditions on financial markets in September may have been somewhat uncomfortable. The prospect of an inflationary lift in energy prices coincided with some weakening in economic growth indicators. Over recent decades, the general absence of “stagflation” (the combination of high inflation and low economic growth) from most economies has been critical in supporting investment returns. So, unsurprisingly, equity markets reacted negatively to the events that unfolded last month.

More reassuringly, however, the size of the response on equity markets was relatively minor in the context of valuations that had only just hit new record highs. Appropriately, market pricing still implies that the risks of a return to an entrenched stagflation environment are very low. More likely, some of the weaker growth numbers and higher inflation make evident the difficulties associated with re-starting economies from substantial periods of disruption. Moreover, supply chains are struggling to meet demand in several areas, impacting prices and activity levels. Finally, recent events also highlight the merits of central banks’ reluctance to normalise monetary policy and interest rate settings on the earlier initial evidence of economic recovery. For equity market investors, one positive takeaway from September could be that this reluctance to change existing accommodative policy will remain in place for a little longer.

Nonetheless, evidence from recent weeks strengthens the case that inflation in the post COVID environment will be higher than what prevailed pre COVID; perhaps earnings growth forecasts underpinning equity market valuations are at the upper levels of the fair value range.

Our experienced financial planners provide tailored strategies and guidance to suit your unique needs and financial goals. If you’re seeking expert investment advice and management, book a chat with a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).