SMSF Penalty Increase from 1 January 2023

What has changed?

Important to note that the dollar value of ATO penalty units has increased from 1st January 2023, so SMSF administrative penalties have increased accordingly.

From 1st January 2023, the value of a penalty unit is $275.

This means that the maximum administrative penalty rises to $16,500 (60 units). You can view the list of contraventions to the Superannuation Industry (Supervision) Act 1993 (SISA) and associated penalties here.

Who is liable to pay the penalty?

What may come as a surprise, the penalty cannot be paid or reimbursed from the assets of the fund.

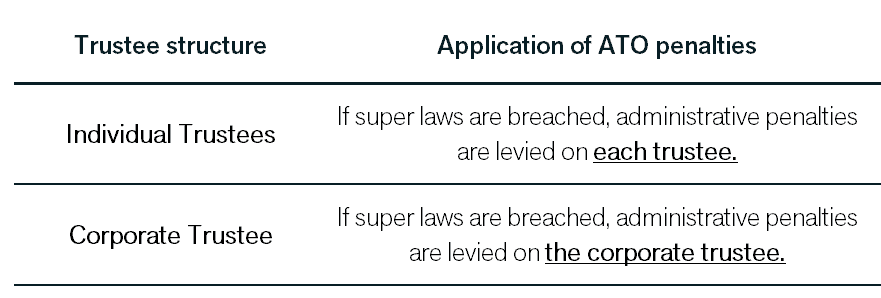

Directors of corporate trustees are jointly and severally liable for the penalty. Individual trustees are each liable for the penalty.

Strategy consideration

As there may be instances where an SMSF has up to 6 SMSF Individual Trustees, the difference between a corporate trustee ($16,500 penalty) and the combined penalties of 6 individual trustees ($99,000 penalty) is considerable.

If you haven’t already considered the benefits of a corporate trustee, then this may be an opportunity to revisit your options.

Thanks for reading, and if you want to discuss your SMSF trustee options, then please book a chat here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).