Super contribution caps set to increase from 1 July 2021 due to indexation

Super contribution caps set to increase from 1 July 2021

It has been a long time coming, but from 1 July 2021 the concessional and non-concessional contribution caps are set to increase due to indexation.

Due to the release of the Average Weekly Ordinary Times Earnings (AWOTE) figure for the December 2020 quarter, both the concessional contribution cap and the non-concessional contribution caps are set to increase due to indexation from 1 July 2021.

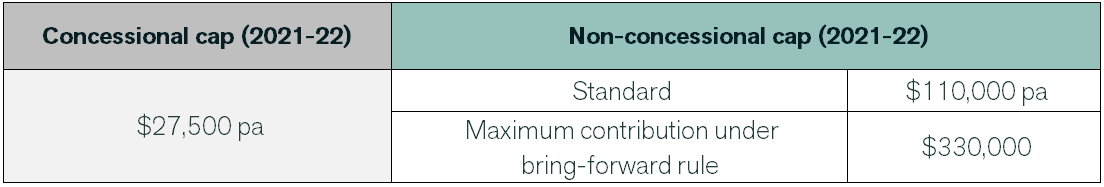

The new concessional and non-concessional contribution caps are outlined in the following table.

It is also important to note the $1.6m non-concessional cap threshold is also changing due to the indexation of the general transfer balance cap on 1 July 2021 to $1.7m.

For example, from 1 July 2021 a person’s non-concessional cap will be nil if their total superannuation balance on 30 June 2021 is $1.7m or more.

In addition, the bring-forward period thresholds (based on a member’s total superannuation balance) are also set to increase from 1 July 2021 due both to the increase in the standard non-concessional cap to $110,000 and the increase in general transfer balance cap to $1.7m.

For a full description of these important changes and how they may impact your retirement, please contact us.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).