Transfer Balance Cap set to increase – and what you need to know

As a result of the CPI figure released in January, the General Transfer Balance Cap (TBC) will increase from $1.7 million to $1.9 million from 1 July 2023.

This increase will have flow-on impacts on superannuation contribution limits and strategies.

What is the transfer balance cap?

The transfer balance cap is the limit on the amount of superannuation that you can transfer from accumulation phase to retirement phase income streams.

Retirement phase income streams include all superannuation income streams except:

- transition to retirement income streams, and

- deferred superannuation income streams that have not entered retirement phase.

Important to note that earnings, losses or income stream payments do not impact the transfer balance account.

Who does the change impact?

It depends. Due to how an individual’s personal transfer balance cap (TBC) is calculated using a proportional indexation approach, the impact will range from a full increase of $200,000 to no change.

Let’s take two extreme examples:

- An individual who has yet to commence a retirement phase income stream on or before 1 July 2023 will get the full benefit of the $200,000 increase to the TBC.

- An individual who has already used their full TBC before 1 July 2023 will not get any immediate benefit from the increase to the TBC.

Strategy considerations

- Individuals considering commencing their first retirement phase income stream between now and 1 July 2023 may be better off waiting until 1 July 2023 to lock in the maximum increase to their personal TBC.

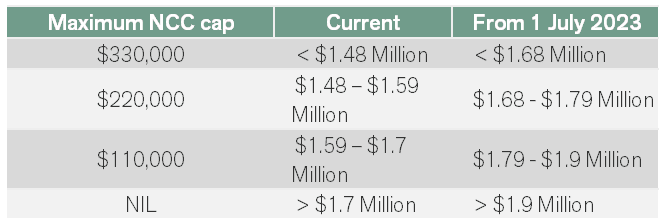

- Individuals with a total superannuation balance (TSB) of greater than $1.48m, may be able to make larger non-concessional contributions. This is because the bring forward rule is reliance on the current TSB which is expected to increase as a result of the TBC increase. These are yet to be confirmed, but estimates provided by the SMSF Association are below.

What should you do?

Depending on your situation, there may be no impact from these changes. If you are considering using bring forward non-concessional contribution provisions or commencing a retirement phase income stream, then it would be beneficial to assess the difference in outcomes if taking action before or after 1 July 2023.

If you have any questions or want to chat about your situation and how the increases to the transfer balance cap might impact you, then please book a chat here.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).