Risk profiling is a foundation in developing a good investment strategy

Understanding investment risk profiling

The importance of investment risk profiling

Getting the level of risk to be the right fit for you as an investor a key component in any wealth creation strategy. Why does it matter? Risk and return go hand in hand, so it goes without saying that this the starting point for any wealth creation strategy. When done well, risk profiling takes into account several aspects of risk included your risk tolerance, risk capacity and also the required level of risk to reach your objectives. Bringing these together is a collaborative approach between you and your adviser which requires open conversations and honest responses. It really is a case of rubbish in, rubbish out.

Understanding what level of risk you can tolerate allows for optimal portfolio and strategy construction to ensure you can stick to the plan through market cycles. Staying invested, avoiding panic and dumb emotional investment decisions are shown to be some of the most significant contributors to long term returns. Doing this in periods of high volatility and uncertainty is much easier when your portfolio had the right level of risk for you from the start.

What is risk profiling?

The risk profiling process can assist you in determining your tolerance to risk and how that relates to particular investments and broader financial plan. It is a process that professional advisers use to assess what the optimal level of risk is for their clients. It involves a mix of tools, including questionnaires, to provide an insight as to what level of volatility is right for you.

The risk profiles are not a perfect science, but a starting point to assess where you sit in terms of comfort on the risk-return spectrum. The higher the perceived return from an investment, usually the greater the risk. On the flip side, the lower the return, the less your capital is at risk.

While important, a risk profile is not the only information you should consider before making an investment decision. These tools do not take into account your individual investment preferences, financial situation, objectives or other needs. These factors need to form part of the process for making investment decisions and are the reason good financial advice requires the adviser to “know their client” deeper than a questionnaire. A risk profile should be seen as a way to facilitate a conversation with your adviser to assess and clarify what type of investor you are, and how much risk you are comfortable with.

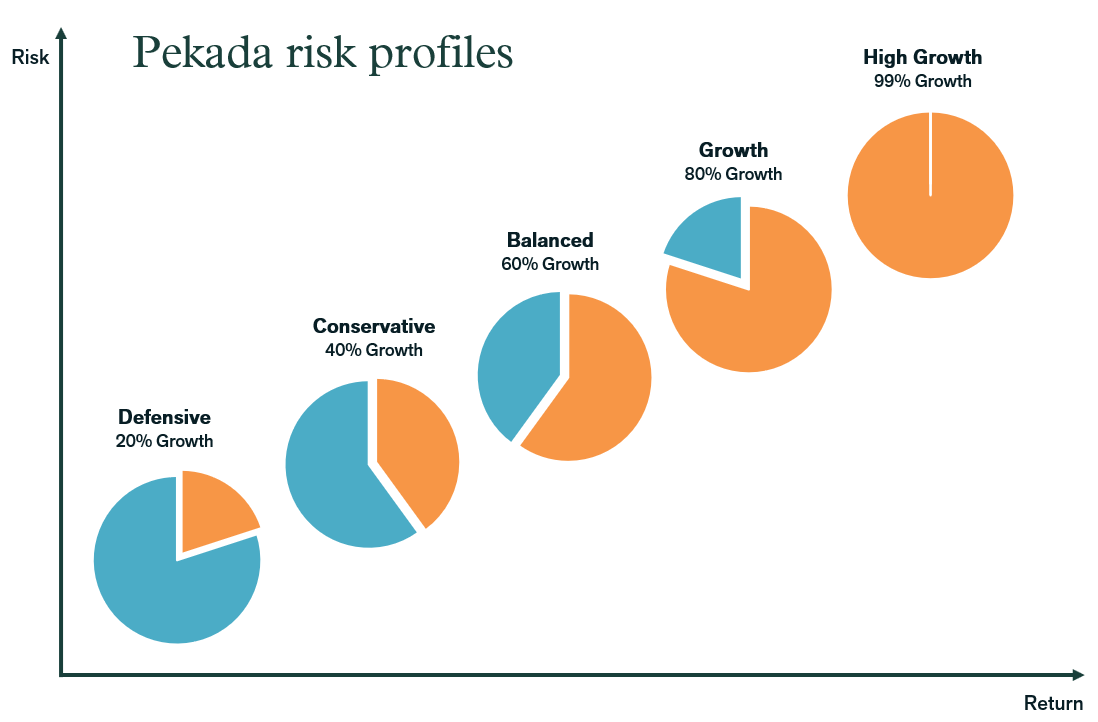

Each of the risk profiles maps to different asset allocations and vary in the split between growth and defensive assets. The varying asset allocations work to adjust the level of volatility and risk for each profile.

- Growth assets include shares or property, and these investments generally have the potential to earn higher returns but carry a higher risk to your capital value over the short term.

- Defensive assets include fixed interest, bonds, term deposits and cash which provide a lower chance of capital loss but generally lower returns.

The risk profiles and asset allocation ranges we use are:

- Defensive (10-30% growth assets)

- Conservative (30-50% growth assets)

- Balanced (50-70% growth assets)

- Growth (70-90% growth assets)

- High growth (90-100% growth assets)

What is Pekada’s investor risk profiling process?

- Online risk profiling questionnaire emailed to individuals. If part of a couple, both individuals will be required to complete their own questionnaire.

- Discussion between you and your adviser to review the results of the questionnaire. Make adjustments if required and agree on end score.

- Map the agreed risk tolerance score with a portfolio asset allocation, which aligns with an appropriate level of risk.

- Construct investment recommendations to achieve desired asset allocation, target volatility and overlay investment preferences.

- Monitor, review and update risk profile as part of your ongoing investment strategy.

Risk profiling FAQ’s

Is my investor risk profile set in stone forever?

No. Financial planning strategies are not a one-off transaction, but rather an ongoing process. If your circumstances, objectives or attitudes to risk change, then you should notify your adviser and ask for a review of your risk tolerance to ensure you’re still comfortable with the current profile.

How long does the questionnaire take to complete?

It depends. Most of the feedback we get from clients is that this takes 15-30 minutes.

What life events should prompt me to consider a review of my risk profile?

There are a variety of events which could warrant a review, and if unsure, please contact us to discuss. Some common reasons are:

- If you have a significant change in your financial objectives, which means previous arrangements are no longer suitable.

- Your capacity for loss has changed due to life-events.

- Your investment timeframes may have shifted.

What are the components of an Investment Risk Profile?

Key components of a risk profile include:

- Risk tolerance: Your psychological comfort with taking risks.

- Risk capacity: Your financial ability to withstand losses.

- Risk perception: Your understanding and awareness of investment risks.

- Risk requirement: The level of risk you need to take to achieve your financial goals.

What are the types of investment risks?

There are various types of investment risks, such as:

- Market Risk: The risk of losses due to changes in market conditions.

- Liquidity Risk: The risk of not being able to quickly sell an investment without reducing its price significantly.

- Credit Risk: The risk that a borrower will default on a loan or that a bond issuer will not make required payments.

- Operational Risk: The risk of loss resulting from inadequate or failed internal processes, people, and systems.

- Inflation Risk: The risk that the value of assets or income will decrease as inflation shrinks the purchasing power of money.

- Currency risk: The risk that change in price of one currency in relation to another negatively impacts the value of your investments in your local currency.

For further information or for expert investment advice, reach out to a Pekada financial planner today.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).