What to make of market weakness in early 2025?

Talking points

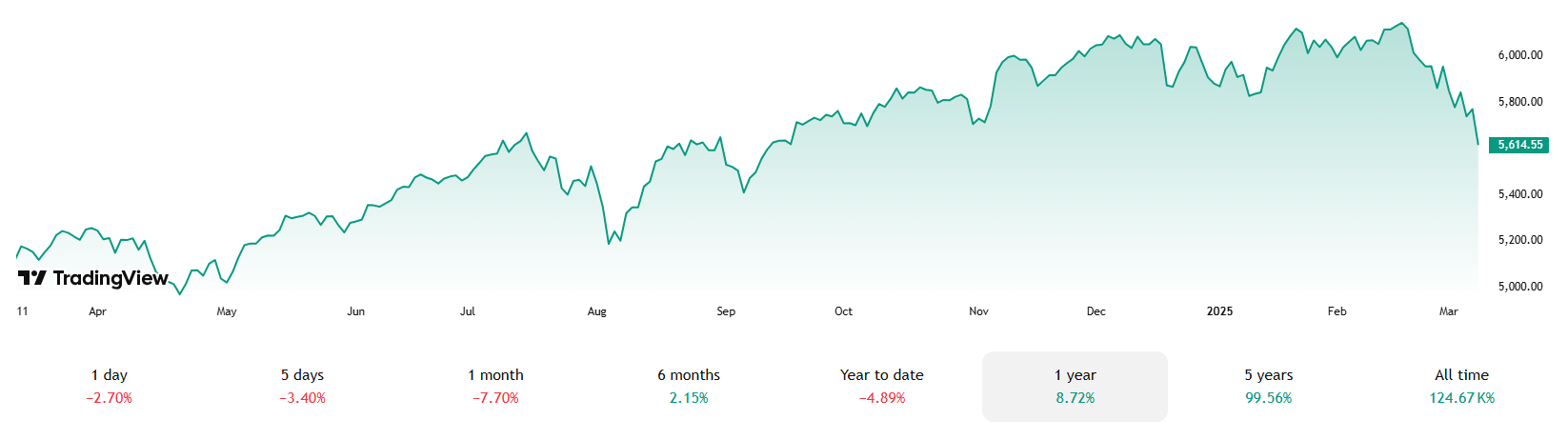

- After forging record highs in mid-February, sharemarkets are letting off some steam.

- Shares sold off in recent weeks due to a mixture of market concentration, economic uncertainty, policy concerns and tectonic shifts in the geopolitical landscape.

- It is natural for investors to feel more anxious during periods of higher volatility.

- But as momentous changes rapidly unfold before our eyes on numerous fronts, history informs us that markets will ultimately find new ways to climb the ‘wall of worry’.

Exhibit 1: US S&P 500 over the twelve months to 11 March 2025 shows a recent decline (Source: TradingView).

If we cast an eye over the performance of financial markets in the years following the outbreak of COVID-19, two outcomes are immediately apparent.

- Risk assets such as shares posted phenomenal returns in three of the last four years, with the ASX easily outpaced by global peers.

- Returns in traditional fixed interest markets have generally been disappointing and, at times, failed to protect investors from sharemarket drawdowns.

Digging deeper, we note bond yields were rebounding off pandemic lows as higher inflation pressures and a US-led global growth recovery permeated financial markets. If we recognise that there is an inverse relationship between bond prices and yields, it is not surprising that fixed interest is only just emerging from a deep bear market. Meanwhile, sharemarket leadership had become increasingly concentrated, with returns mainly driven by a handful of stocks in just a few sectors.

While bull markets in shares can persist over periods of years, most investors would not expect a third consecutive year of +20% returns for global shares. Historically, bull markets have ended when central banks overtightened monetary policy settings, upending momentum and giving pause for thought. However, in 2025, we see central banks largely cutting interest rates while keeping a keen eye on signs of future inflation.

So, what is driving the current sell-off and can we tone down the noise?

Recent economic indicators have fallen short of expectations, including:

- The Purchasing Managers’ Index (PMI) for the US services sector revealed a contraction for the first time in more than two years.

- On the trade front, households and businesses were warned that US tariffs (import taxes) could be materially increased. This brought forward spending towards the end of 2024, which ultimately translated into weaker spending at the beginning of 2025.

- Recent surveys have indicated weakening consumer sentiment amid growing concerns over inflation and the economy.

- The number of US rate cuts being factored in by traders for 2025 has been drastically reduced over the last few months.

Despite these challenges, there are several reasons to remain optimistic about the longer-term future of financial markets. Economies have shown remarkable resilience in the aftermath of the pandemic. While growth outcomes have tended to be weaker, employment markets have displayed relative strength. Historically, labour market strength and a feeling of solid job security have minimised the chances of a deep recession, even if interest rates have not moved to more supportive levels.

More specifically, recent market returns appear to be emanating from a broader range of sectors and regions. Simultaneously, technological advancements are occurring at phenomenal speed, and new beneficiaries will eventually benefit from breakthroughs in artificial intelligence and healthcare innovation.

Elsewhere, increased fiscal spending in Europe will ultimately be positive for many industrial companies that have previously faced more muted growth profiles. Japan is emerging from its decades-long malaise, while recent weakness in India also presents opportunities in emerging markets. On the domestic front, a two-year per capita recession ended at the end of 2024, and the RBA has finally commenced its policy easing cycle.

Where to from here?

While the current market weakness is undoubtedly concerning, it’s essential to maintain perspective. Financial markets have weathered numerous challenges in the past and have consistently demonstrated resilience and a positive trajectory over the long term. We continue to monitor the situation closely and are prepared to adjust portfolio settings where it makes sense to do so.

As long term investors, we believe that maintaining a diversified investment strategy and focusing on high-quality assets will best position portfolios for future growth opportunities. While market volatility presents a less comfortable landscape to navigate—it often presents opportunities for patient investors.

If you have any queries or want to discuss your personal investment strategy then please book a chat with your adviser.

Pete is the Co-Founder, Principal Adviser and oversees the investment committee for Pekada. He has over 18 years of experience as a financial planner. Based in Melbourne, Pete is on a mission to help everyday Australians achieve financial independence and the lifestyle they dream of. Pete has been featured in Australian Financial Review, Money Magazine, Super Guide, Domain, American Express and Nest Egg. His qualifications include a Masters of Commerce (Financial Planning), SMSF Association SMSF Specialist Advisor™ (SSA) and Certified Investment Management Analyst® (CIMA®).